Carnival Cruises 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

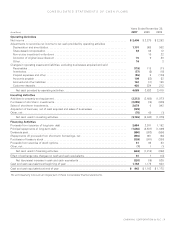

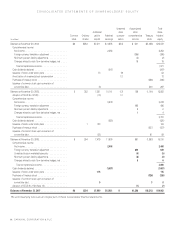

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

8 | CARNIVAL CORPORATION & PLC

Unearned Accumulated Total

Additional stock other share-

Common Ordinary paid-in Retained compen- comprehensive Treasury holders’

(in millions) stock shares capital earnings sation income stock equity

Balances at November 30, 2004 $6 $353 $7,311 $ 8,535 $(16) $ 541 $(1,058) $ 15,672

Comprehensive income:

Net income

.............................

2,253 2,253

Foreign currency translation adjustment

............

(395) (395)

Minimum pension liability adjustments

............

(2) (2)

Changes related to cash flow derivative hedges, net

. . . .

15 15

Total comprehensive income

.................

1,871

Cash dividends declared

......................

(647) (647)

Issuance of stock under stock plans

...............

73 (9) 64

Amortization of unearned stock compensation

.........

12 12

Purchases of treasury stock

....................

(386) (386)

Issuance of common stock upon conversion of

convertible debt

..........................

(3) 300 297

Balances at November 30, 2005

...................

6 353 7,381 10,141 (13) 159 (1,144) 16,883

Adoption of SFAS No. 123(R)

...................

(13) 13

Comprehensive income:

Net income

.............................

2,279 2,279

Foreign currency translation adjustment

............

496 496

Minimum pension liability adjustments

............

2 2

Changes related to cash flow derivative hedges, net

. . . .

4 4

Total comprehensive income

.................

2,781

Cash dividends declared

......................

(820) (820)

Issuance of stock under stock plans

...............

1 133 134

Purchases of treasury stock

....................

(837) (837)

Issuance of common stock upon conversion of

convertible debt

..........................

(22) 91 69

Balances at November 30, 2006

...................

6 354 7,479 11,600 661 (1,890) 18,210

Comprehensive income:

Net income

.............................

2,408 2,408

Foreign currency translation adjustment

............

649 649

Unrealized loss on marketable security

............

(5) (5)

Minimum pension liability adjustments

............

(8) (8)

Changes related to cash flow derivative hedges, net

. . . .

6 6

Total comprehensive income

.................

3,050

Cash dividends declared

......................

(1,087) (1,087)

Issuance of stock under stock plans

...............

115 115

Purchases of treasury stock

....................

(326) (326)

Issuance of common stock upon conversion of

convertible debt

..........................

5 3 8

Adoption of SFAS No. 158 (Note 12)

...............

(7) (7)

Balances at November 30, 2007

..................

$6 $354 $7,599 $12,921 $ $1,296 $(2,213) $ 19,963

The accompanying notes are an integral part of these consolidated financial statements.