Assurant 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT, INC.2011 Form10-K6

PARTI

ITEM 1 Business

Lender-placed and voluntary manufactured housing

insurance

Manufactured housing insurance is o ered on a lender-placed and

voluntary basis. Lender-placed insurance is issued after an insurance

tracking process similar to that described above. e tracking is performed

by Assurant Specialty Property using a proprietary insurance tracking

administration system, or by the lenders themselves. A number of

manufactured housing retailers in the U.S. use our proprietary premium

rating technology to assist them in selling property coverages at the

point of sale.

Other insurance

We believe there are opportunities to apply our lender-placed business

model to other products and services. We have developed products in

adjacent and emerging markets, such as the lender-placed ood and

mandatory insurance rental markets. We also act as an administrator for

the U.S. Government under the voluntary National Flood Insurance

Program, for which we earn a fee for collecting premiums and processing

claims. is business is 100% reinsured to the Federal Government.

Marketing and Distribution

Assurant Specialty Property establishes long-term relationships with

leading mortgage lenders and servicers. e majority of our lender-placed

agreements are exclusive. Typically these agreements have terms of three to

ve years and allow us to integrate our systems with those of our clients.

We o er our manufactured housing insurance programs primarily

through manufactured housing lenders and retailers, along with

independent specialty agents. e independent specialty agents distribute

ood products and miscellaneous specialty property products. Multi-

family housing products are distributed primarily through property

management companies and a nity marketing partners.

Underwriting and Risk Management

Our lender-placed homeowners insurance program and certain of our

manufactured home products are not underwritten on an individual

policy basis. Contracts with our clients require us to automatically issue

these policies when a borrower’s insurance coverage is not maintained.

ese products are priced to factor in the lack of individual policy

underwriting. We monitor pricing adequacy based on a variety of

factors and adjust pricing as required, subject to regulatory constraints.

Because several of our product lines (such as homeowners, manufactured

home, and other property policies) are exposed to catastrophe risks,

we purchase reinsurance coverage to protect the capital of Assurant

Specialty Property and to mitigate earnings volatility. Our reinsurance

program generally incorporates a provision to allow the reinstatement

of coverage, which provides protection against the risk of multiple

catastrophes in a single year.

Assurant Health

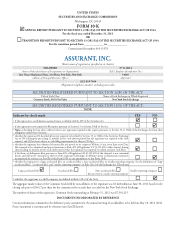

For the Years Ended

December31,2011 December31,2010

Net earned premiums and other considerations:

Individual markets $ 1,286,236 $ 1,375,005

Group markets 473,653 489,117

Total net earned premiums before premium rebates 1,759,889 1,864,122

Premium rebates(1) (41,589) —

TOTAL $ 1,718,300 $ 1,864,122

Segment net income $ 40,886 $ 54,029

Loss ratio(2) 74.0% 69.9%

Expense ratio(3) 26.3% 29.7%

Combined ratio(4) 98.8% 98.1%

Equity(5) $ 405,199 $ 402,167

(1) As of January1,2011, the Company began accruing premium rebates to comply with the minimum medical loss ratio requirements under the Affordable Care Act.

(2) The loss ratio is equal to policyholder benefits divided by net earned premiums and other considerations.

(3) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income

are not included in the above table.)

(4) The combined ratio is equal to total benefits, losses and expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income are not

included in the above table.)

(5) Equity excludes accumulated other comprehensive income.

Product and Services

Assurant Health competes in the individual medical insurance market

by o ering medical insurance and short-term medical insurance to

individuals and families. Our products are o ered with di erent plan

options to meet a broad range of customer needs and levels of a ordability.

Assurant Health also o ers medical insurance to small employer groups.

e Patient Protection and A ordable Care Act and the Health Care

and Education Reconciliation Act of 2010, and the rules and regulations

thereunder (together, “the A ordable Care Act”) were signed into law

in March2010 and represent signi cant changes to the current U.S.

health care system. e legislation is far-reaching and is intended to

expand access to health insurance coverage over time. e legislation