Baker Hughes 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 0 9 A N N U A L R EP O R T T O S TO C K H O L D ER S

Table of contents

-

Page 1

20 0 9 A NNUA L REP ORT TO STOCK HOLDER S -

Page 2

... research and development • Product lines • Mergers and acquisitions Our cover depicts the contributions of our employees as they build the new Baker Hughes organization that will enable long-term growth and profitability. Additional information about the company is available on our website... -

Page 3

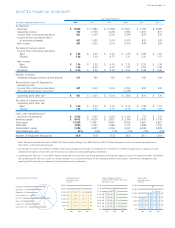

... BY REGION TOTAL REVENUES 2007-2009, by Quarter (In millions) TOTAL OPERATING PROFIT AFTER TAX PER SHARE (DILUTED) 2007-2009, by Quarter TOTAL DEBT 2007-2009, by Quarter (In millions) Canada, 5% Asia Pacific, 11% Middle East, 10% Russia Caspian, 4% USA, 32% Africa, 11% Europe, 15% Latin America... -

Page 4

... inside cover of this annual report. In brief, increasing market share and achieving long-term profitable growth requires Baker Hughes to pursue two related enterprise strategies: continue to build global capabilities to serve our customers around the world, and deploy customized local solutions to... -

Page 5

... in the southern United States, to a geomarket organization with Eastern and Western Hemispheres, nine presidents in regions around the world, and 23 geomarket managing directors on the ground in all the major markets. The geographic organization improves customer focus in a number of ways. By... -

Page 6

...broad, multi-product line customer solutions. The Drilling & Evaluation product center focuses on drill bits, drilling systems, and logging-while-drilling and wireline products and services for formation evaluation. The Completion & Production product center develops well completion technologies and... -

Page 7

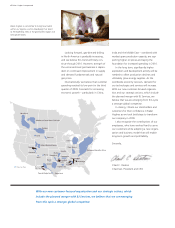

... committee of the Board of Directors, our General Counsel and our Chief Compliance Officer. Opportunities and Outlook Looking forward, Baker Hughes will focus on a number of areas which provide opportunities for long-term growth, including relationships with national oil companies, development... -

Page 8

... in Baker Hughes as we took bold steps to transform our company in 2009. I also recognize the contributions of our employees, who have worked hard to serve our customers while adopting a new organization and business model that will enable long-term growth and profitability. Sincerely, New AMbany... -

Page 9

... your proxy. By order of the Board of Directors, Sandra E. Alford Corporate Secretary Houston, Texas March 12, 2010 TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE (I) VOTE YOUR SHARES BY TELEPHONE OR THE INTERNET, OR (II) IF YOU RECEIVED A PAPER COPY, THEN SIGN, DATE AND RETURN YOUR PROXY... -

Page 10

... Equity Awards At Fiscal Year-End ...29 Option Exercises And Stock Vested ...30 Pension Benefits ...30 Nonqualified Deferred Compensation ...31 Potential Payments Upon Termination or Change in Control ...31 Director Compensation ...43 Compensation Committee Report...44 Compensation Committee... -

Page 11

...from the Holders of 25% of our Voting Stock and AGAINST Stockholder Proposal No. 1 regarding Majority Vote Standard for Director Elections. Proxies may be revoked at any time prior to the exercise thereof by filing with the Company's Corporate Secretary, at the Company's executive offices, a written... -

Page 12

... without receiving instructions from you. The following table sets forth information about the holders of the Common Stock known to the Company on March 2, 2010 to own beneficially 5% or more of the Common Stock, based on filings by the holders with the SEC. For the purposes of this Proxy Statement... -

Page 13

... receive (i) 0.40035 shares of the Company's common stock, par value $1.00 per share, and (ii) $2.69 per share in cash. For more information regarding the Merger, you are urged to read the joint proxy statement/prospectus dated February 12, 2010, which the Company and BJ Services filed with the SEC... -

Page 14

4 Baker Hughes Incorporated and her financial expertise; Dr. Jungels' technical knowledge, executive roles, 38 successful years of experience in the international energy industry and service as a member of public company boards; Mr. Lash's engineering and high technology knowledge and skills, his ... -

Page 15

... a director of the Greater Houston Partnership, a member of the Business Council and serves on the Advisory Board of the World Affairs Council of Houston. Chairman of the Board, President and Chief Executive Officer of Baker Hughes Incorporated since February 1, 2008. Chairman of the Board and Chief... -

Page 16

6 Baker Hughes Incorporated Nominees (cont'd.) Anthony G. Fernandes Principal Occupation Former Chairman, President and Chief Executive Officer of Phillip Services Corporation (diversified industrial services provider) from August 1999 to April 2002. He was Executive Vice President of ARCO (... -

Page 17

... Proxy Statement 7 Nominees (cont'd.) J.W. Stewart* Principal Occupation Age Director Since 2010 Chairman of the Board of Directors, President and Chief Executive Officer of BJ 65 Services Company (pressure pumping services) from 1990 to 2010. Prior to 1990, Mr. Stewart held various management... -

Page 18

8 Baker Hughes Incorporated vested or forfeited, will become fully vested on the annual meeting of stockholders next following the date the nonmanagement director attains the age of 72); and (ii) options to acquire the Company's Common Stock with a value of $30,000 issued in each of January and ... -

Page 19

.../Ethics Committee provides assistance to the Board of Directors in overseeing matters relating to the accounting and reporting practices of the Company, the adequacy of the Company's disclosure controls and internal controls, the quality and integrity of the quarterly and annual financial statements... -

Page 20

..., or Finance Committee or with the independent non-management directors of the Company as a group, by sending such written communication to the Company's Corporate Secretary, c/o Baker Hughes Incorporated, 2929 Allen Parkway, Suite 2100, Houston, Texas, 77019. The procedures for "Stockholder... -

Page 21

... information to the Audit/Ethics Committee addressing issues related to risk analysis and risk management. At every regularly scheduled meeting of the Audit/Ethics Committee the Company's Chief Compliance Officer provides a report to the Committee regarding the Company's Business Code of Conduct... -

Page 22

... of the Senior Executives; (ix) reviewing and reporting to the Board the levels of stock ownership by the Senior Executives in accordance with the Stock Ownership Policy; (x) reviewing the Company's employee benefit programs and recommending for approval all committee administrative changes that may... -

Page 23

... programs consist of our shortterm incentives, made up of the Baker Hughes Incorporated Annual Incentive Compensation Plan, as amended (the "Annual Incentive Plan") and discretionary bonuses, and long-term incentives, made up of stock options, restricted stock awards ("RSAs"), restricted stock units... -

Page 24

... levels for Senior Executives, the Committee encourages a balance between short and long-term business goals by employing both types of compensation programs. Our incentive plans are established to emphasize long-term decision making. Because the value of our long-term incentive opportunity... -

Page 25

...Compensation Committee reviews Survey Data and evaluates the Senior Executive's level of responsibility and experience as well as Company performance. The Compensation Committee also considers the Senior Executive's success in achieving business results, promoting our core values and keys to success... -

Page 26

...report to Mr. O'Donnell, a Company Vice President, who was named President Baker Hughes Western Hemisphere Operations. Annual Incentive Plan The Annual Incentive Plan provides Senior Executives with the opportunity to earn cash bonuses based on the achievement of specific Company-wide, business unit... -

Page 27

... to driving the Company's reorganization from a product line focus to a geographic focus, recruitment of key positions and diversification of the management team, realization of efficiency gains in information technology, health safety & environment and supply chain, achievement of safety goals... -

Page 28

... and to provide a balanced long-term incentive program. Beginning in 2005, the Compensation Committee approved equity awards in shares of restricted stock (or RSUs in non-United States jurisdictions) in addition to the previously offered fixed-price stock options. Capitalized terms used in this... -

Page 29

...stockholder value creation. The objectives of the performance units are to (i) ensure a long-term focus on capital employment; (ii) develop human resource capability; (iii) enable long-term growth opportunities; (iv) motivate accurate financial forecasting; and (v) reward long-term goal achievement... -

Page 30

...the Code. Although equity awards may be deductible for tax purposes by the Company, the accounting rules pursuant to FASB ASC Topic 718 require that the portion of the tax benefit in excess of the financial compensation cost be recorded to additional paid-in capital. Employee Stock Purchase Plan The... -

Page 31

...taxqualified, defined benefit plan funded entirely by us. Under the provisions of the Pension Plan, a cash balance account is established for each participant. Age-based pay credits are made quarterly to the accounts as a percentage of eligible compensation. Eligible compensation generally means all... -

Page 32

... in control of the Company), severance benefits may be paid to the Senior Executives. Additional severance benefits payable to our PEO are addressed in his employment agreement discussed below. The Senior Executives are covered under a general severance plan known as the Baker Hughes Incorporated... -

Page 33

... receive the following, all as established from time to time by the Board of Directors or the Compensation Committee: • a base salary; • the opportunity to earn annual cash bonuses in amounts that may vary from year to year and that are based upon achievement of performance goals; • long-term... -

Page 34

...Senior Executive's Highest Bonus Amount (as defined below), prorated based upon the number of days of his service during the performance period (reduced by any payments received by the Senior Executive under our Annual Incentive Compensation Plan, as amended, in connection with the Change in Control... -

Page 35

... at levels high enough to assure our stockholders of management's commitment to value creation. The Compensation Committee annually reviews each Senior Executive's compensation and stock ownership levels to determine whether they are appropriate or if adjustments need to be made. In 2009, each... -

Page 36

... (b) still be in compliance with the Stock Ownership Level as of the day the shares are sold based on current share price and salary level. Annual Review The Compensation Committee reviews all Required Ownership Shares levels of the Senior Executives covered by the Policy on an annual basis. The PEO... -

Page 37

... ($) Bonus ($) Stock Awards (1) ($) Option Awards (1) ($) Non-Equity Incentive Plan Compensation ($) All Other Compensation ($) Total ($) Chad C. Deaton - Principal Executive Officer Peter A. Ragauss - Principal Financial Officer Alan R. Crain - Senior Vice President and General Counsel David... -

Page 38

... 2008-2010 Long-Term Performance Unit Awards, which awards are paid in cash. Amounts shown represent the number of shares granted in 2009 for RSAs. Our practice is that the exercise price for each stock option is the fair market value on the date of grant. Under our long-term incentive program, fair... -

Page 39

...Vested (#) Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units, or Other Rights that Have Not Vested ($) Name Option Exercise Price ($) Option Expiration Date (1) Number of Shares or Units that Have Not Vested (#) (2) Market Value of Shares or Units of Stock that Have... -

Page 40

...following table sets forth certain information regarding options and stock awards exercised and vested, respectively, during 2009 for the persons named in the Summary Compensation Table above. Option Exercises and Stock Vested Option Awards Number of Shares Acquired on Exercise (#) Value Realized on... -

Page 41

...term of the employment agreement, continuation of medical insurance benefits at active employee premium rates (1); e. a lump sum payment equivalent to the monthly basic life insurance premium applicable to Mr. Deaton's basic life insurance coverage on the date of termination multiplied by the number... -

Page 42

..." rules on payments and benefits received in connection with the Change in Control. The gross-up payment would make the Senior Executive whole for excise taxes (and for all taxes on the gross-up payment) in respect of payments and benefits received pursuant to all the Company's plans, agreements and... -

Page 43

... Control were to have occurred on that date. Under the terms of Mr. Crain's stock options, he would have to pay an aggregate of $3,200,057 to purchase these shares. Mr. Crain's options with respect to 48,418 of our shares were in-the-money (per share stock value greater than per share exercise price... -

Page 44

34 Baker Hughes Incorporated John A. O'Donnell Mr. O'Donnell's options to purchase an aggregate of 34,343 of our shares, with a value of $40.48 per share would have become fully exercisable on December 31, 2009, if a Change of Control were to have occurred on that date. Under the terms of Mr. O'... -

Page 45

... on payments and benefits received in connection with the Change in Control. The gross-up payment would make the officer whole for excise taxes (and for all taxes on the gross-up payment) in respect of payments and benefits received pursuant to all the Company's plans, agreements and arrangements... -

Page 46

...he is due under our employee benefit plans and equity and incentive compensation plans: a. a lump sum payment equal to one and one-half times the Senior Executive's annual base salary in effect immediately prior to his termination of employment; and b. outplacement services for a period of 12 months... -

Page 47

... an odd number of directors); or • our stockholders approve a plan of complete liquidation or dissolution of us. Full Vesting of Restricted Stock Awards Upon Termination of Employment by the Senior Executive for Good Reason or By Us Without Cause in Connection with a Potential Change in Control If... -

Page 48

... affiliates sold a business unit, (ii) on December 31, 2009 the Senior Executive's employment with us terminated in connection with the sale and (iii) the sale did not constitute a 2002 D&O Plan Change in Control, a pro-rata portion of the Senior Executive's then outstanding restricted stock awards... -

Page 49

... our affiliates sold a business unit, (ii) on December 31, 2009, Mr. O'Donnell's employment with us terminated in connection with the sale and (iii) the sale did not constitute a 2002 D&O Plan Change in Control. The maximum value of this accelerated vesting of Mr. O'Donnell's restricted stock awards... -

Page 50

40 Baker Hughes Incorporated If Mr. O'Donnell had terminated employment with us on December 31, 2009 due to retirement his options to purchase an aggregate of 34,343 of our shares, with a value of $40.48 per share would have become fully exercisable on December 31, 2009. Under the terms of Mr. O'... -

Page 51

... and $109,692 in complete settlement of his performance unit award granted under the 2002 D&O Plan on January 24, 2007, January 23, 2008 and March 31, 2009, respectively, for a total of $266,892. Baker Hughes Incorporated Supplemental Retirement Plan Under the SRP the Senior Executives may elect to... -

Page 52

... of service, Mr. Barr had a fully vested interest in all of his accounts under the SRP. The value of Mr. Barr's SRP accounts as of April 30, 2009 was $1,894,681. Baker Hughes Incorporated Annual Incentive Compensation Plan In the event of the retirement, disability or death of a Senior Executive he... -

Page 53

...Financial Statements included in our annual report under Item 8 of the Form 10-K for the year ended December 31, 2009. The following table shows the aggregate number of stock awards and options awards outstanding for each director as of December 31, 2009 as well as the grant date fair value of stock... -

Page 54

...31, 2009 with management, the Company's internal auditors and Deloitte & Touche. Deloitte & Touche informed the Audit/Ethics Committee that the Company's audited financial statements are presented fairly in conformity with accounting principles generally accepted in the United States of America. The... -

Page 55

... statements, review of quarterly financial statements and audit services related to the effectiveness of the Company's internal control over financial reporting. Auditrelated fees consist primarily of services related to the S-4 filing with the SEC regarding the proposed merger with BJ Services. Tax... -

Page 56

... of our directors, officers and employees away from performing their primary functions of oversight of the Company, managing the Company and carrying out their operational responsibilities, respectively. In addition, if the Company were ever in negotiations to sell itself, our Board may have... -

Page 57

... was submitted to Baker Hughes by the United Brotherhood of Carpenters Pension Fund (with an address of 101 Constitution Avenue, N.W., Washington D.C. 20001) who is the owner of 4,728 shares of the Company's Common Stock, and is included in this Proxy Statement in compliance with SEC rules and... -

Page 58

...Parkway, Suite 2100, Houston, Texas 77019. Nominations of directors by stockholders must be received by the Chairman of the Governance Committee of the Company's Board of Directors, P.O. Box 4740, Houston, Texas 77210-4740 or the Corporate Secretary, c/o Baker Hughes Incorporated, 2929 Allen Parkway... -

Page 59

..., disclosure controls and internal controls, enterprise risk management and environmental policies • Reviewing quarterly earnings release and quarterly and annual financial statements to be filed with the Securities and Exchange Commission ("SEC") • Evaluating and setting the compensation of the... -

Page 60

... for Stockholder Recommended Director Candidates" , by submitting within the prescribed time period the name and supporting information to: Chairman, Governance Committee of the Board of Directors, P.O. Box 4740, Houston, Texas 77210-4740 or to the Corporate Secretary, c/o Baker Hughes Incorporated... -

Page 61

... an evaluation of the Committee and its activities. Governance Committee Purpose: The Committee's purpose is to develop and recommend to the Board a set of corporate governance principles applicable to the Company ("Corporate Governance Guidelines") and to oversee compliance with, conduct reviews of... -

Page 62

... for reviewing and evaluating and, as applicable, approving the officer compensation plans of the Company. It is also the purpose of the Committee to produce an annual report on executive compensation for inclusion in the Company's proxy statement for the Annual Meeting of Stockholders. Principal... -

Page 63

... long-range plans. In addition the Committee will periodically review the Company's activities with credit rating agencies, its policy governing approval levels for capital expenditures and funding thereof and its insurance programs. The Committee's Charter shall be posted on the Company's website... -

Page 64

54 Baker Hughes Incorporated The Board endorses and supports the Company's Core Values and Keys for Success: Core Values Integrity: We believe integrity is the foundation of our individual and corporate actions that drives an organization of which we are proud. • We are a responsible corporate ... -

Page 65

..., sound business judgment and support for the Core Values of the Company; vii) Understand financial statements; viii) Are independent as defined by the Securities and Exchange Commission ("SEC") and the New York Stock Exchange; ix) Support the ideals of the Company's Business Code of Conduct and are... -

Page 66

... Incorporated EXHIBIT C BAKER HUGHES INCORPORATED POLICY FOR DIRECTOR INDEPENDENCE, AUDIT/ETHICS COMMITTEE MEMBERS AND AUDIT COMMITTEE FINANCIAL EXPERT (As Amended October 23, 2008) INDEPENDENCE I. Introduction A member of the Board of Directors ("Board") of Baker Hughes Incorporated ("Company... -

Page 67

... auditing or evaluation of financial statements; or (d) Other relevant experience. EXHIBIT D BAKER HUGHES INCORPORATED POLICY AND SUBMISSION PROCEDURES FOR STOCKHOLDER RECOMMENDED DIRECTOR CANDIDATES (As Amended October 23, 2008) The Governance Committee of Baker Hughes Incorporated ("Company") has... -

Page 68

..., Compensation Committee, Finance Committee or with the independent nonmanagement directors of the Company as a group, by sending such written communication to the following address: Corporate Secretary c/o Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100 Houston, TX 77019-2118 Stockholders... -

Page 69

... Company's internal controls over financial reporting and disclosure controls and procedures, and the quality and integrity of the financial statements of the Company; and (ii) to oversee the Company's compliance programs. The independent auditor is ultimately accountable to the Board of Directors... -

Page 70

... of the MD&A section. Have management review the Company's financial results with the Board of Directors. • Review and discuss with management and the independent registered public accounting firm management's report on internal control prior to the filing of the Company's annual report on Form 10... -

Page 71

... over financial reporting and any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal controls. • Review reports, media coverage and similar public information provided to analysts and rating agencies, as the Committee... -

Page 72

...between management and the independent auditor or to assure compliance with laws and regulations or with Company policies. Meetings The Committee will meet at least five times per year as determined by the Board of Directors. Special meetings may be called, as needed, by the Chairman of the Board of... -

Page 73

...recently completed second fiscal quarter (based on the closing price on June 30, 2009 reported by the New York Stock Exchange) was approximately $11,257,160,000. As of February 19, 2010, the registrant has outstanding 311,904,517 shares of common stock, $1 par value per share. DOCUMENTS INCORPORATED... -

Page 74

.... Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services... -

Page 75

... Baker Hughes is a major supplier of wellbore-related products and technology services and systems. We operate in over 90 countries around the world and our corporate headquarters is in Houston, Texas. We provide products and services for drilling and evaluation of oil and gas wells; completion... -

Page 76

... producing regions of the world. • The Drilling and Evaluation segment consists of the following product lines: drilling fluids, drill bits, directional drilling, drilling evaluation services, wireline formation evaluation, wireline completion and production services and reservoir technology and... -

Page 77

...; permanent monitoring and chemical injection systems; and integrated operations and project management services. The primary drivers of our customer's buying decisions for completion and production products and services include reducing operating expenditures through improving production rates and... -

Page 78

...steel and crop protection. Pipeline Management. Baker Hughes offers a variety of products and services for the pipeline transportation industry. We offer custom turnkey cleaning programs that improve efficiency by combining chemical treatments with brush and scraper tools that are pumped through the... -

Page 79

...the merger consideration will fluctuate based upon changes in the price of shares of Baker Hughes common stock and the number of BJ Services common shares and options outstanding at the closing date. MARKETING, COMPETITION AND ECONOMIC CONDITIONS We market our products and services on a product line... -

Page 80

6 Baker Hughes Incorporated competitors who may participate in only a few product lines, for example, Smith International, National Oilwell Varco, Champion Technologies, Inc., Nalco Holding Company, and Newpark Resources, Inc. Our products and services are sold in highly competitive markets, and ... -

Page 81

... Hemisphere Controller of Baker Oil Tools from 1997 to 1999 and Director of Corporate Audit for the Company from 1990 to 1996. Employed by the Company in 1990. Jay G. Martin 58 Senior Vice President and Chief Operating Officer effective April 30, 2009. Group President of Drilling and Evaluation... -

Page 82

... Hemisphere Operations since May 2009. President of Baker Petrolite Corporation from 2005 to May 2009. President of Baker Hughes Drilling Fluids from 2004 to 2005. Vice President, Business Process Development of the Company from 1998 to 2002; Vice President, Manufacturing, of Baker Oil Tools from... -

Page 83

... of operations. Many of our customers' activity levels and spending for our products and services and ability to pay amounts owed us have been impacted by economic conditions. Access to capital is dependent on our customers' ability to access the funds necessary to develop economically attractive... -

Page 84

...contract terms and conditions with our customers, especially state-owned national oil companies, our ability to manage warranty claims and our ability to effectively manage our commercial agents can also impact our results of operations. Managing development of competitive technology and new product... -

Page 85

..., which may limit our ability to respond to short lead time orders. People are a key resource to developing, manufacturing and delivering our products and services to our customers around the world. Our ability to manage the recruiting, training and retention of the highly skilled workforce required... -

Page 86

... revenue and expenses reported in U.S. Dollars and may impact our results of operations. The condition of the capital markets and equity markets in general can affect the price of our common stock and our ability to obtain financing, if necessary. If the Company's credit rating is downgraded, this... -

Page 87

... to complete the merger with BJ Services could negatively affect our stock price and our future business and financial results. Completion of the merger with BJ Services is not assured and is subject to risks, including the risks that approval of the transaction by stockholders of both Baker Hughes... -

Page 88

...and Baker Hughes in connection with the merger, the litigation could adversely affect our business, financial condition or results of operations following the merger if the proposed settlement has not been completed. Demand for the combined company's products and services, including pressure pumping... -

Page 89

... Represents shares purchased from employees to pay the option exercise price related to stock-for-stock exchanges in option exercises or to satisfy the tax withholding obligations in connection with the vesting of restricted stock awards and restricted stock units. There were no share repurchases... -

Page 90

... 31, 2004 in Baker Hughes common stock, the S&P 500 Index and the S&P 500 Oil and Gas Equipment and Services Index. The Corporate Performance Graph and related information shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference... -

Page 91

...net of tax Net income Per share of common stock: Income from continuing operations: Basic Diluted Dividends Balance Sheet Data: Cash, cash equivalents and short-term investments Working capital (current assets minus current liabilities) Total assets Long-term debt Stockholders' equity $ 9,664 7,397... -

Page 92

... Technology and the Vice President of Supply Chain report to our Chief Operating Officer. The reorganization of the Company by geography and product lines is intended to strengthen our client-focused operations by moving management into the countries where we conduct our business. The product-line... -

Page 93

... the annual injection season. Natural gas prices increased in late December as colder-than-normal temperatures led to strong withdrawals of natural gas from storage. Rig Counts Baker Hughes has been providing rig counts to the public since 1944. We gather all relevant data through our field service... -

Page 94

... sales and service and rentals are similar. The table below details certain consolidated statement of operations data and their percentage of revenues (dollar amounts in millions). 2009 $ % $ 2008 % $ 2007 % Revenues Cost of revenues Research and engineering Marketing, general and administrative... -

Page 95

... we opened the first phase of the Center for Technology and Innovation in Houston, Texas. This facility focuses on research and development of completion and production systems in harsh environments. The second phase was completed in 2008. Marketing, General and Administrative Marketing, general and... -

Page 96

... field development and production. This spending is dependent on a number of factors, including our customers' forecasts of future energy demand, their expectations for future energy prices, their access to resources to develop and produce oil and gas and their ability to fund their capital programs... -

Page 97

... development, administration and enforcement of our Business Code of Conduct, as well as legal compliance standards, policies, procedures and processes. The CCO reports directly to the Senior Vice President and General Counsel and the Chairman of the Audit/Ethics Committee of our Board of Directors... -

Page 98

24 Baker Hughes Incorporated group and our other company attorneys located throughout the world are available to answer legal questions regarding the Compliance Program and provide assistance to employees. In connection with our settlements with the DOJ and SEC, we retained an independent monitor (... -

Page 99

... some of our customers renewed access. Our capital planning process is focused on utilizing cash flows generated from operations in ways that enhance the value of our company. In 2009, we used cash to pay for a variety of activities including working capital needs, dividends, debt maturities and... -

Page 100

... enhance our current operations or expand our operations into new markets or product lines. We may also from time to time sell business operations that are not considered part of our core business. During 2009, we paid $47 million, net of cash acquired of $4 million, for several acquisitions and as... -

Page 101

..., we believe cash on hand and operating cash flows will provide us with sufficient capital resources and liquidity to manage our working capital needs, meet contractual obligations, fund capital expenditures, and support the development of our short-term and long-term operating strategies. We may... -

Page 102

... change as new events occur, as more experience is acquired, as additional information is obtained and as the business environment in which we operate changes. We have defined a critical accounting estimate as one that is both important to the portrayal of either our financial condition or results... -

Page 103

... regarding long-term forecasts of future revenues and costs related to the assets subject to review. In turn, these forecasts are uncertain in that they require assumptions about demand for our products and services, future market conditions and technological developments. We perform our annual... -

Page 104

... expected experience. The discount rate enables us to state expected future cash flows at a present value on the measurement date. The development of the discount rate for our U.S. plans was based on a bond matching model whereby a hypothetical bond portfolio of high-quality, fixed-income securities... -

Page 105

...of investment policies and strategies, major categories of plan assets, fair value measurement of plan assets and significant concentration of credit risks. We adopted the new disclosure requirements in the fourth quarter of 2009. See Note 14 of the Notes to Consolidated Financial Statements in Item... -

Page 106

... Hughes Incorporated spending, profitability, strategies for our operations, impact of any common stock repurchases, oil and natural gas market conditions, market share and contract terms, costs and availability of resources, economic and regulatory conditions, the potential merger with BJ Services... -

Page 107

...We conduct operations around the world in a number of different currencies. The majority of our significant foreign subsidiaries have designated the local currency as their functional currency. As such, future earnings are subject to change due to fluctuations in foreign currency exchange rates when... -

Page 108

... Baker Hughes Incorporated ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Management's Report on Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as such term is defined in Exchange... -

Page 109

2009 Form 10-K 35 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the internal control over financial reporting of Baker Hughes Incorporated and subsidiaries (the "Company") as of December... -

Page 110

... REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the accompanying consolidated balance sheets of Baker Hughes Incorporated and subsidiaries (the "Company") as of December 31, 2009... -

Page 111

... STATEMENTS OF OPERATIONS Year Ended December 31, (In millions, except per share amounts) 2009 2008 2007 Revenues: Sales Services and rentals Total revenues Costs and expenses: Cost of sales Cost of services and rentals Research and engineering Marketing, general and administrative Acquisition... -

Page 112

...taxes payable Other accrued liabilities Total current liabilities Long-term debt Deferred income taxes and other tax liabilities Liabilities for pensions and other postretirement benefits Other liabilities Commitments and contingencies Stockholders' Equity: Common stock, one dollar par value (shares... -

Page 113

... Defined benefit pension plans, net of tax of $2 Total comprehensive income Issuance of common stock, pursuant to employee stock plans Tax provision on stock plans Stock-based compensation Cash dividends ($0.60 per share) Balance, December 31, 2009 See Notes to Consolidated Financial Statements... -

Page 114

...investments Stock-based compensation costs (Benefit) provision for deferred income taxes Gain on sale of product line Gain on disposal of assets Provision for doubtful accounts Changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Accrued employee compensation... -

Page 115

... ACCOUNTING POLICIES Nature of Operations Baker Hughes Incorporated ("Baker Hughes") is engaged in the oilfield services industry. We are a major supplier of wellbore related products and technology services and systems and provide products and services for drilling, formation evaluation, completion... -

Page 116

...charged to expense as incurred. The capitalized costs of computer software developed or purchased for internal use are classified in machinery and equipment in PP&E. In 2006, the Financial Accounting Standards Board ("FASB") issued an update to Accounting Standards Codification ("ASC") 360, Property... -

Page 117

... statements of operations as incurred. Derivative Financial Instruments We monitor our exposure to various business risks including commodity prices, foreign currency exchange rates and interest rates and occasionally use derivative financial instruments to manage these risks. Our policies... -

Page 118

...outstanding common stock of BJ Services in exchange for newly issued shares of the Company's common stock and cash. BJ Services is a leading provider of pressure pumping and oilfield services. The Merger Agreement and the merger have been approved by the Board of Directors of both the Company and BJ... -

Page 119

...merger consideration will fluctuate based upon changes in the price of shares of Baker Hughes common stock and the number of BJ Services common shares and options outstanding at the closing date. NOTE 3. GAIN ON SALE OF PRODUCT LINE In February 2008, we sold the assets associated with the Completion... -

Page 120

... stock on the date of grant. Compensation cost for RSAs and RSUs is primarily recognized on a straight-line basis over the vesting or service period and is net of forfeitures. A summary of our RSA and RSU activity and related information is presented below (in thousands, except per share/unit prices... -

Page 121

... pricing model with the following assumptions: 2009 2008 2007 We calculated estimated volatility using historical daily prices based on the expected life of the stock purchase plan. The risk-free interest rate is based on the observed U.S. Treasury yield curve in effect at the time the ESPP shares... -

Page 122

... at December 31: 2009 2008 Deferred tax assets: Receivables Inventory Property Employee benefits Other accrued expenses Operating loss carryforwards Tax credit carryforwards Capitalized research and development costs Other Subtotal Valuation allowances Total Deferred tax liabilities: Goodwill... -

Page 123

2009 Form 10-K 49 The following presents a rollforward of our unrecognized tax benefits and associated interest and penalties included in the balance sheet. Gross Unrecognized Tax Benefits, Excluding Interest and Penalties Interest and Penalties Total Gross Unrecognized Tax Benefits Balance at ... -

Page 124

...the following at December 31: 2009 2008 NOTE 9. GOODWILL AND INTANGIBLE ASSETS The changes in the carrying amount of goodwill are detailed below by segment: Drilling and Evaluation Completion and Production Total Finished goods Work in process Raw materials Total $ 1,570 126 140 $ 1,836 $ 1,693... -

Page 125

... AND LIABILITIES We measure certain financial assets and liabilities at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. We use the fair... -

Page 126

... the ARS investments we used Level 3 inputs. These inputs were based on the underlying structure of each security and their collateral values, including assessments of the credit quality, the default risk, the expected cash flows, the discount rates and the overall capital market liquidity. Based on... -

Page 127

... tax effects): Derivative Statement of Operations Location Amount of Gain Recognized in Income Foreign Currency Forward Contracts Interest Rate Swaps Marketing, general and administrative Interest Expense $ 11 6 Concentration of Credit Risk We sell our products and services to numerous companies... -

Page 128

...Consolidated Financial Statements. • The Drilling and Evaluation segment consists of the following product lines: drilling fluids, drill bits, directional drilling, drilling evaluation services, wireline formation evaluation, wireline completion and production services and reservoir technology and... -

Page 129

...the location of the asset at December 31: 2009 2008 2007 The following table presents the details of "Corporate and Other" total assets at December 31: 2009 2008 2007 United States Canada and other North America Latin America Europe, Africa, Russia, Caspian Middle East, Asia Pacific Total $ 1,377... -

Page 130

... U.S. employees who retire and have met certain age and service requirements. ASC 715, Compensation - Retirement requires an employer to measure the funded status of each of its plans as of the date of its year end statement of financial position effective for 2008. The impact of moving our funded... -

Page 131

... n/a n/a The development of the discount rate for our U.S. plans was based on a bond matching model whereby a hypothetical bond portfolio of high-quality, fixed-income securities is selected that will match the cash flows underlying the projected benefit obligation. The discount rate assumption for... -

Page 132

...conditions. The U.S. Committee also reviews the long-term characteristics of various asset classes, focusing on balancing risk with expected return. Accordingly, the U.S. Committee selected the following four asset classes as allowable investments for the assets of the U.S. Plan: U.S. equities, Real... -

Page 133

... securities to achieve returns in line with the Financial Times (London) Stock Exchange ("FTSE") All-Share Index. Invests in global securities from the world's developed markets, including the U.S. and, on an annualized basis, seeks to outperform the Morgan Stanley Capital International World Index... -

Page 134

... value of the assets using Level 3 unobservable inputs. Non-U.S. Property Fund Non-U.S. Insurance Contracts U.S. Property Fund Total Beginning balance at January 1, 2009 Unrealized gains (losses) Net purchases (sales) Ending balance at December 31, 2009 Expected Cash Flows For all pension plans... -

Page 135

... maintain a system of internal accounting controls sufficient to provide reasonable assurances that: (i) transactions are executed in accordance with management's general or specific authorization; and (ii) transactions are recorded as necessary: (I) to permit preparation of financial statements in... -

Page 136

... of the State of Delaware (the "Delaware Chancery Court") on behalf of the public stockholders of BJ Services, with respect to the Merger Agreement, dated as of August 30, 2009, among Baker Hughes, its wholly owned subsidiary, BSA Acquisition LLC, a Delaware limited liability company ("Merger Sub... -

Page 137

2009 Form 10-K 63 Texas Cases On September 4, 2009, a purported stockholder class action lawsuit styled Garden City Employees' Retirement System v. BJ Services Company, et al., was filed in the 80th Judicial District Court of Harris County, Texas, on behalf of the public stockholders of BJ Services... -

Page 138

... outstanding for purchase obligations related to capital expenditures and inventory under purchase orders and contracts of approximately $221 million at December 31, 2009. It is not practicable to estimate the fair value of these financial instruments. None of the off-balance sheet arrangements... -

Page 139

...reports that we file under the Exchange Act is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. Design and Evaluation of Internal Control Over Financial... -

Page 140

... Annual Meeting of Stockholders to be filed with the SEC pursuant to the Exchange Act within 120 days of the end of our fiscal year on December 31, 2009 ("Proxy Statement"), which sections are incorporated herein by reference. For information regarding our executive officers, see "Item 1. Business... -

Page 141

... growth measures and total shareholder return) and Baker Value Added (our metric that measures operating profit after tax less the cost of capital employed). Restricted Stock snd Restricted Stock Units. With respect to awards of restricted stock and restricted stock units, the Compensation Committee... -

Page 142

...dividing by the fair market value of our common stock on the last day of the quarter. The per share exercise price of the option will be the fair market value of a share of our common stock on the date the option is granted. Stock options granted under the Deferral Plan vest on the first anniversary... -

Page 143

...Control Agreement between Baker Hughes Incorporated and each of the executive officers effective as of January 1, 2009. 10.3+ Stock Option Agreement issued to Chad C. Deaton on October 25, 2004 in the amount of 75,000 shares of Company Common Stock (filed as Exhibit 10.4 to Quarterly Report of Baker... -

Page 144

... executive officers effective as of January 1, 2009 (filed as Exhibit 10.4 to Current Report of Baker Hughes Incorporated on Form 8-K filed December 19, 2008). 10.9+ Baker Hughes Incorporated Director Retirement Policy for Certain Members of the Board of Directors (filed as Exhibit 10.10 to Annual... -

Page 145

...Bank of New York Trust Company, N.A. dated as of April 26, 2007, effective May 1, 2007 (filed as Exhibit 10.1 to Quarterly Report of Baker Hughes Incorporated on Form 10-Q for the quarter ended March 31, 2007). 10.59 Agreement and Plan of Merger among Baker Hughes Incorporated, Baker Hughes Delaware... -

Page 146

... LLC and BJ Services Company (filed as Exhibit 2.1 to Current Report of Baker Hughes incorporated on Form 8-K filed August 31, 2009). 21.1* Subsidiaries of Registrant. 23.1* Consent of Deloitte & Touche LLP. 31.1* Certification of Chad C. Deaton, Chief Executive Officer, dated February 25, 2010... -

Page 147

... caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. BAKER HUGHES INCORPORATED Date: February 25, 2010 /s/CHAD C. DEATON Chad C. Deaton Chairman of the Board, President and Chief Executive Officer KNOWN ALL PERSONS BY THESE PRESENTS, that each person whose... -

Page 148

74 Baker Hughes Incorporated BAKER HUGHES INCORPORATED SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS Balance at Beginning of Period Charged to Cost and Expenses Charged to Other Accounts (2) Balance at End of Period (In millions) Write-offs (1) Year ended December 31, 2009 Reserve for doubtful... -

Page 149

...related to risk analysis and risk management; • annually reviews compliance with our Business Code of Conduct and Foreign Corrupt Practices Act policies. The Baker Hughes Business Code of Conduct and Code of Ethical Conduct Certifications are available on our website; • prepares an annual report... -

Page 150

... Plans • Business Code of Conduct • Environmental Policy • Biographies of Board Members • Biographies of Executive Officers Ownership Structure Investors Source Shares (millions) % of Total New York Stock Exchange Last year our Annual CEO Certification, without qualifications, was timely... -

Page 151

..., Supply Chain Clifton Triplett Vice President and Chief Information Officer Peter A. Ragauss Senior Vice President and Chief Financial Officer David E. Emerson Vice President, Corporate Development Gary R. Flaharty Vice President, Investor Relations Alan J. Keifer Vice President and Controller John... -

Page 152

Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100 Houston, Texas 77019-2118 P.O. Box 4740 Houston, TX 77210-4740 (713) 439-8600 www.bakerhughes.com