Barnes and Noble 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share repurchases under this program may be made

through open market and privately negotiated transactions

from time to time and in such amounts as manage-

ment deems appropriate. As of February , , the

Company has repurchased ,, shares at a cost of

approximately . million under its share repurchase

programs. The maximum dollar value of common shares

that may yet be purchased under the current program is

approximately . million as of February , . The

repurchased shares are held in treasury.

On September , , the Company completed its acqui-

sition of all of Bertelsmann AG’s (Bertelsmann) interest

in barnesandnoble.com llc (Barnes & Noble.com). The

purchase price paid by the Company was . million

(including acquisition related costs) in a combination

of cash and a note. The note issued to Bertelsmann in

the amount of . million was paid in fi scal . As

a result of the acquisition, the Company increased its

economic interest in Barnes & Noble.com to approxi-

mately . On May , , the Company completed a

merger (the Merger) pursuant to which Barnes & Noble.

com became a wholly owned subsidiary of the Company.

The purchase price paid by the Company in the Merger

was . million (including acquisition related costs).

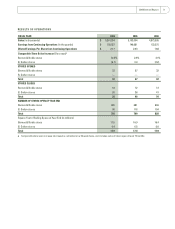

Contractual Obligations

The following table sets forth the Company’s contractual obligations as of February , (in millions):

CONTRACTUAL OBLIGATIONS PAYMENTS DUE BY PERIOD

Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Long-term debt $ — $ — $ — $ — $ —

Capital lease obligations — — — — —

Operating leases 2,241.9 353.0 650.4 515.3 723.2

Purchase obligations 50.2 36.2 10.2 3.7 0.1

Other long-term liabilities refl ected on the

registrant’s balance sheet under GAAP — — — — —

Total $ 2,292.1 $ 389.2 $ 660.6 $ 519.0 $ 723.3

See also Note 9 to the Notes to Consolidated Financial Statements for information concerning the Company’s Pension and Postretirement Plans.

2006 Annual Report 17