Big Lots 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Of course, it’s not just about products. With new leadership in store operations, our team is focused on being

Ready for Business by improving the consistency and timeliness of our in-store execution and taking customer

service to a new level. These efforts should supplement our merchandising and improve our ability to drive sales.

Real Estate

Perhaps the best way to describe our real estate strategy is that we have moved counter to the market and

most of retail. During the latter part of 2005 and early 2006, we closed a number of underperforming locations.

We told our shareholders and the investment community that we would be slowing new store growth significantly.

We source our real estate like we source our merchandise — always looking for great value — and at the time,

real estate was not a value. Instead, we focused on improving our internal productivity and operations to more

efficiently manage our existing stores.

Shortly after we made the decision to slow new store growth, a Wall Street analyst told me, “If you are waiting for

real estate prices or rents to go down, you could be waiting for an awfully long time, or you may NEVER be a store

growth story again.” Despite his point of view, I was not about to use our shareholders’ cash to chase overpriced

real estate just to be a store growth story for the sake of the market. Instead, we focused on becoming a more

productive and efficient operation, knowing that the real estate market would eventually come back. We understand

what works for our strategy, and we understand the value of cash and how to put it to good use.

Several retailers who were growing are now slowing, and some have gone away altogether. Heading into 2009,

rents continue to moderate, the availability of space has increased and our business is much stronger and better

positioned. We are a financially solid company with an investment grade credit rating that generates significant

cash flow each year and an infrastructure that can support up to 1,800 stores. We are highly motivated to open new

stores, but it has to be at the right price. We believe that our patience has resulted in the best possible deals for

our shareholders and, as a result, we believe now is the correct time to grow our store base. As other retailers fail

or scale back, we have an opportunity to gain market share and become a more dominant retailer when the current

economic downturn reverses.

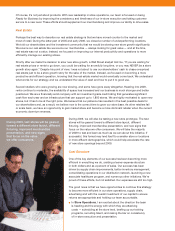

During 2009, we will also be testing a new store prototype. The test

stores will be geared toward a different store layout, different

fixturing, improved merchandise presentation, and new signs that

focus on the value we offer consumers. We will take the majority

of 2009 to test and learn as much as we can about this initiative. If

successful, this format may lend itself to a smaller store or locations

in more affluent demographics, which could help accelerate the rate

of new store openings beyond 2009.

Cost Structure

One of the key elements of our success has been becoming more

efficient in everything we do, yielding a leaner expense structure

in both dollars and as a percent of sales. Our success has been

driven by supply chain improvements, better inventory management,

consolidating operations in our distribution network, launching a new

associate healthcare program, and numerous other initiatives. We’re

proud of these efforts, but not satisfied. Our expenses are still too high.

The good news is that we have opportunities to continue this strategy

to become more efficient in our store operations, supply chain,

advertising and with the overall investment of our capital to ensure

returns are appropriate and holding our team accountable.

NIn Store Operations, I am excited about the direction the team

is heading and the energy with which they are attacking

costs — scheduling at the store level, beefing up our training

programs, recruiting talent, and raising the bar on consistency

of in-store execution and presentation.

During 2009, test stores will be geared

toward a different store layout, different

fixturing, improved merchandise

presentation, and new signs

that focus on the value

we offer consumers.