Amtrak 2014 Annual Report Download - page 20

Download and view the complete annual report

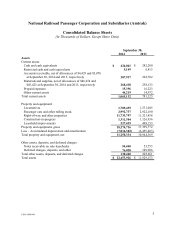

Please find page 20 of the 2014 Amtrak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Railroad Passenger Corporation and Subsidiaries (Amtrak)

Notes to Consolidated Financial Statements (continued)

1509-1694994 12

3. Basis of Presentation and Summary of Significant Accounting Policies (continued)

Cash and Cash Equivalents

All short-term investments with original maturities of 90 days or less are considered cash and

cash equivalents. These consist of bank deposits, money market fund investments, and treasury

bills. Cash and cash equivalents are maintained at various financial institutions and, at times,

balances may exceed federally insured limits.

Restricted Cash and Cash Equivalents

Restricted cash and cash equivalents consist primarily of funds received that are restricted for

specific purposes or cash set aside and restricted for specific payments. The balance in restricted

cash and cash equivalents as of September 30, 2014 consists of restricted funds for certain

operations of the Amtrak Police Department. As of September 30, 2013, the balance in restricted

cash and cash equivalents consisted of (i) restricted funds for certain operations of the Amtrak

Police Department (ii) restricted cash from a contractor performing work for the Illinois

Department of Transportation, (iii) restricted cash held for Amtrak’ s Office of Inspector General

and used to reimburse the cost of program management and oversight under the American

Recovery and Reinvestment Act of 2009; and (iv) restricted cash set aside and used to fund

union employee healthcare claims paid by a former insurance provider in connection with

Amtrak’ s self-insured medical program.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable in the Consolidated Balance Sheets includes billed and unbilled accounts

receivable. Billed accounts receivable represent amounts for which invoices have been sent to

customers. These accounts receivable are recorded at the invoiced amount and do not bear

interest. Unbilled accounts receivable represent amounts recognized as revenue for which

invoices have not yet been sent to customers. The Company recorded $102.3 million and

$46.4 million of unbilled accounts receivable as of September 30, 2014 and 2013, respectively.

The allowance for doubtful accounts is the Company’ s best estimate of the amount of probable

credit losses in the Company’ s billed accounts receivable. To determine its allowance for

doubtful accounts, the Company evaluates historical loss experience and the characteristics of

current accounts, as well as general economic conditions and trends.