Ally Bank 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Ally Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

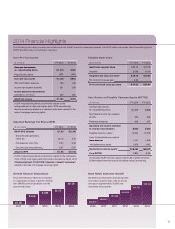

2010 2011 2012 2013 2014

$8.3B

$5.7B

$4.9B

$3.6B

$1.2B

20102009 2011 2012 2013 2014

389,043

497,965

621,604

783,537

909,130

303,673

(

$

millions)

F

Y 2014

F

Y 2013

Cor

Cor

ep

e p

re-

re

tax

tax

in

in

com

com

e,

e,

ex. repositionin

g

item

s

$

1,619

$

850

R

epos

i

t

i

on

i

n

g

i

tem

s

1

(18

(18

7)

7)

(24

(24

4)

4)

C

or

e p

re-tax income $ 1

,43

2

$

606

O

ID amortization ex

p

ens

e

186

249

3

2

1

(

59

)

Inc

Inc

ome

ome

(l

(l

oss

oss

)f

) f

rom

rom

di

di

sco

sco

nti

nti

nue

nue

d

d

ope

rations, net o

f

ta

x

225

(

55

)

G

AAP net inc

ome

$

1

,

150

$

36

1

(

1

)

2014 repositioning items are primarily related to the

e

xtin

g

uishment of hi

g

h-cost le

g

acy debt. 2013 repositionin

g

i

tems are pr

i

mar

ily

re

l

ate

d

to a va

l

uat

i

on wr

i

te

d

own re

l

ate

d

to t

h

e

sale o

f

mort

g

a

g

e servicin

g

ri

g

hts

.

($

millions

)

F

Y 2014

F

Y 2013

C

ore

p

re-tax income,

e

x. repositionin

g

items

$1

$ 1

61

,61

9

9

$8

$ 8

50

50

N

orma

li

ze

d

i

ncome tax ex

pen

se

a

t 34

%

550

2

89

Preferred dividends

268

26

7

O

peratin

g

net income availa

ble

to

com

mon

sh

are

holder

s

$

800

$

294

T

ang

ibl

e common equ

i

t

y

1

1

3

,

522 12

,

69

5

L

ess:

U

namort

i

ze

d

core or

i

g

i

na

l

iss

iss

ue

ue

dis

dis

cou

cou

nt

nt

1

,

44

1

1,

656

N

et deferred ta

x a

sse

t

1

,

926

1

,

61

5

N

orma

li

ze

d

common e

q

u

ity

2

$ 1

$

0,1

0,

54

5

$ 9

$9

,42

,

4

C

or

e R

O

T

C

E

7.9

%

3.1

%

(

1) Includes GAAP Common equity less

$

1.3B of preferred stock

.

(

2) Normalized common equity calculated usin

g

2 period av

g

.

(

$

per share)

F

Y 2014

F

Y 2013

GAA

GAA

Pb

P b

ook

ook

va

va

lue

lue

pe

pe

rs

r s

har

har

e

e

$

29.4

6

$

27.00

G

oodwil

l

(

0.06

)

(

0.06

)

T

ang

ibl

e

b

oo

k

va

l

ue per s

h

ar

e

$ 2

9.4

0

$ 2

6.94

P

ro-forma

C

hina sale gai

n

0

.

82

-

P

ro-forma book value

p

er shar

e

$

30.23

$

26.94

(

$

p

er share

)

FY

20

14

FY

20

1

3

G

AAP EP

S

(

diluted

)

$

1.8

3

$

(

1.64

)

D

iscontinued operatio

ns,

net

of

ta

x

(

0.47

)

0.1

3

OID expense, net of t

ax

0.2

5

0.3

9

O

ne time items

/

repositionin

g

1

0

.

07

0

.

97

Ad

j

usted EP

S

$ 1

.6

8

$

(

0.14

)

(

1

)

2014 repositioning items are primarily related to the extinguish-

m

ent of hi

g

h-cost le

g

acy debt and certain discrete tax items. 2013

rep

rep

osi

osi

tio

tio

nin

nin

gi

g i

tem

tem

sa

s a

re

re

pri

pri

mar

mar

ily

ily

re

re

lat

lat

ed

ed

to

to

av

a v

alu

alu

ati

ati

on

on

wri

wri

te

te

dow

dow

n

n

related to the sale o

f

mort

g

a

g

e servicin

g

ri

g

hts

.

2014 Financial Highlights

Growth Channel Originations Bank Retail Customer Growth

Core Pre-Tax Income

Core Return on Tangible Common Equity (ROTCE)

Tangible Book Value

Adjusted Earnings Per Share (EPS)

V