Bank of Montreal 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

*

®1

®1

®1

TM1

®1

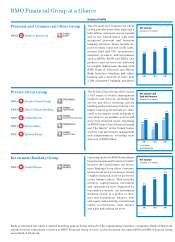

BMO Financial Group at a Glance

Personal and Commercial Client Group

Private Client Group

Investment Banking Group

The Personal and Commercial Client

Group provides more than eight and a

half million customers across Canada

and in the United States with fully

integrated personal and business

banking solutions. These include de-

posit accounts, loans and credit cards,

mutual fund and GIC investments,

insurance products, and investments

such as RRSPs, RESPs and RRIFs. Our

products and services are delivered

by a highly skilled team through 1,142

BMO Bank of Montreal and Harris

Bank branches, telephone and online

banking and a network of more than

2,290 automated banking machines.

The Private Client Group offers clients

a full range of wealth management

products and services, including full

service and direct investing, private

banking and investment products. Our

highly trained professionals are dedi-

cated to serving the needs and goals of

our clients to accumulate, protect and

grow their financial assets. Operating

as BMO Private Client Group in Canada

and The Harris

®

1

in the United States,

we have total assets under management

and administration, including term

deposits, of $282 billion.

Operating under the BMO Nesbitt Burns

brand in Canada and the Harris Nesbitt

®

1

brand in the United States, the Invest-

ment Banking Group offers corporate,

institutional and government clients

complete financial services across the

entire balance sheet. This includes

advisory, capital-raising, investment

and operating services. Supported by

top-ranked research, our Investment

Banking Group is a leader in mer-

gers and acquisitions, advisory, debt

and equity underwriting, institutional

equity, securitization, trade finance

and sales and trading services.

Business Profile

Bank of Montreal has taken a unified branding approach that links all of the organization’s member companies. Bank of Montreal,

together with its subsidiaries, is known as BMO

®

Financial Group. As such, in this document, the names BMO and BMO Financial Group

mean Bank of Montreal.

200320022001

748

818

946

Net Income

(Canadian $ in millions)

200320022001

107

135

71

114

136

183

Net Income and

Cash Net Income

(Canadian $ in millions)

Net Income

Cash Net Income

458

601

722

200320022001

Net Income

(Canadian $ in millions)