Barnes and Noble 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

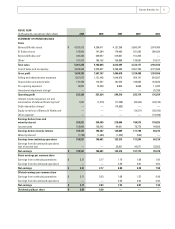

53 WEEKS ENDED FEBRUARY 3, 2007 COMPARED

WITH 52 WEEKS ENDED JANUARY 28, 2006

Sales

The Company’s sales increased . million, or .,

during fi scal to . billion from . billion

during fi scal . This increase was primarily attributable

to a . million increase in sales at Barnes & Noble

stores, a . million increase in Sterling Publishing

third party sales, off set by a . million decrease in

sales at B. Dalton stores.

Barnes & Noble store sales increased . million, or

., during fi scal to . billion from .

billion during fi scal and accounted for . of

total Company sales. The . increase in Barnes &

Noble store sales was primarily attributable to the inclu-

sion of the rd week in fi scal that contributed an

increase to sales of . million, new Barnes & Noble

stores that contributed an increase in sales of .

million, off set by closed stores that decreased sales by

. million and a . decrease in comparable store

sales, which decreased sales by . million.

In fi scal , B. Dalton sales declined . million

or . and represented . of total Company sales.

The decrease was primarily a result of store closings that

contributed to a decrease in sales of . million, a .

decrease in comparable store sales, which contributed to

a decrease in sales of . million, off set by the inclusion of

the rd week in fi scal that contributed an increase

to sales of . million.

In fi scal , the Company opened Barnes & Noble

stores and closed , bringing its total number of Barnes

& Noble stores to with . million square feet. The

Company closed B. Dalton stores, ending the period

with B. Dalton stores and . million square feet. As

of February , , the Company operated stores in

the fi fty states and the District of Columbia.

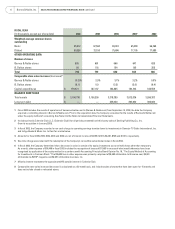

Cost of Sales and Occupancy

The Company’s cost of sales and occupancy includes

costs such as merchandise costs, distribution center

costs (including payroll, supplies, depreciation and

other operating expenses), rental expense, common

area maintenance, merchant association dues and lease-

required advertising, partially off set by landlord tenant

allowances amortized over the life of the lease.

Cost of sales and occupancy increased . million, or

., to . billion in fi scal from . billion

in fi scal . As a percentage of sales, cost of sales

and occupancy decreased to . in fi scal from

. in fi scal . This decrease was primarily attrib-

utable to favorable inventory shortage results and the

deep discounted selling price on J. K. Rowling’s Harry

Potter and the Half-Blood Prince in fi scal , off set by

the enhancement in the Company’s Member program

whereby adult hardcover discounts would increase by an

additional .

Selling and Administrative Expenses

Selling and administrative expenses increased .

million, or ., to . billion in fi scal from

. billion in fi scal . As a percentage of sales, sell-

ing and administrative expenses increased to . in

fi scal from . in fi scal . This increase was

primarily due to sales deleveraging due to negative com-

parable store sales as well as an increase in the amount

of stock-based compensation expense, primarily related

to the adoption of Statement of Financial Accounting

Standards (SFAS) No. (Revised), “Share-Based

Payment” (SFAS R), off set by a lower impairment

charge in fi scal related to property and equipment.

Depreciation and Amortization

Depreciation and amortization decreased . million,

or ., to . million in fi scal from .

million in fi scal . The decrease was primarily due

to lower depreciation on certain Barnes & Noble store

assets that became fully depreciated, off set by the higher

depreciation in the Company’s new distribution center

and accelerated depreciation in connection with the

closing of the Company’s Internet distribution center

in Memphis, Tennessee.

Pre-Opening Expenses

Pre-opening expenses increased . million, or .,

in fi scal to . million from . million in

fi scal . The increase in pre-opening expenses was

primarily the result of higher costs associated with the

locations of the stores opened in the fi rst quarter of

as well as an increase in new Barnes & Noble stores

opened during fi scal compared to the new Barnes

& Noble stores opened during fi scal .

12 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued