Barnes and Noble 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following table sets forth, for the periods indicated, the percentage relationship that certain items bear to total sales

of the Company:

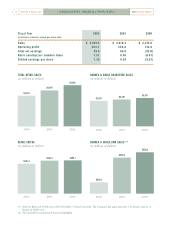

Fiscal Year 2002 2001 2000

Sales 100.0 % 100.0 % 100.0 %

Cost of sales and occupancy 73.2 73.1 72.4

Gross margin 26.8 26.9 27.6

Selling and administrative expenses 18.3 18.6 18.6

Legal settlement expense -- 0.1 --

Depreciation and amortization 2.8 3.0 3.3

Pre-opening expenses 0.2 0.2 0.2

Impairment charge 0.5 -- 2.4

Operating margin 5.0 5.0 3.1

Interest expense, net and amortization of deferred financing fees ( 0.4 ) ( 0.8 ) ( 1.2 )

Equity in net loss of Barnes & Noble.com ( 0.5 ) ( 1.8 ) ( 2.4 )

Other expense ( 0.3 ) ( 0.2 ) ( 0.2 )

Earnings (loss) before income taxes and minority interest 3.8 2.2 ( 0.7 )

Income taxes 1.5 0.9 0.4

Income before minority interest 2.3 1.3 ( 1.1 )

Minority interest ( 0.4 ) -- --

Net earnings (loss) 1.9 % 1.3 % ( 1.1 )%

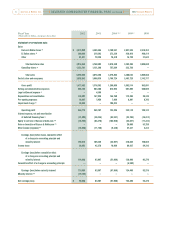

(1) Fiscal 2002 operating profit is net of a non-cash impairment

charge of $25,328. Fiscal 2001 operating profit is net

of legal and settlement expenses of $4,500. Fiscal 2000

operating profit is net of a non-cash impairment charge

of $106,833.

(2) Comparable store sales for Barnes & Noble stores are

determined using stores open at least 15 months, due to

the high sales volume associated with grand openings.

Comparable store sales for B. Dalton and GameStop

stores are determined using stores open at least 12 months.

13

2002 Annual Report Barnes & Noble, Inc.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]