Barnes and Noble 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

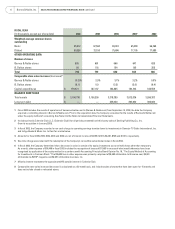

Operating Profi t

The Company’s consolidated operating profi t increased

. million, or ., to . million in fi scal

from . million in fi scal . This increase was

primarily due to the matters discussed above.

Interest Expense, Net and Amortization of Deferred

Financing Fees

Interest income (expense), net, and amortization of

deferred fi nancing fees, increased . million, or

., to . million in fi scal from (.)

million in fi scal . The increase was due to reduced

average borrowings.

Income Taxes

Barnes & Noble’s eff ective tax rate in fi scal

decreased to . compared with . during

fi scal . The decrease in the eff ective tax rate was

primarily due to a decrease in the Company’s overall

eff ective state tax rate.

Minority Interest

Minority interest was . million in fi scal compared

with . million in fi scal , and relates to the

approximate outside interest in Calendar Club.

Income From Discontinued Operations

On October , , the Board of Directors of the

Company approved an overall plan for the complete dis-

position of all of the Company’s Class B common stock

in GameStop, the Company’s former video game operat-

ing segment. The plan was completed in November

with the distribution to the Company’s stockholders

of the GameStop Class B common stock. As a result,

GameStop is no longer a subsidiary of the Company

and, accordingly, the Company is presenting all histori-

cal results of operations of GameStop as discontinued

operations.

Earnings

As a result of the factors discussed above, the Company

reported consolidated net earnings of . million (or

. per share) during fi scal compared with net

earnings of . million (or . per share) during

fi scal .

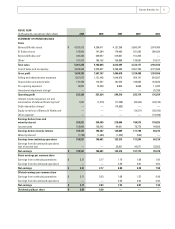

52 WEEKS ENDED JANUARY 28, 2006 COMPARED

WITH 52 WEEKS ENDED JANUARY 29, 2005

Sales

The Company’s sales increased . million, or .,

during fi scal to . billion from . billion

during fi scal . This increase was attributable to a

. million increase in sales at Barnes & Noble stores

and a . million increase in sales at Barnes & Noble.

com, off set by a . million decrease in sales at B.

Dalton stores.

Barnes & Noble store sales increased . million, or

., during fi scal to . billion from .

billion during fi scal and accounted for . of

total Company sales. The . increase in Barnes &

Noble store sales was attributable to an increase in com-

parable store sales of ., coupled with the opening of

new stores during fi scal , which contributed to a

. increase in square footage.

In fi scal , B. Dalton sales declined . and

represented . of total Company sales. The decrease

was primarily a result of store closings and a .

reduction in square footage, off set by an increase in

comparable store sales of . in fi scal .

In fi scal , the Company opened Barnes & Noble

stores and closed , bringing its total number of Barnes

& Noble stores to with . million square feet. The

Company closed B. Dalton stores, ending the period

with B. Dalton stores and . million square feet. As

of January , , the Company operated stores in

the fi fty states and the District of Columbia.

Cost of Sales and Occupancy

The Company’s cost of sales and occupancy includes

costs such as merchandise costs, distribution center

costs (including payroll, supplies, depreciation and

other operating expenses), rental expense, common

area maintenance, merchant association dues and lease-

required advertising, partially off set by landlord tenant

allowances amortized over the life of the lease.

Cost of sales and occupancy increased . million,

or ., to . billion in fi scal from .

billion in fi scal . As a percentage of sales, cost of

sales and occupancy decreased to . in fi scal

from . in fi scal . This decrease was due to less

purchases from book wholesalers at higher costs than

direct purchases from publishers, higher purchases

2006 Annual Report 13