Ally Bank 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Ally Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1

Item 1. Business

General

Ally Financial Inc. (formerly GMAC Inc.) is a leading, independent, financial services firm with $182.3 billion in assets. Founded in

1919, we are a leading automotive financial services company with over 90 years of experience providing a broad array of financial products

and services to automotive dealers and their customers. We became a bank holding company on December 24, 2008, under the Bank Holding

Company Act of 1956, as amended (the BHC Act). Our banking subsidiary, Ally Bank, is an indirect wholly owned subsidiary of Ally

Financial Inc. and a leading franchise in the growing direct (internet, telephone, mobile, and mail) banking market, with $46.9 billion of

deposits at December 31, 2012. The terms “Ally,” “the Company,” “we,” “our,” and “us” refer to Ally Financial Inc. and its subsidiaries as a

consolidated entity, except where it is clear that the terms means only Ally Financial Inc.

Our Business

Dealer Financial Services, which includes our Automotive Finance and Insurance operations, and Mortgage are our primary lines of

business. Our Dealer Financial Services business is centered on our strong and longstanding relationships with automotive dealers and

supports manufacturers with which we have marketing relationships and their marketing programs. Our Dealer Financial Services business

serves the financial needs of almost 15,000 dealers with a wide range of financial services and insurance products. We believe our dealer-

focused business model makes us the preferred automotive finance company for thousands of our automotive dealer customers. We have

developed particularly strong relationships with thousands of dealers resulting from our longstanding relationship with General Motors

Company (GM) and our relationship with Chrysler Group LLC (Chrysler), providing us with an extensive understanding of the operating

needs of these dealers relative to other automotive finance companies. In addition, we have established specialized incentive programs that

are designed to encourage dealers to direct more of their business to us.

Ally Bank, our direct banking platform, provides us with a stable and diversified low-cost funding source. Our focus is on building a

stable deposit base driven by our compelling brand and strong value proposition. Ally Bank raises deposits directly from customers through

the direct banking channel via the internet, over the telephone, and through mobile applications. Ally Bank offers a full spectrum of deposit

product offerings including certificates of deposit, savings accounts, money market accounts, IRA (individual retirement account) deposit

products, as well as an online checking product. We continue to expand the product offerings in our banking platform in order to meet

customer needs. Ally Bank's assets and operating results are divided between our Automotive Finance operations and Mortgage operations

based on its underlying business activities.

Our strategy is to extend our leading position in automotive finance in the United States by continuing to provide automotive dealers and

their retail customers with premium service, a comprehensive product suite, consistent funding and competitive pricing, reflecting our

commitment to the automotive industry. We are focused on expanding profitable dealer relationships, prudent earning asset growth, and

higher risk-adjusted returns. Our growth strategy continues to focus on diversifying the franchise by expanding into different products as well

as broadening our network of dealer relationships. During 2012, we continued to focus on the used vehicle market, which resulted in strong

growth in used vehicle financing volume. We also seek to broaden and deepen the Ally Bank franchise, prudently growing stable, quality

deposits while extending our foundation of products and providing a high level of customer service.

Strategic Actions

Subsidiaries' Bankruptcy Filings

On May 14, 2012, Residential Capital, LLC (ResCap) and certain of its wholly owned direct and indirect subsidiaries (collectively, the

Debtors) filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern

District of New York. In connection with the filings, Ally Financial Inc. and its direct and indirect subsidiaries and affiliates (excluding the

Debtors) reached an agreement with the Debtors and certain creditor constituencies on a prearranged Chapter 11 plan, which is subject to

bankruptcy court approval and certain other conditions. As a result of the bankruptcy filing, effective May 14, 2012 the Debtors were

deconsolidated from our financial statements. For further details with respect to the bankruptcy and the deconsolidation, refer to Item 1A.

Risk Factors and Note 1 to the Consolidated Financial Statements.

Sale of International Businesses

During 2012, we committed to sell substantially all of our remaining international businesses, which included automotive finance,

insurance, and banking and deposit operations. On February 1, 2013, we completed the sale of our Canadian automotive finance operation to

Royal Bank of Canada, and we expect the sales of our remaining international operations in Europe and Latin America, as well as our share in

a joint venture in China, to close in stages throughout 2013. As a result of the sales, for all periods presented, the operating results for these

operations have been removed from continuing operations. Refer to Note 2 and Note 31 to the Consolidated Financial Statements for more

details.

Dealer Financial Services

Dealer Financial Services includes our Automotive Finance operations and Insurance operations. Our primary customers are automotive

dealers, which are independently owned businesses. As part of the process of selling a vehicle, automotive dealers typically originate loans

and leases to their retail customers. Dealers then select Ally or another automotive finance provider to which they sell loans and leases.

References to consumer automobile loans in this document include installment sales financing unless the context suggests otherwise.

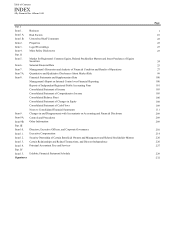

Table of Contents

Part I

Ally Financial Inc. • Form 10-K