American Home Shield 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ServiceMaster ANNUAL REPORT 2004

Fellow Shareholders,

Our stated goals for 2004 were to deliver

revenue growth in the mid-single digits,

to grow earnings per share faster than

revenues and to generate

cash from operations that

increase with earnings and continue to

substantially exceed net income.

We delivered on those goals.

Table of contents

-

Page 1

...UA L R E P O R T 2 0 0 4 Fe l l o w S h a r e h o l d e r s , Our stated goals for 2004 were to deliver revenue growth in the mid-single digits, to grow earnings per share faster than revenues and to generate cash from operations that increase with earnings and continue to substantially exceed net... -

Page 2

... and commercial services, by attracting new customers into our healthy categories, by winning customers away from competitors and by better satisfying our customers so they stay with us. Every day we get closer to our ultimate goal: transforming the experience of the home and business owner. -

Page 3

... are we reaching the customers we want tomorrow? By offering superior service that wins customers from our competition. By creating a brand experience so powerful that it brings new customers into the market. By acquisition, as we continue to convince local competitors it is better to become part of... -

Page 4

... for when we come to their home. They want it their way. If we satisfy that need, they will do more business with us, and they will recommend...tools they need to be more productive, to rid their jobs of unnecessary hassles and to be more effective in delivering a great customer experience. We... -

Page 5

... and backing it up with a guarantee. Those are transformational acts. They open doors that open more doors that open still more doors. They extend our business model, expand the universe of potential customers and tilt the competitive playing ï¬eld in our direction. Looking at our performance, you... -

Page 6

... and services, and Coleman H. Peterson, former Executive Vice President of People at Wal-Mart Stores Inc., where he was responsible for recruitment, retention and development of Wal-Mart's retail organization. We shall miss the experience and wisdom of two directors who retired in 2004. Donald... -

Page 7

We have millions of customers. We want to keep all of them. And we want a lot more just like them. They will decide how it turns out. All we can do is make them satisï¬ed, over and over again... -

Page 8

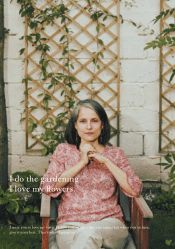

I do the gardening. I love my ï¬,owers. I want you to love my lawn. I know you've got other customers but when you're here, give it your best. That's what I count on. -

Page 9

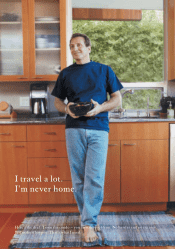

I travel a lot. I'm never home. Here's the deal: I own the condo - you own the problems. No hassles and no excuses. Just make it happen. That's what I need. -

Page 10

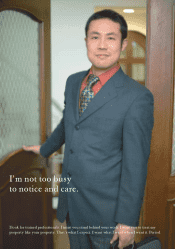

I'm not too busy to notice and care. I look for trained professionals. I insist you stand behind your work. I want you to treat my property like your property. That's what I expect. I want what I want when I want it. Period. -

Page 11

When I call, you answer. When you say you'll be here - be here. When you say you can ï¬x it - ï¬x it. That's what I want. -

Page 12

...And that is what each one of our leading national brands is focused on - meeting individual needs, over 45 million times each year. It's a differentiation strategy, a service strategy and a growth strategy rolled into one. -

Page 13

... undertaken a values renewal process across the enterprise. We have done so with respect for our heritage, and a consciousness of where we are today and want to be tomorrow. We believe that three of our four values statements still hold strong: Honor God in All We Do, Help People Develop, and Grow... -

Page 14

... to our customers. In Janitorial, we now go above and beyond customer expectations by providing systematized inspections and reviews of our cleaning performance. In Residential, a multi-market pilot generated new insights and a training program to take advantage of add-on sales. 2004 was another... -

Page 15

... termite and pest control American Home Shield 4 locations Home warranty plans 233 locations AmeriSpec Home inspections 63 locations ARSService Express Re s c u e Ro o t e r Residential/commercial plumbing, electrical, heating, ventilation, air conditioning maintenance, repair services... -

Page 16

e s s ay s o n va l u e s I started my career at American Home Shield 20 years ago as an account executive. I'm fortunate to be working at a company where doing the right thing for our customers and employees is always a top priority. For me, to honor God means acting ethically, leading a spiritual... -

Page 17

... left wondering why they waited so long. I've worked with some customers for so long that I'm now working on their kids' homes. I like to think that I've come a long way since my retired customer taught me that lesson. Excel with Customers John Aliano, Branch Manager, American Residential Services -

Page 18

...re. Whether it's on the phone or at the home, our employees have to be at their very best during the ï¬rst contact with the customer. For this reason, we're very selective in who we hire and diligent in how we train and develop them. I have a very diverse workforce with different ethnic backgrounds... -

Page 19

...a large public accounting ï¬rm. I left the ï¬rm during a period of corporate scandal and sweeping reform in the public accounting profession. However, I learned a lot by being around some great companies while in public accounting and wanted to become part of a team that builds a business together... -

Page 20

...year 2002. As a result of this agreement, the Company recorded a non-cash reduction in its fourth quarter and full year 2004 tax provision, thereby increasing net income by approximately $159 million. Approximately $150 million related to continuing operations ($.49 per diluted share) and $9 million... -

Page 21

... Statements of Cash Fl ows Notes to the Consolidated Financial Statements Management's Report on Internal Control over Financial Reporting Report of Independent Reg istered Public Accounting Firm Management Certifications Quarterly Operating Results Leadership Team Corporate Information 2004 annual... -

Page 22

..., adapt to new trends in the marketplace, manage its costs, invest in process and technology improvements, and launch new marketing programs and service offerings. Management believes that the Company has made a lot of headway in doing this while also improving its revenue and earnings growth... -

Page 23

...of time effectively covered by the examination were recorded. This resulted in a non-cash reduction in the Company's 2004 income tax provision, thereby increasing 2004 consolidated net income by approximately $159 million ($150 million, or $.49 per diluted share, related to continuing operations and... -

Page 24

... business model at American Home Shield, and there will always be some marketbased variability in the timing and amount of investment gains realized from year to year. The comparison of the effective tax rate is impacted by the 2004 reduction in the tax provision related to the Company's agreement... -

Page 25

... non-bait at the end of 2004. As a result, overall termite completion revenue increased only modestly in 2004, even though the Company achieved solid double-digit unit growth in sales and improved price realization for each treatment alternative viewed discreetly. 2004 annual report ServiceMaster... -

Page 26

... revenue growth and continued very strong controls over claim costs. Partially offsetting these factors were continuing investments to increase market penetration and customer retention. In 2005, American Home Shield is planning to continue its efforts to expand sales in less established real estate... -

Page 27

Within ARS Service Express, revenue decreased three percent. These operations reported good growth in residential construction revenue, excluding the impact of closed branches. Plumbing revenue increased modestly as relatively strong improvements in sewer line repairs and light commercial services ... -

Page 28

... estimated fair value. During the fourth quarter of 2003, the Company recorded a reduction in revenue and operating income as a result of a correction in its historical method of recognizing renewal revenue from certain Terminix and American Home Shield customers who have prepaid. The effects of... -

Page 29

...offset by a $5 million increase in operating income in the lawn care operations. Revenue in the lawn care operations increased six percent over 2002 reï¬,ecting a four percent increase in the number of customers, which was supported by tuck-in acquisitions, and 2004 annual report ServiceMaster 27 -

Page 30

... its management team and industry experience at all levels, emphasized higher margin sales, tightened control over indirect costs and overheads, and sold or closed 12 under-performing branches or service lines. The American Home Shield segment reported a six percent increase in revenue to... -

Page 31

... base, businesses that need relatively little working capital to fund growth in their operations, and signiï¬cant annual deferred taxes. The Company receives a signiï¬cant annual cash tax beneï¬t due to a large base of amortizable intangible assets which exist for income tax reporting purposes... -

Page 32

..., 2004, with approximately $300 million of that amount effectively required to support regulatory requirements at American Home Shield and for other purposes. In February 2005, the Company utilized approximately $125 million of its excess cash amount to fund the previously discussed tax payments to... -

Page 33

... as well as home warranty agreements. These costs vary with and are directly related to a new sale or contract renewal. Property and equipment increased, reï¬,ecting general business growth as well as increases related to information and productivity enhancing operating systems. The Company does not... -

Page 34

... in liabilities from discontinued operations represents a non-cash reduction in tax reserves resulting from the IRS agreement as well as certain payments. The remaining liabilities primarily represent obligations related to long-term self-insurance claims. 32 ServiceMaster 2004 annual report -

Page 35

... of excess insurance coverage above those limits. Accruals for self-insurance losses and warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial projections. Current activity could differ causing a change in estimates. The Company has... -

Page 36

... review, the Company carried forward the valuations for all reporting units except ARS. A valuation analysis performed for ARS indicated no impairment issue. Revenue from lawn care, pest control, liquid and fumigation termite applications, as well as heating/air conditioning and plumbing services... -

Page 37

... $159 million. Approximately $150 million related to continuing operations ($.49 per diluted share) and $9 million related to discontinued operations ($.03 per diluted share). See the "Income Taxes" note in the Notes to the Consolidated Financial Statements. 2004 annual report ServiceMaster 35 -

Page 38

... operations ($.49 per diluted share) and $9 million related to discontinued operations ($.03 per diluted share). See the "Income Taxes" note in the Notes to the Consolidated Financial Statements. See accompanying Notes to the Consolidated Financial Statements. 36 ServiceMaster 2004 annual report -

Page 39

... Notes receivable Long-term marketable securities Other assets To t a l A s s e t s Liabilities and Shareholders' Equity: Current Liabilities: $ 3,140,202 $ 2,956,426 Accounts payable Accrued liabilities: Payroll and related expenses Self-insured claims and related expenses Income taxes payable... -

Page 40

...cation amounts (net of tax) relating to comprehensive income: 2004 2003 2002 Unrealized holding gains (losses) arising in period Less: (Gains) losses realized Net unrealized gains (losses) on securities See accompanying Notes to the Consolidated Financial Statements. $ 4,647 (3,821) $ 826 $ 9,335... -

Page 41

... operations tax expense Non-cash charge (credit) for impaired assets and other items, net of tax Depreciation expense Amortization expense Deferred income tax expense Change in working capital, net of acquisitions: Receivables Inventories and other current assets Accounts payable Deferred revenue... -

Page 42

... of excess insurance coverage above those limits. Accruals for self-insurance losses and warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial projections. Current activity could differ causing a change in estimates. The Company has... -

Page 43

... primarily of payments received for annual contracts relating to home warranty, termite baiting, pest control and lawn care services. The revenue related to these services is recognized over the contractual period as the direct costs emerge, such as when the services are performed or claims are... -

Page 44

...note to the Consolidated Financial Statements, during the third quarter of 2003 the Company recorded a pre-tax, non-cash impairment charge of $481 million relating to TruGreen LandCare, ARS and AMS. As required by SFAS 144 "Accounting for the Impairment or Disposal of Long-Lived Assets", the Company... -

Page 45

... of FASB Statement No. 123", provides alternative methods of transitioning to the fair-value based method of accounting for employee stock options as compensation expense. The Company is using the "prospective method" of SFAS 148 and is expensing the fair value of new employee option grants awarded... -

Page 46

..., Terminix, American Home Shield, ARS/AMS and Other Operations. In accordance with Statement of Financial Accounting Standards No. 131, the Company's reportable segments are strategic business units that offer different services. The TruGreen segment provides residential and commercial lawn care and... -

Page 47

... Expense Capital Expenditures: $ $ TruGreen Terminix American Home Shield ARS/AMS Other Operations Total Capital Expenditures N/M = Not meaningful $ (1) In the third quarter of 2003, the Company recorded a non-cash, pre-tax impairment charge of $481 million related to its goodwill and intangible... -

Page 48

...and the "Goodwill and Intangible Assets" note in the Notes to Consolidated Financial Statements for information relating to goodwill acquired and amounts impaired, respectively. % Change 2003 % Change 2002 TruGreen Terminix American Home Shield ARS/AMS Other Operations Total $ 681,954 643,567... -

Page 49

... review and the extended period of time effectively covered by the examination were recorded. This resulted in a non-cash reduction in the Company's 2004 income tax provision, thereby increasing 2004 consolidated net income by approximately $159 million ($150 million related to continuing operations... -

Page 50

...ï¬t, and permanent items. Income tax expense from continuing operations is as follows: (In thousands) Current 2004 Accounting standards require that the Company recognize deferred taxes relating to the differences between the ï¬nancial reporting and tax basis of the assets. As the annual tax bene... -

Page 51

... In the fourth quarter of 2002, the purchaser of the Company's European pest control and property services operations made a claim for a purchase price adjustment (relating to the sale completed in 2001), relating to an alleged breach of certain conditions in the purchase agreement. In the course of... -

Page 52

...arrangements. Most of the property leases provide that the Company pay taxes, insurance and maintenance applicable to the leased premises. As leases for existing locations expire, the Company expects to renew the leases or substitute another location and lease. Rental expense for 2004, 2003 and 2002... -

Page 53

... risks. The Company has self-insured retention limits and insured layers of excess insurance coverage above such self-insured retention limits. Accruals for self-insurance losses and warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial... -

Page 54

...." Marketable securities are designated as available for sale and recorded at current market value, with unrealized gains and losses reported in a separate component of shareholders' equity. As of December 31, 2004 and 2003, the Company's investments consist primarily of domestic publicly traded... -

Page 55

... FASB Statement No. 123", provides alternative methods of transitioning to the fairvalue based method of accounting for employee stock options as compensation expense. The Company is using the "prospective method" permitted under SFAS 148 and is expensing the fair value of new employee option grants... -

Page 56

... for employee share options under the intrinsic method of Accounting Principles Board Opinion 25, as permitted under GAAP. Accordingly, no compensation cost had been recognized in the accompanying ï¬nancial statements in 2002 related to these options. See the "Stock-Based Compensation" note in... -

Page 57

... shares for the diluted earnings per share calculation includes the incremental effect related to outstanding options whose market price is in excess of the exercise price. Shares potentially issuable under convertible securities have been considered outstanding for purposes of the diluted earnings... -

Page 58

...31, 2004, the Company's internal control over ï¬nancial reporting is effective based on those criteria. The Company's independent registered public accounting ï¬rm has issued an audit report on our assessment of the Company's internal control over ï¬nancial reporting. This report follows. report... -

Page 59

... by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual. The Company has also ï¬led, as exhibits to its Annual Report on Form 10-K for the year ended December 31, 2004, the certiï¬cations of its Chief Executive Ofï¬cer and Chief Financial Ofï¬cer required by Section 302 of... -

Page 60

...the "Interim Reporting" section in the Signiï¬cant Accounting Policies, for interim accounting purposes, TruGreen ChemLawn and other business segments of the Company incur pre-season advertising costs. In addition, TruGreen ChemLawn incurs costs related to annual repairs and maintenance procedures... -

Page 61

...year 2002. As a result of this agreement, the Company recorded a non-cash reduction in its fourth quarter and full year 2004 tax provision, thereby increasing net income by approximately $159 million. Approximately $150 million related to continuing operations ($.49 per diluted share) and $9 million... -

Page 62

... Chief Operating Ofï¬cer Terminix International M a r k T. B u r e l President ARS Service Express/ Rescue Rooter A l b e r t T. C a n t u Group President American Residential Services, ServiceMaster Clean, Merry Maids Scott J. Cromie President and Chief Operating Ofï¬cer American Home Shield... -

Page 63

...t t e l Senior Vice President Human Resources James A. Goetz Senior Vice President and Chief Information Ofï¬cer Katrina L. Helmkamp President Terminix International Michael M. Isakson President and Chief Operating Ofï¬cer ServiceMaster Clean Jim L. Kaput Senior Vice President and General Counsel... -

Page 64

... President and Chief Operating Officer American Home Shield M i t c h e l l T. E n g e l Chief Marketing Officer James A. Goetz Senior Vice President and Chief Information Officer Jim L. Kaput Senior Vice President and General Counsel Steven C. Preston Executive Vice President Board of Directors...