Amgen 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following known adjustments are presented net of their related tax impact of

$0.29, $0.36, $0.44, $0.26, $0.14, and $0.11 for 2009, 2008, 2007, 2006, 2005,

and 2004, respectively.

(a) Effective January 1, 2009, we adopted a new accounting standard that changed the

method of accounting for convertible debt that may be partially or wholly settled in

cash, which includes our convertible notes. In addition, as required, we revised our

previously reported fi nancial statements to retrospectively apply this change in

accounting to applicable prior periods.

(b) To exclude the ongoing, non-cash amortization of acquired product technology rights,

primarily ENBREL, related to the Immunex Corporation (“Immunex”) acquisition in 2002.

(c) To exclude the net tax benefi t recognized as the result of resolving certain transfer

pricing issues with the Internal Revenue Service for prior periods.

(d) To exclude stock option expense.

(e) To exclude restructuring and related costs primarily including, as applicable, asset

impairment charges, staff separation costs, accelerated depreciation, loss accruals

for certain leases, integration costs associated with certain cost saving initiatives,

and the loss on disposal of certain less signifi cant products and related assets.

(f) To exclude, for the applicable periods, the ongoing, non-cash amortization of the

R&D technology intangible assets acquired with alternative future uses with the

2006 acquisitions of Abgenix, Inc. (“Abgenix”), and Avidia, Inc. (“Avidia”).

(g) To exclude, for the applicable periods, loss accruals, awards, or cost recoveries

for legal settlements.

(h) To exclude the net tax benefi t resulting from adjustments to previously established

deferred taxes, primarily related to prior acquisitions and stock option expense, due

to changes in California tax law effective for future periods.

(i) To exclude the tax benefi t principally related to certain prior period charges excluded

from “Adjusted” earnings.

(j) To exclude the write-off of inventory resulting from, in 2008, a strategic decision to

change manufacturing processes and, in 2007, changing regulatory and reimbursement

environments.

(k) To exclude, for the applicable periods, the non-cash expense associated with writing

off the acquired in-process R&D related to the acquisitions of Alantos Pharmaceutical

Holding, Inc. (“Alantos”) and Ilypsa, Inc. (“Ilypsa”) in 2007, Abgenix and Avidia in 2006,

and Tularik Inc. (“Tularik”) in 2004.

(l) To exclude merger-related expenses incurred due to the Alantos, Ilypsa, Abgenix, Avidia,

Tularik, and Immunex acquisitions, primarily related to incremental costs associated with

retention, integration, and/or recording inventory acquired at fair value which is in excess

of our manufacturing cost for the applicable acquisitions and periods.

(m) To exclude the write-off of the cost of a semi-completed manufacturing asset that will not

be used due to a change in manufacturing strategy.

(n) To exclude severance related expenses incurred in connection with our acquisition of

the remaining 51 percent ownership interest of Dompe Biotec, S.p.A.

(o) To exclude the impairment of a non-ENBREL related intangible asset previously

acquired in the Immunex acquisition.

(p) To exclude the tax liability incurred in connection with the repatriation of certain foreign

earnings under the American Jobs Creation Act of 2004.

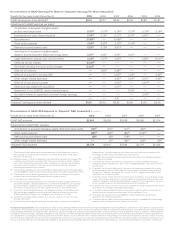

Results for the years ended December 31, 2009 2008 2007 2006 2005

GAAP R&D expense $2,864 $3,030 $3,266 $3,366 $2,314

Adjustments to GAAP R&D expense:

Amortization of acquired intangible assets, R&D technology rights (70)(f) (70)(f) (71)(f) (48)(f)

—

Stock option expense (49)(d) (46)(d) (83)(d) (104)(d)

—

Restructuring and related costs (6)(e) (3)(e) (19)(e)

—

—

Other merger-related expenses

—

(1)(l) (29)(l) (23)(l) (12)(l)

“Adjusted” R&D expense $2,739 $2,910 $3,064 $3,191 $2,302

Reconciliation of GAAP R&D Expense to “Adjusted” R&D (Unaudited) ($ in millions)

Reconciliation of GAAP Earnings Per Share to “Adjusted” Earnings Per Share (Unaudited)

Results for the years ended December 31, 2009 2008 2007 2006 2005 2004

GAAP earnings per share (diluted)(a) $4.51 $3.77 $2.74 $2.36 $2.89 $1.81

Adjustments to GAAP earnings per share*:

Amortization of acquired intangible assets,

product technology rights 0.18(b) 0.17(b) 0.16(b) 0.17(b) 0.17(b) 0.16(b)

Incremental non-cash interest expense 0.15(a) 0.13(a) 0.11(a) 0.12(a) 0.04(a)

—

Tax settlement (0.09)(c)

—

(0.08)(c)

—

—

—

Stock option expense 0.08(d) 0.07(d) 0.12(d) 0.14(d)

—

—

Restructuring and related costs 0.05(e) 0.10(e) 0.51(e)

—

—

—

Amortization of acquired intangible assets,

research and development (R&D) technology rights 0.04(f) 0.04(f) 0.04(f) 0.03(f)

—

—

Legal settlements, awards, and cost recoveries 0.03(g) 0.21(g) 0.02(g)

—

0.02(g) (0.01)(g)

California tax law change (0.02)(h)

—

—

—

—

—

Tax benefi t resulting from prior period charges (0.02)(i)

—

—

—

—

—

Write-off of inventory

—

0.06(j) 0.08(j)

—

—

—

Write-off of acquired in-process R&D

—

—

0.53(k) 1.03(k)

—

0.42(k)

Other merger-related expenses

—

—

0.02(l) 0.02(l) 0.01(l) 0.02(l)

Write-off of manufacturing asset

—

—

0.02(m)

—

0.04(m)

—

Severance associated with acquisition

—

—

0.01(n)

—

—

—

Impairment of non-ENBREL related intangible asset

—

—

—

0.03(o)

—

—

Tax liability related to repatriation of certain foreign earnings

—

—

—

—

0.03(p)

—

Other

—

—

0.01

—

—

—

“Adjusted” earnings per share (diluted) $4.91 $4.55 $4.29 $3.90 $3.20 $2.40

Forward-looking statements: This Annual Report contains forward-looking statements that are based on Amgen management’s current expectations and beliefs and are subject to a number of risks,

uncertainties, and assumptions that could cause actual results to differ materially from those described. All statements, other than statements of historical fact, are statements that could be deemed

forward-looking statements, including estimates of revenues, adjusted earnings per share and other fi nancial metrics, expected political, clinical or regulatory results or practices, the development

of Amgen’s product candidates, including anticipated product approvals, planned international expansion and other such estimates and results. Forward-looking statements involve signifi cant risks

and uncertainties, including those more fully described in the Risk Factors found in the Form 10-K contained within this Annual Report and the most recent periodic reports on Form 10-Q and

Form 8-K fi led by Amgen with the U.S. Securities and Exchange Commission, and actual results may vary materially. Except where otherwise indicated, Amgen is providing this information as of

February 15, 2010, and does not undertake any obligation to update any forward-looking statements contained in this Annual Report as a result of new information, future events, or otherwise.

*