American Eagle Outfitters 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 American Eagle Outfitters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

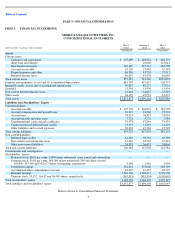

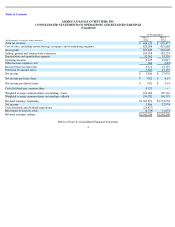

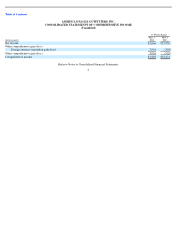

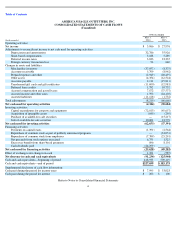

AMERICAN EAGLE OUTFITTERS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Interim Financial Statements

The accompanying Consolidated Financial Statements of American Eagle Outfitters, Inc. (the “Company”) at May 3, 2014 and May 4, 2013 and

for the 13 week period ended May 3, 2014 and May 4, 2013 have been prepared in accordance with generally accepted accounting principles in

the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-

X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. Certain notes and

other information have been condensed or omitted from the interim Consolidated Financial Statements presented in this Quarterly Report on

Form 10-Q. Therefore, these Consolidated Financial Statements should be read in conjunction with the Company’s Fiscal 2013 Annual

Report. In the opinion of the Company’s management, all adjustments (consisting of normal recurring adjustments and those described in the

footnotes that follow) considered necessary for a fair presentation have been included. The existence of subsequent events has been evaluated

through the filing date of this Quarterly Report on Form 10-Q.

As used in this report, all references to “we,” “our” and the “Company” refer to American Eagle Outfitters, Inc. and its wholly owned

subsidiaries. “American Eagle Outfitters,” “American Eagle,” “AEO” and the “AE Brand” refer to our American Eagle Outfitters stores. “aerie”

refers to our aerie

®

by American Eagle

®

stores. “AEO Direct” refers to our e-commerce operations, ae.com and aerie.com.

The Company’s business is affected by the pattern of seasonality common to most retail apparel businesses. The results for the current and prior

periods are not necessarily indicative of future financial results.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany transactions

and balances have been eliminated in consolidation. At May 3, 2014, the Company operated in one reportable segment.

Fiscal Year

The Company’s financial year is a 52/53 week year that ends on the Saturday nearest to January 31. As used herein, “Fiscal 2015” and “Fiscal

2014” refer to the 52 week periods ending January 30, 2016 and January 31, 2015, respectively. “Fiscal 2013” refers to the 52 week period

ended February 1, 2014.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of our contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis,

our management reviews the Company’s estimates based on currently available information. Changes in facts and circumstances may result in

revised estimates.

Recent Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2013-11, Income Taxes

(Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists (“ASU 2013-11”). ASU 2013-11 requires an entity to present an unrecognized tax benefit, or a portion of an unrecognized

tax benefit, in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward. To the extent a net operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date,

the unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined with deferred tax

assets. ASU No. 2013-11 is effective for financial statements issued for annual reporting periods beginning after December 15, 2013 and interim

periods within those years. The Company adopted ASU 2013-11 on February 2, 2014 with no significant impact to its Consolidated Financial

Statements.

7