Baker Hughes 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO O U R S TO C K H O L D E R S

2009 was an important year of transition

for Baker Hughes. In a difficult market, we

made several strategic moves to enhance our

ability to compete on a global scale and fully

participate in the most significant opportuni-

ties in our industry over the next decade.

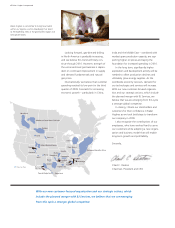

During the year, we reorganized to be

more responsive to our customers, relocating

operational leadership from our existing

offices to 32 region and geomarket offices

around the world. We created enterprise-

wide marketing, technology and supply

chain organizations to focus on key market

segments, optimize our product portfolio,

accelerate the pace of product introduction,

and improve our operational efficiency. We

also reached agreement to acquire BJ Services

Company, a provider of pressure pumping

and other oilfield services. BJ Services will

add significant capabilities in pressure pump-

ing and stimulation, closing a significant gap

in our technology portfolio.

In 2009, the world faced the worst global

recession since the Great Depression and

demand for energy fell in step with the

decline in economic activity. Capital spend-

ing by our customers, as measured by the

Barclays Capital Spending Survey, declined

15% in 2009 compared to 2008. The aver-

age U.S. active rotary rig count of 1,090 in

2009 was down 42%, from 1,879 rigs in

2008, and the average international rig

count of 997 was down 8% for the year.

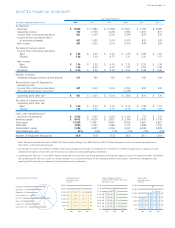

Baker Hughes revenues of $9.66 billion

in 2009 were down 19% from $11.86 bil-

lion in 2008. Net income was $421 million

or $1.36 per diluted share compared to

$1.64 billion or $5.30 per diluted share in

2008. North America revenues declined 31%

and revenues outside of North America fell

9% in 2009 compared to 2008.

The year ended with a bit of good news.

Worldwide revenue increased 9% sequen-

tially in the fourth quarter compared to the

third quarter of 2009 as activity increased

in all geographic regions.

Net income for 2009 was impacted by

charges of $250 million before tax ($0.55

per diluted share), including $138 million

associated with reorganization and sever-

ance, $18 million in acquisition-related costs,

and an increase of $94 million to our allow-

ance for doubtful accounts, as many of our

domestic and international customers strug-

gled in the challenging economic conditions

of 2009. Our operating profit margin for

the year was impacted by the lower activity

levels, significant price erosion, and the extra

costs we carried to ensure a smooth organi-

zational transition. Given the progress we

have made on our transformation, these

additional costs should largely be behind

us as we enter 2010.

During 2009, debt decreased $533 mil-

lion to $1.80 billion, and cash and short-

term investments decreased $360 million to

$1.60 billion as compared to 2008. Capital

expenditures were $1.09 billion, depreciation

and amortization expense was $711 million

and dividend payments were $185 million

in 2009.

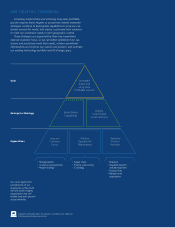

Strategic Direction

For the past several years, Baker Hughes

has invested significantly in people, infra-

structure and technology. These investments

served as the foundation for the next set of

strategic actions designed to help us increase

market share and achieve long-term profit-

able growth. We communicated this strategy

to our organization with the visual aid of a

simple pyramid, as depicted on the inside

cover of this annual report.

In brief, increasing market share and

achieving long-term profitable growth

requires Baker Hughes to pursue two related

enterprise strategies: continue to build global

capabilities to serve our customers around

the world, and deploy customized local solu-

tions to meet our customers’ needs in each

geographic market.

We further identified three imperatives

that are critical to the implementation of

these strategies. First, improve our customer

focus, so we can better understand our

customers and proactively meet their needs.

Second, achieve operational effectiveness

and improve our overall cost position. Third,

optimize our existing technology portfolio

and fill strategic gaps, including our reser-

voir engineering capabilities and pressure

pumping services. To implement these imper-

atives, we launched a number of initiatives,

including a major reorganization and tar-

geted acquisitions.

This Annual Report to Stockholders, including the letter to stockholders from Chairman Chad C. Deaton, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. The words “will,” “expect,” “should,” “scheduled,” “plan,” “aim,” “ensure,” “believe,” “promise,” “anticipate,” “estimate”, “could” and similar expressions are intended to identify forward-

looking statements. Baker Hughes’ expectations regarding these matters are only its forecasts. These forecasts may be substantially different from actual results, which are affected by many factors, including the pending BJ Services acqui-

sition, and those listed in ”Risk Factors“ and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Items 1A and 7 of the Annual Report on Form 10-K of Baker Hughes Incorporated for its

year ended December 31, 2009. The use of “Baker Hughes,” “our,” “we” and similar terms are not intended to describe or imply particular corporate organizations or relationships.

Chad C. Deaton

Chairman, President and

Chief Executive Officer

2 Baker Hughes Incorporated