Assurant 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT, INC.2011 Form10-K 5

PARTI

ITEM 1 Business

insurance business. Expertise gained in the domestic credit insurance

market has enabled us to extend our administrative infrastructure

internationally. Systems, training, computer hardware and our overall

market development approach are customized to t the particular needs

of each targeted international market.

Underwriting and Risk Management

We write a signi cant portion of our contracts on a retrospective

commission basis. is allows us to adjust commissions based on claims

experience. Under these commission arrangements, the compensation

of our clients is based upon the actual losses incurred compared to

premiums earned after a speci ed net allowance to us. We believe that

these arrangements better align our clients’ interests with ours and help

us to better manage risk exposure.

Pro ts from our preneed life insurance programs are generally earned

from interest rate spreads—the di erence between the death bene t

growth rates on underlying policies and the investment returns generated

on the assets we hold related to those policies. To manage these spreads,

we regularly adjust pricing to re ect changes in new money yields.

Assurant Specialty Property

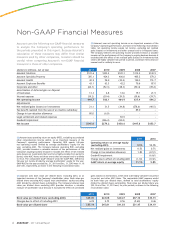

For the Years Ended

December31,2011 December31,2010

Net earned premiums and other considerations by major product grouping:

Homeowners (lender-placed and voluntary) $ 1,274,485 $ 1,342,791

Manufactured housing (lender-placed and voluntary) 216,613 220,309

Other(1) 413,540 390,123

TOTAL $ 1,904,638 $ 1,953,223

Segment net income $ 305,065 $ 424,287

Loss ratio(2) 45.0% 35.1%

Expense ratio(3) 38.7% 39.5%

Combined ratio(4) 81.9% 73.3%

Equity(5) $ 1,114,308 $ 1,134,432

(1) Other primarily includes lender-placed flood, miscellaneous specialty property and multi-family housing insurance products.

(2) The loss ratio is equal to policyholder benefits divided by net earned premiums and other considerations.

(3) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income

is not included in the above table.)

(4) The combined ratio is equal to total benefits, losses and expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income is not

included in the above table.)

(5) Equity excludes accumulated other comprehensive income.

Products and Services

Assurant Specialty Property’s business strategy is to pursue long-term

growth in lender-placed homeowners insurance, and adjacent markets

with similar characteristics, such as lender-placed ood insurance,

and renters insurance. Assurant Specialty Property also writes other

specialty products.

In June2011 we acquired SureDeposit, the market leader in rental

security deposit alternatives. We believe that this acquisition will help

build our niche multi-family housing business which is focused on

distribution through property managers.

Lender-placed and voluntary homeowners insurance

e largest product line within Assurant Specialty Property is homeowners

insurance, consisting principally of re and dwelling hazard insurance

o ered through our lender-placed programs. e lender-placed program

provides collateral protection to lenders, mortgage servicers and investors

in mortgaged properties in the event that a homeowner does not maintain

insurance on a mortgaged dwelling. Lender-placed insurance coverage

is not limited to the outstanding loan balance; it provides structural

coverage, similar to that of a standard homeowners policy. e policy

is based on the replacement cost of the property and ensures that a

home can be repaired or rebuilt completely in the event of damage.

It protects both the lender’s interest and the borrower’s interest and

equity. We also provide insurance to some of our clients on properties

that have been foreclosed and are being managed by our clients. is

type of insurance is called Real Estate Owned (“REO”) insurance. is

market experienced signi cant growth in recent years as a result of the

housing crisis, but is now stabilizing.

In the majority of cases, we use a proprietary insurance-tracking

administration system linked with the administrative systems of our

clients to continuously monitor the clients’ mortgage portfolios to verify

the existence of insurance on each mortgaged property and identify

those that are uninsured. If a potential lapse in insurance coverage is

detected, we begin a process of noti cation and outreach to both the

homeowner and the last-known insurance carrier or agent through

phone calls and written correspondence. is process usually takes

75 days to complete. If at the end of this process we still cannot verify

that insurance has not lapsed, a lender-placed policy is procured by the

lender. e homeowner is still encouraged, and always maintains the

option, to obtain or renew the insurance of his or her choice.