American Eagle Outfitters 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 American Eagle Outfitters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Credit Agreement has various borrowing options, including rates of interest that are based on (i) an Adjusted London Interbank Offered

Rate (“LIBOR” as defined in the Credit Agreement) plus a margin ranging from 1.00% to 1.75% based on a defined leverage ratio, payable at

the end of the applicable interest period; and (ii) a Base Rate (as defined in the Credit Agreement), plus a margin ranging from 0.00% to 0.75%

based on a defined leverage ratio, payable quarterly.

Under the Credit Agreement, the Company is also required to pay a commitment fee ranging from 0.175% to 0.30%, based on the defined

leverage ratio, on the unused portion of the total lender commitments.

As of May 3, 2014, the Company was in compliance with the terms of the Credit Agreement and had $8.2 million outstanding in letters of credit

and no borrowings.

The Credit Agreement replaced uncommitted demand lines in the aggregate amount of $110.0 million USD and $25.0 million Canadian Dollar

(“CAD”).

Additionally, the Company has agreements with two separate financial institutions for an aggregate of $155.0 million United States dollars

(“USD”) for the purposes of trade letter of credit issuances. The availability of any future issuances under the trade letter of credit facilities is

subject to acceptance by the respective financial institutions.

As of May 3, 2014, the Company had outstanding trade letters of credit of $32.7 million.

9. Share-Based Compensation

The Company accounts for share-based compensation under the provisions of ASC 718, Compensation—Stock Compensation (“ASC 718”),

which requires companies to measure and recognize compensation expense for all share-based payments at fair value. Total share-based

compensation expense included in the Consolidated Statements of Operations for the 13 weeks ended May 3, 2014 and May 4, 2013 was $3.2

million ($2.0 million, net of tax) and $5.3 million ($3.3 million, net of tax), respectively.

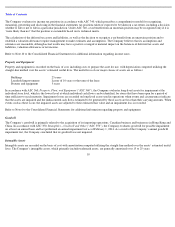

Stock Option Grants

The Company grants both time-based and performance-based stock options. Time-based stock option awards vest over the requisite service

period of the award or to an employee’s eligible retirement date, if earlier. Performance-based stock option awards vest over one year and are

earned if the Company meets pre-established performance goals.

A summary of the Company’s stock option activity for the 13 weeks ended May 3, 2014 follows:

The weighted-average grant date fair value of stock options granted during the 13 weeks ended May 3, 2014 and May 4, 2013 was $3.99 and

$3.42, respectively. The aggregate intrinsic value of options exercised during the 13 weeks ended May 3, 2014 and May 4, 2013 was $1.0

million and $0.5 million, respectively.

15

Options

Weighted

-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic Value

(In thousands)

(In years)

(In thousands)

Outstanding

—

February 1, 2014

3,925

$

17.65

Granted

126

$

14.50

Exercised (1)

(552

)

$

12.33

Cancelled

(840

)

$

25.31

Outstanding

—

May 3, 2014

2,659

$

16.18

2.4

276

Vested and expected to vest

—

May 3, 2014

2,647

$

16.19

2.4

276

Exercisable

—

May 3, 2014 (2)

81

$

8.09

1.1

276

(1)

Options exercised during the 13 weeks ended May 3, 2014 had exercise prices ranging from $8.09 to $13.12.

(2) Options exercisable represent “in-the-money” vested options based upon the weighted-average exercise price of vested options compared

to the Company

’

s stock price at May 3, 2014.