Allstate 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

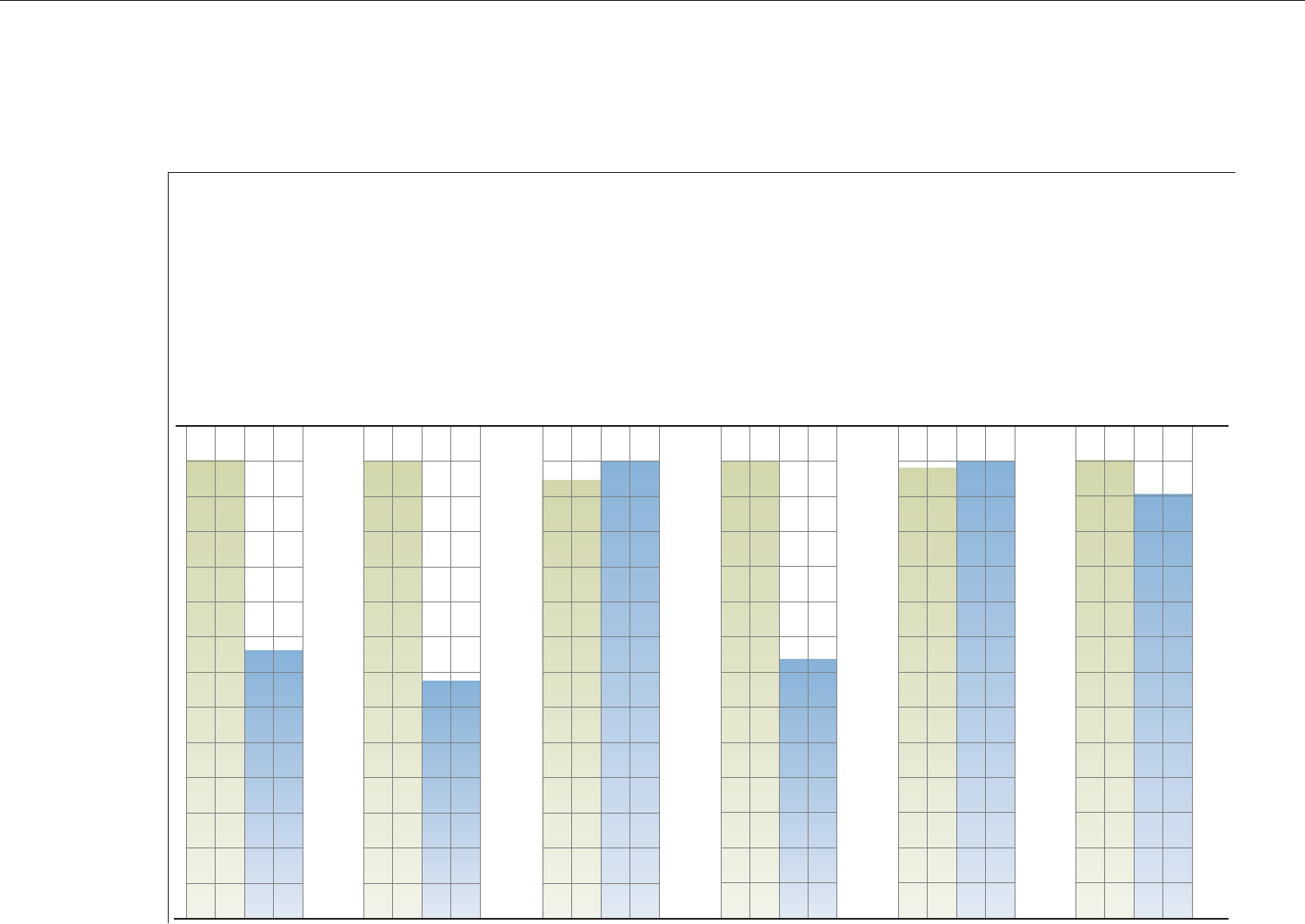

20052004 20052004 20052004 20052004 20052004 20052004

(in dollars) (in billions) (in billions) (percent) (in dollars) (in billions)

$4.54

$2.64

$3.1

$1.6

$33.9

$35.4 $28.62 $29.08 $21.8

$20.2

15.0%

8.4%

Highlights: In 2005,

Allstate incurred

$5.7 billion in losses

primarily related to

the three devastating

hurricanes in the Gulf

states. Nevertheless,

we generated net

income of $1.8

billion, which pro-

duced an 8.4 percent

return on equity.

We also repurchased

43.8 million shares at

a cost of $2.5 billion.

Our total shareholder

return of 7.0 percent

outpaced the S&P

500 in 2005, as it has

in each of the last

five years, and as

it has cumulatively

since we became a

public company in

June 1993.

Net Income per

Diluted Share

Net income per diluted

share, which decreased 41.9

percent in 2005, divides net

income by the number of

weighted average diluted

shares outstanding. It

demonstrates net income

during the year that is

attributable to each share

of stock.

Operating Income*

In 2005, operating income

was $1.6 billion. This is a

common measure used by

the investment community

to analyze our results.

Operating income reveals

trends in our insurance and

financial services business

that may be obscured by

business decisions and

economic developments

unrelated to the insurance

underwriting process.

Revenues

Revenues rose 4.3 percent to

$35.4 billion in 2005.

Revenues indicate Allstate’s

total premium and invest-

ment results.

Return on Equity

Return on average

beginning and ending

period shareholders’ equity,

which measures how well

Allstate used shareholders’

equity to generate net

income, decreased to

8.4 percent in 2005 from

15.0 percent in 2004.

Shareholders’ Equity

Shareholders’ equity, which

is the company’s total assets

minus total liabilities,

indicates the book value

of the ownership interest

of Allstate shareholders.

It declined 7.5 percent

in 2005 to $20.2 billion

from $21.8 billion in 2004,

reflecting a net return

of capital to shareholders

through dividends and

share repurchasing.

Measuring our Performance

*Measures we use that are not

based on accounting principles

generally accepted in the

United States (non-GAAP)

are defined and reconciled to

the most directly comparable

GAAP measure, and operating

measures are defined in the

“Definitions of non-GAAP and

Operating Measures” section

on page 17 of this report.

Financial Highlights

Book Value per Diluted

Share Excluding the Net

Impact of Unrealized Net

Capital Gains on Fixed

Income Securities*increased

by 1.6 percent in 2005.

This measure, commonly

used by insurance investors

as a valuation technique,

is shareholders’ equity less

unrealized net capital gains

on fixed income securities

divided by the number of

diluted shares

outstanding

on December 31.