Amgen 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

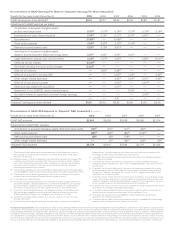

Any products or technologies that are directly or indirectly successful in addressing anemia associated with

chemotherapy and renal failure could negatively impact product sales of Aranesp®. The following table reflects

companies and their currently marketed products that compete with Aranesp®in the United States and Europe in

the supportive cancer care and nephrology segments, unless otherwise indicated. The table and discussion below

of competitor marketed products and potential products may not be exhaustive.

Territory Competitor Marketed Product Competitor

U.S. PROCRIT®(1) Centocor Ortho Biotech Products(2)

Europe EPREX®/ERYPO®Janssen-Cilag(2)

Europe NeoRecormon®F. Hoffmann-La Roche Ltd. (“Roche”)

Europe Retacrit™(3)/Silapo®(3) Hospira Enterprises B.V. (“Hospira”)/

Stada Arzneimittel AG

Europe Binocrit®(3)/Epoetin alfa Hexal®(3)/

Abseamed®(3)

Sandoz GmbH (“Sandoz”)/Hexal Biotech

Forschungs GmbH (“Hexal”)/Medice

Arzneimittel Pütter GmbH & Company

KG

Europe MIRCERA®(4) Roche

Europe Biopoin®CT Arztneimittel GmbH (“CT

Arztneimittel”)

(1) In the United States, Aranesp®competes with PROCRIT®in the supportive cancer care and pre-dialysis set-

tings.

(2) A subsidiary of J&J.

(3) Biosimilar product approved and launched in certain EU countries.

(4) Competes with Aranesp®in the nephrology segment only.

In the United States, Aranesp®also competes with EPOGEN®, primarily in the U.S. hospital dialysis clinic

setting. In addition to competition from the above-noted marketed products, the following product candidates

could compete with Aranesp®in the future. Affymax Inc. and Takeda Pharmaceutical Company Limited

(“Takeda”) are co-developing Hematide™, an ESA for the treatment of anemia in renal patients and they have

announced plans to file for regulatory approval in 2010. FibroGen Inc. is developing FG-2216 and FG-4592, or-

ally active ESAs, for the treatment of anemia and is also studying FG-4592 for the treatment in anemia of CKD.

Additionally, in December 2008, Merck & Company, Inc. (“Merck”) announced the formation of a new biotech

division, Merck Bioventures, which is developing a late-stage pegylated ESA (MK-2578), which they have an-

nounced they expect to launch in 2012.

EPOGEN®(Epoetin alfa)

We were granted an exclusive license to manufacture and market EPOGEN®in the United States under a li-

censing agreement with KA. We have retained exclusive rights to market EPOGEN®in the United States for

dialysis patients. We granted Ortho Pharmaceutical Corporation, a subsidiary of J&J (which has assigned its

rights under the Product License Agreement to Centocor Ortho Biotech Products), a license to commercialize re-

combinant human erythropoietin as a human therapeutic in the United States in all markets other than dialysis

(see “Business Relationships — Johnson & Johnson”).

We launched EPOGEN®in the United States in 1989 for the treatment of anemia associated with CRF for

patients who are on dialysis. We market EPOGEN®in the United States for the treatment of anemic adult and

pediatric patients with CRF who are on dialysis. EPOGEN®is indicated for elevating or maintaining the red

blood cell level (as determined by hematocrit or Hb measurements) and decreasing the need for blood trans-

fusions in these patients.

EPOGEN®sales in the United States for the years ended December 31, 2009, 2008 and 2007 were $2.6 bil-

lion, $2.5 billion and $2.5 billion, respectively.

7