Barnes and Noble 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[LETTER TO OUR SHAREHOLDERS continued]

3

2002 Annual Report Barnes & Noble, Inc.

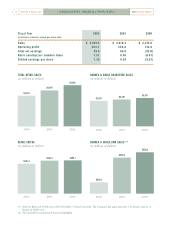

Though lost somewhat in the shuffle of the dot com boom/bust hype, Barnes & Noble.com

is slowly, yet steadily, fulfilling our early expectations. Never intended to be all things to

all consumers, the goal from the very beginning was to create a great web site and to offer

a compelling group of benefits for customers. While online sales of most other retailers

suffered in 2002, Barnes & Noble.com increased sales by 4.5 percent which, together

with a 50 percent reduction in operational expenses, inched it ever closer to its goal of

profitability. Barnes & Noble.com ended the year with $70 million in cash on hand and no

debt. We own approximately 38 percent of Barnes & Noble.com, and our share of their

losses has declined by 70 percent from the prior year.

Most remarkable is the phenomenal success of GameStop, the nation’s largest video-game

retailer, of which we own approximately 60 percent. Despite the troubling year for the retail

industry in general, GameStop increased sales by 20.7 percent year-over-year, and comparable

sales by 11.4 percent. All together, 210 new stores were added in 2002, with many more to

come in the future. Although we believe the embedded value of this important asset has

not been adequately recognized, its contribution over time to our earnings per share will

inevitably become a larger part of our compelling growth story.

Let me conclude by noting that visibility into the near-term future of retail is at best very

difficult as of this writing. The effects of the war, the economy and the shape of the

consumer spending curve are simply too difficult to quantify with any certainty. It is

tempting to say that things are certain to get better than this, but the key questions remain,

by how much, and how soon?

The coming holiday season will conclude a make or break year for many retailers. However,

due to our strong balance sheet and cash flow, we will take whatever good or bad is on the

horizon. We will also execute to the best of our ability all of the many, many programs we

have put in place. We will drive sales and we will spend wisely, and work hard to deliver

(EPS) growth to our shareholders this coming year, and in the years to follow.

This report is dedicated again to the tens of thousands of great booksellers who work in our

stores and in our home office. To the public, they remain the face of Barnes & Noble. Also

to our shareholders, much thanks for your support.

Sincerely,

Leonard Riggio

Chairman