Bank of Montreal 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BMO Financial Group 186th Annual Report 200312

Canadian and North American

Peer Group Comparisons

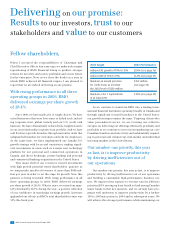

2003 2002* Five-Year Average

Cdn. N.A. N.A. Cdn. N.A. N.A. Cdn. N.A. N.A.

BMO Rank bank bank bank BMO Rank bank bank bank BMO Rank bank bank bank

perf. of six avg. avg. q’tile perf. of six avg. avg. q’tile perf. of six avg. avg. q’tile

Financial Performance Measures (%)

Five-year total shareholder return (TSR) 12.9 6 16.3 9.6 2 7.9 4 8.2 3.3 1 12.9 6 16.3 9.6 2

Diluted earnings per share (EPS) growth 28.4 5 64.9 14.0 2 0.8 2 (29.6) 18.2 3 10.4 6 14.3 8.8 4

Return on common shareholders’ equity (ROE) 16.4 5 15.8 16.4 3 13.4 2 9.9 14.1 3 15.1 3 15.1 15.9 3

Net economic profit (NEP) growth 91.8 3 2,997.0 45.0 2 (15.2) 2 (97.0) 24.5 3 21.9 5 593.2 17.5 3

Revenue growth 4.7 3 1.2 (1.9) 3

–

3 0.8 6.5 3 5.0 6 7.5 7.4 3

Expense-to-revenue ratio 65.7 3 67.3 60.0 3 68.1 4 68.6 59.9 4 65.4 3 66.6 62.3 3

Provision for credit losses as a % of

average net loans and acceptances 0.30 2 0.39 0.95 1 0.56 2 0.96 1.42 1 0.40 1 0.55 1.00 1

Financial Condition Measures (%)

Gross impaired loans and acceptances as a %

of equity and allowance for credit losses 12.2 5 11.4 7.6 4 15.2 4 14.6 10.0 4 12.1 3 13.7 8.4 4

Cash and securities-to-total assets 29.1 6 31.4 38.2 3 24.9 6 28.7 38.2 4 26.8 5 29.0 37.0 3

Tier 1 Capital Ratio 9.55 6 10.20 8.75 1 8.80 4 9.07 8.50 2 8.61 6 8.96 8.26 2

Credit rating

Standard & Poor’s AA

-

1A+A+1 AA

-

1AA

-

A+ 1 AA

-

1AA

-

A+ 1

Moody’s Aa3 2 Aa3 Aa3 2 Aa3 2 Aa3 Aa3 2 Aa3 2 Aa3 Aa3 2

The Canadian bank peer group average is based on the performance of Canada’s six largest banks:

BMO Financial Group, Canadian Imperial Bank of Commerce, National Bank of Canada, RBC Financial

Group, Scotiabank and TD Bank Financial Group. The North American bank peer group average is

based on the performance of North America’s 17 largest banks, consisting of all banks in North

America having shareholders’ equity that is at least 75% as large as BMO’s. It includes the Canadian

peer group, except National Bank of Canada, as well as Bank of America Corporation, Bank One

Corporation, Citigroup, FleetBoston Financial Corporation, J.P. Morgan Chase & Co., KeyCorp, National

City Corporation, The PNC Financial Services Group Inc., SunTrust Banks Inc., U.S. Bancorp, Wachovia

Corporation, and Wells Fargo & Company.

Results are as at or for the years ended October 31 for Canadian banks and as at or for the years

ended September 30 for U.S. banks, as appropriate.

For consistency with our peer groups, the non-interest expense-to-revenue ratios include

amortization of goodwill for all banks for years prior to 2002 in the calculation of the five-

year average.

*

In the 2002 MD&A, performance data was based on results excluding non-recurring items. See page 20.

Canadian Peer Group Comparison

BMO’s absolute performance in 2003 was appreciably better

than in 2002 on all 11 of our primary financial performance and

condition measures. Our 2003 performance was better than our

five-year average on 7 of 11 measures and our five-year average

performance improved on 8 of 11 measures relative to the five-

year average in 2002.

In 2003, our performance was above the Canadian peer group

average on four of seven financial performance measures, com-

pared with above average performance on five measures in 2002.

Notwithstanding our improved results in 2003, our rankings in

the Canadian peer group deteriorated from the relatively strong

rankings of a year ago. In 2002, two of our five peers experienced

sharp declines in EPS while another two experienced declines

of more than 18%. BMO’s EPS increased modestly in 2002 in the

difficult operating environment. Our reasonably strong operating

results in fiscal 2002 and the relatively weak results of some of

our peers that year have affected our rankings and performance

relative to the peer group averages in 2003 in certain of the

growth-related performance measures.

Improving productivity was BMO’s top priority for 2003. Our

expense-to-revenue ratio improved by 240 bps and our ranking

climbed from fourth to third among Canadian banks. BMO’s

cash

productivity ratio (see page 20) improved 260 bps in 2003

to 64.5%, rising from fifth best to second best of Canada’s major

banks. In 2004, we are targeting a further 150 to 200 bps improve-

ment in cash productivity.

BMO’s provision for credit losses represented 30 bps of average

net loans and acceptances, the second best of Canada’s banks.

The top-ranked bank in 2003 recorded a provision representing

183 bps of average net loans and acceptances a year ago, com-

pared with BMO’s 56 bps charge in 2002.

Our ranking declined on three of the four financial condition

measures and was also below average on three of four. However,

our Tier 1 Capital Ratio and cash and securities-to-total assets

ratio are both above our minimum targ

ets.

BMO’s gross impaired loans and acceptances as a percentage

of equity and allowance for credit losses improved by 3 per-

centage points from 2002 to 12.2%, but our ranking slipped to

fifth among Canadian banks. The ratio can be affected by the

speed with which companies designate loans as impaired, the

level of losses companies experience on their impaired loans

and the timing of write-offs. BMO’s credit experience,

as meas-

ured by required provisions for credit losses, remains

top-tier

in Canada and North America.

North American Peer Group Comparison

Our rankings in the North American peer group were better in

2003 than a year ago. Our quartile ranking improved on three of

the financial performance measures, declined on one and was

unchanged on the remaining three. Our performance was better

than average on five of the measures in 2003 and was average on

another. In 2002, our performance was better than average on two

of the seven measures.

BMO’s quartile ranking improved on two of the financial

condition measures and was unchanged on the remaining two.

Our performance was above average on three of four measures

in 2003, consistent with 2002.