American Eagle Outfitters 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 American Eagle Outfitters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Reclassification

Certain reclassifications have been made to the Consolidated Financial Statements for prior periods in order to conform to the current period

presentation.

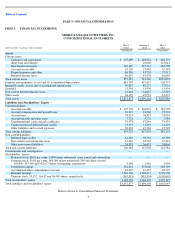

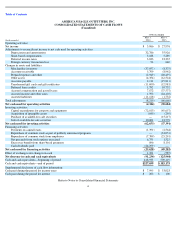

3. Cash and Cash Equivalents and Short-term Investments

The following table summarizes the fair market values for the Company’s cash and marketable securities, which are recorded on the

Consolidated Balance Sheets:

Proceeds from the sale of investments were $10.0 million and $23.8 million for the 13 weeks ended May 3, 2014 and May 4, 2013, respectively.

There were no purchases of investments for the 13 weeks ended May 3, 2014. The purchase of investments was $15.2 million for the 13 weeks

ended May 4, 2013.

There were no unrecognized gains or losses for the Company’s available-for-

sale securities for the 13 weeks ended May 3, 2014 or May 4, 2013.

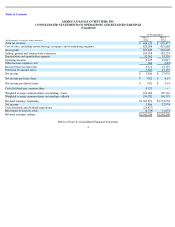

4. Fair Value Measurements

ASC 820, Fair Value Measurement Disclosures (“ASC 820”),

defines fair value, establishes a framework for measuring fair value in accordance

with GAAP, and expands disclosures about fair value measurements. Fair value is defined under ASC 820 as the exit price associated with the

sale of an asset or transfer of a liability in an orderly transaction between market participants at the measurement date.

Financial Instruments

Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of

unobservable inputs. In addition, ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value.

These tiers include:

As of May 3, 2014 and May 4, 2013, the Company held certain assets that are required to be measured at fair value on a recurring basis. These

include cash equivalents and short-term investments.

12

(In thousands)

May 3,

2014

February 1,

2014

May 4,

2013

Cash and cash equivalents:

Cash

$

217,117

$

330,013

$

302,188

Money

-

market

88,535

25,696

54,954

Treasury bills

22,047

63,224

6,033

Commercial paper

—

—

20,000

Total cash and cash equivalents

$

327,699

$

418,933

$

383,175

Short

-

term investments:

Treasury bills

$

—

$

10,002

$

103,144

Term

-

deposits

—

—

9,897

Total short

-

term investments

$

—

$

10,002

$

113,041

Total

$

327,699

$

428,935

$

496,216

•

Level 1

—

Quoted prices in active markets for identical assets or liabilities.

• Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or

liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets or liabilities.

• Level 3 —

Unobservable inputs (i.e., projections, estimates, interpretations, etc.) that are supported by little or no market activity and

that are significant to the fair value of the assets or liabilities.