Baker Hughes 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

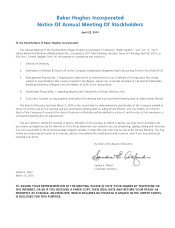

2009 Proxy Statement 3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

On August 30, 2009, the Company entered into an Agree-

ment and Plan of Merger (the “Merger Agreement”), by and

among the Company, BJ Services Company, a Delaware corpo-

ration (“BJ Services”), and BSA Acquisition LLC, a Delaware

limited liability company and a wholly owned subsidiary of the

Company (“Merger Sub”), pursuant to which BJ Services will be

merged with and into Merger Sub, with Merger Sub surviving

the merger as a wholly owned subsidiary of the Company (the

“Merger”). The Merger Agreement and the Merger have been

approved by the Board of Directors of both the Company and

BJ Services. In the Merger, each issued and outstanding share

of BJ Services’ common stock will be converted into the right

to receive (i) 0.40035 shares of the Company’s common stock,

par value $1.00 per share, and (ii) $2.69 per share in cash.

For more information regarding the Merger, you are urged

to read the joint proxy statement/prospectus dated February 12,

2010, which the Company and BJ Services filed with the SEC

on February 16, 2010 and was first mailed to Company stock-

holders and BJ Services stockholders on or about February 16,

2010. You are urged to read the joint proxy statement/pro-

spectus and any other relevant materials filed by the Company

or BJ Services because they contain important information

about the Company, BJ Services and the Merger. The joint

proxy statement/prospectus and other relevant materials and

any other documents filed by the Company or BJ Services with

the SEC, may be obtained free of charge from the SEC’s web-

site at www.sec.gov. In addition, the documents filed with the

SEC by the Company may be obtained free of charge from

the Company’s website at www.bakerhughes.com.

Completion of the Merger is expected to occur on

March 19, 2010, the date the Company and BJ Services

have scheduled special meetings of stockholders, subject to

adjournment or postponement, where the stockholders of

each entity will vote whether to approve the Merger. However,

the completion of the Merger is subject to customary closing

conditions, and although the Company expects the Merger to

be completed on March 19, 2010, as anticipated, the Merger

may not be completed prior to the Company’s Annual Meeting

on April 22, 2010.

As of the date of this proxy statement, the Company’s

Board of Directors consists of eleven directors, ten of whom

are independent non-management directors. The Merger

Agreement includes an agreement that two members of the

BJ Services Board of Directors be added to the Baker Hughes

Board of Directors following completion of the Merger.

J.W. Stewart and James L. Payne have been designated to

become members of the Baker Hughes Board of Directors

upon closing of the Merger. Therefore, if the Merger is com-

pleted prior to the Annual Meeting, a total of thirteen nomi-

nees will be voted upon at the Annual Meeting for election

to the Board of Directors: eleven of the nominees will have

served as directors since the last annual meeting and the

remaining two will have been appointed to the Company

Board of Directors upon closing of the Merger. If the Merger

is not completed prior to the Annual Meeting, only the eleven

incumbent directors will be voted upon for election to the

Company Board of Directors.

In analyzing director nominations and director vacancies

the Governance Committee strives to recommend candidates

for director positions who will create a collective membership

on the Board with varied experience and perspective and who

maintain a Board that reflects diversity, including but not lim-

ited to gender, ethnicity, background, country of citizenship

and experience. The Governance Committee strives to recom-

mend candidates who demonstrate leadership and significant

experience in a specific area of endeavor, comprehend the role

of a public company director, exemplify relevant expertise,

experience and a substantive understanding of domestic con-

siderations and geopolitics, especially those pertaining to the

service sector of the oil and gas and energy related industries.

When analyzing whether directors and nominees have

the experience, qualifications, attributes and skills, taken as a

whole, to enable the Board of Directors to satisfy its oversight

responsibilities effectively in light of the Company’s business

and structure, the Governance Committee and the Board of

Directors focus on the information as summarized in each

of the Directors’ individual biographies set forth on pages 5

through 7. In particular, the Board considered Mr. Deaton’s

senior executive experience for over 12 years in the oilfield

services industry combined with extensive knowledge in his

successful energy business career for over 30 years as well as

active participation in energy-related professional organizations.

His knowledge, expertise and management leadership regard-

ing the issues affecting our business and the Company have

been invaluable to the Board of Directors in overseeing the

business and affairs of our Company. Similarly the Board has

considered the extensive backgrounds of each of the indepen-

dent non-management directors, including Mr. Brady’s experi-

ence and leadership of public companies in the energy services

sector and manufacturing sector together with his financial

expertise; Mr. Cazalot’s role as chief executive and director of

a publicly traded energy company as well as his 37 successful

years of experience in the global energy business; Ambassador

Djerejian’s extensive international and governmental experience,

particularly his more than 30 years in the United States Foreign

Service, including service as the U.S. Ambassador to two coun-

tries, as well as his role as director of two other public com-

panies in the energy sector; Mr. Fernandes’ leadership roles

in several public companies in the energy and manufacturing

sectors, including his service as a director of other public com-

panies and his extensive financial expertise; Ms. Gargalli’s lead-

ership and consulting experience, extensive public board service