Allstate 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

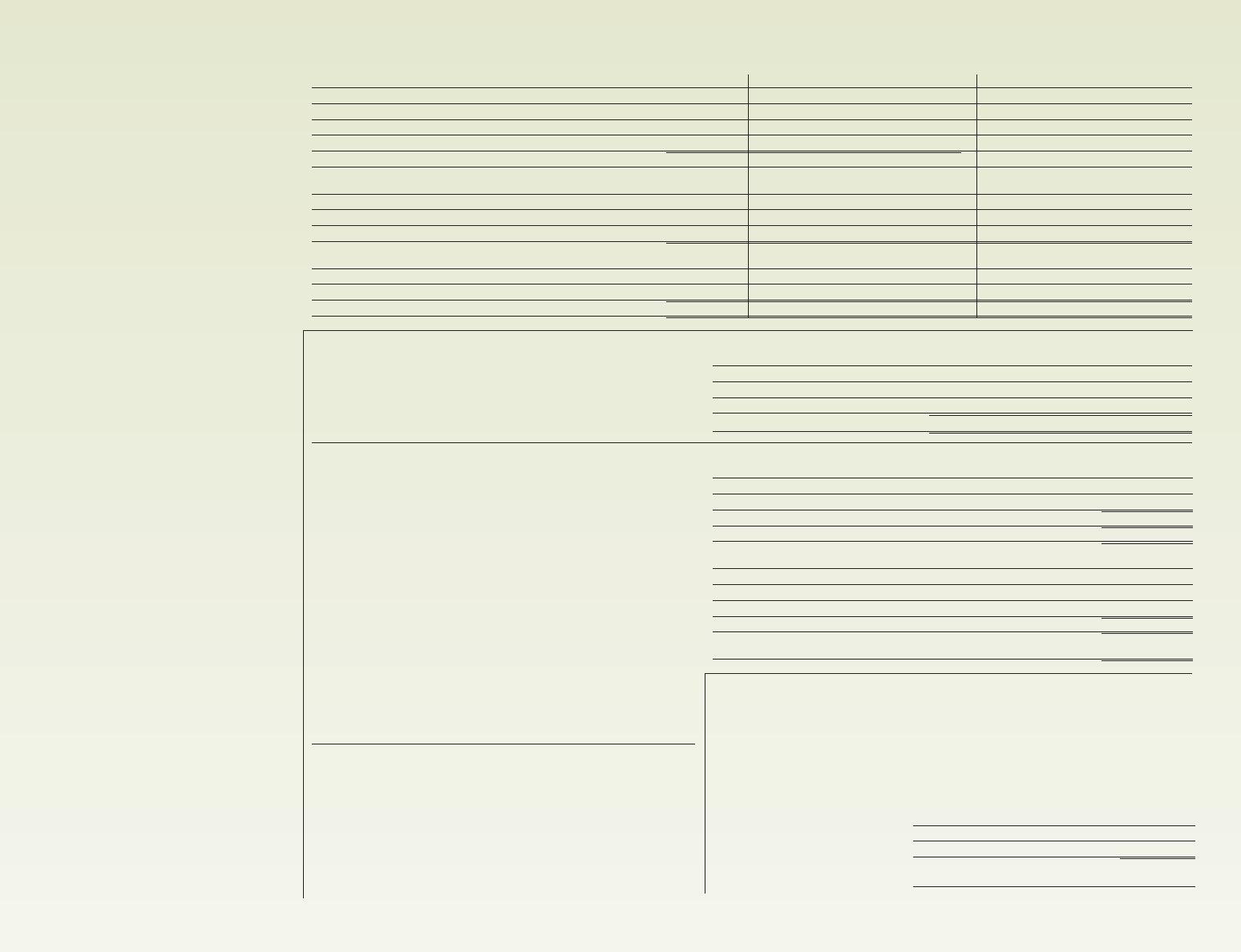

17

Book value per diluted share

As of December 31, ($ in millions, except per share data) 2004 2005

Book value per diluted share

Numerator: Shareholders’ equity $21,823 $20,186

Denominator: Shares outstanding and dilutive potential shares outstanding 688.0 651.0

Book value per diluted share $ 31.72 $ 31.01

Book value per diluted share, excluding the net impact of unrealized

net capital gains on fixed income securities

Numerator: Shareholders’ equity $21,823 $20,186

Unrealized net capital gains on fixed income securities 2,134 1,255

Adjusted shareholders’ equity $19,689 $18,931

Denominator: Shares outstanding and dilutive potential shares outstanding 688.0 651.0

Book value per diluted share, excluding the net impact of

unrealized net capital gains on fixed income securities $ 28.62 $ 29.08

We believe that investors’ understanding of

Allstate’s performance is enhanced by our disclosure

of the following non-GAAP and operating financial

measures. Our methods of calculating these meas-

ures may differ from those used by other companies

and therefore comparability may be limited.

Operating income is income before cumulative

effect of change in accounting principle, after-tax,

excluding:

• realized capital gains and losses, after-tax, except

for periodic settlements and accruals on non-

hedge derivative instruments which are reported

with realized capital gains and losses but includ-

ed in operating income,

• amortization of deferred policy acquisition costs

(“DAC”) and deferred sales inducements (“DSI”),

to the extent they resulted from the recognition

of certain realized capital gains and losses,

• (loss) gain on disposition of operations, after-tax,

and

• adjustments for other significant non-recurring,

infrequent or unusual items, when a) the nature

of the charge or gain is such that it is reasonably

unlikely to recur within two years, or (b) there

has been no similar charge or gain within the

prior two years.

Net income is the GAAP measure that is most

directly comparable to operating income.

We use operating income to evaluate our results

of operations. It reveals trends in our insurance and

financial services business that may be obscured by

the net effect of realized capital gains and losses,

(loss) gain on disposition of operations and adjust-

ments for other significant non-recurring, infre-

quent or unusual items. Realized capital gains and

losses and (loss) gain on disposition of operations

may vary significantly between periods and are gen-

erally driven by business decisions and economic

developments such as market conditions, the tim-

ing of which is unrelated to the insurance under-

writing process. Moreover, we reclassify periodic

settlements on non-hedge derivative instruments

into operating income to report them in a manner

consistent with the economically hedged invest-

ments, replicated assets or product attributes (e.g.

net investment income and interest credited to con-

tractholder funds) and by doing so, appropriately

reflect trends in product performance. Non-recur-

ring items are excluded because, by their nature,

they are not indicative of our business or economic

trends. Therefore, we believe it is useful for

investors to evaluate these components separately

and in the aggregate when reviewing our perform-

ance. We note that the price to earnings multiple

commonly used by insurance investors as a forward-

looking valuation technique uses operating income

as the denominator. We use adjusted measures of

operating income and operating income per diluted

share in incentive compensation. Operating income

should not be considered as a substitute for net

income and does not reflect the overall profitability

of our business.

The following tables reconcile operating income

and net income for the years ended December 31.

Operating income

Allstate Financial Consolidated Per diluted share

($ in millions, except per share data) 2004 2005 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005

Operating income $ 551 $ 581 $

1,492

$

2,075

$

2,662

$

3,091

$

1,582

$ 2.06 $ 2.92 $ 3.77 $ 4.41 $ 2.37

Realized capital gains and losses 1 19 (352) (924) 196 591 549

Income tax (expense) benefit (4) (7) 127 326 (62) (199) (189)

Realized capital gains and losses, after-tax (3) 12 (225) (598) 134 392 360 (0.31) (0.84) 0.19 0.56 0.54

Reclassification of periodic settlements and accruals on non-hedge derivative

instruments, after-tax (32) (40) (4) (3) (15) (32) (40) (0.01) (0.01) (0.02) (0.04) (0.06)

DAC and DSI amortization related to realized capital gains and losses, after-tax (89) (103) (11) (1) (30) (89) (103) (0.01) — (0.05) (0.13) (0.16)

(Loss) gain on disposition of operations, after-tax (6) (12) (40) 2 (26) (6) (12) (0.06) — (0.04) (0.01) (0.02)

Non-recurring increase in liability for future benefits, after-tax — (22) ————(22) ————(0.03)

Income before dividends on preferred securities and cumulative effect of change

in accounting principle, after-tax 421 416 1,212 1,475 2,725 3,356 1,765 1.67 2.07 3.85 4.79 2.64

Dividends on preferred securities of subsidiary trust, after tax — — (45) (10) (5) — — (0.06) (0.01) — — —

Cumulative effect of change in accounting principle, after-tax (175) — (9) (331) (15) (175) — (0.01) (0.46) (0.02) (0.25) —

Net income $ 246 $ 416 $1,158 $1,134 $2,705 $3,181 $1,765 $ 1.60 $ 1.60 $ 3.83 $ 4.54 $ 2.64

Premiums and deposits is an operat-

ing measure that we use to analyze pro-

duction trends for Allstate Financial

sales. It includes premiums on insurance

policies and annuities and all deposits

and other funds received from customers

on deposit-type products including the

net new deposits of Allstate Bank, which

we account for under GAAP as increases

to liabilities rather than as revenue.

The following table illustrates where

premiums and deposits are reflected in

the consolidated financial statements for

the years ended December 31.

Premiums and deposits

($ in millions) 2001 2002 2003 2004 2005

Life and annuity premiums $ 1,345 $ 1,371 $ 1,365 $ 1,045 $ 918

Deposits to contractholder funds 7,970 9,484 10,373 13,616 12,004

Deposits to separate accounts and other 1,290 979 1,357 1,258 1,473

Total premiums and deposits $10,605 $11,834 $13,095 $15,919 $14,395

Book value per diluted share

excluding the net impact of unre-

alized net capital gains on fixed

income securities is calculated by

dividing shareholders’ equity after

excluding the net impact of unrealized

net capital gains on fixed income securi-

ties and related DAC and life insurance

reserves by total shares outstanding plus

dilutive potential shares outstanding.

Book value per diluted share is the most

directly comparable GAAP measure.

We use the trend in book value per

diluted share excluding unrealized net

capital gains on fixed income securities

in conjunction with book value per

diluted share to identify and analyze the

change in net worth attributable to

management efforts between periods.

We believe the non-GAAP ratio is use-

ful to investors because it eliminates the

effect of items that can fluctuate signifi-

cantly from period to period and are

generally driven by economic develop-

ments, primarily market conditions, the

magnitude and timing of which are

generally not influenced by manage-

ment, and we believe it enhances under-

standing and comparability of perform-

ance by highlighting underlying

business activity and profitability driv-

ers. We note that book value per dilut-

ed share excluding unrealized net capi-

tal gains on fixed income securities is a

measure commonly used by insurance

investors as a valuation technique. Book

value per diluted share excluding unre-

alized net capital gains on fixed income

securities should not be considered as a

substitute for book value per diluted

share and does not reflect the recorded

net worth of our business. The follow-

ing table shows the reconciliation.

New sales of financial products by

Allstate exclusive agencies is an

operating measure that we use to quan-

tify the current year sales of financial

products by the Allstate Agency propri-

etary distribution channel. New sales of

financial products by Allstate exclusive

agencies includes annual premiums on

new insurance policies, initial premi-

ums and deposits on annuities, net new

deposits in the Allstate Bank and sales

of other companies’ mutual funds, and

excludes renewal premiums. New sales

of financial products by Allstate exclu-

sive agencies for the years ended

December 31, 2005, 2004, 2003, 2002,

2001 and 2000 totaled $2.40 billion,

$2.27 billion, $1.83 billion, $1.61 bil-

lion, $702 million and $414 million,

respectively.

Combined ratio, excluding the

effect of catastrophe losses, is com-

puted as the difference between two

operating ratios, combined ratio (a

GAAP measure) and the effect of catas-

trophes on the combined ratio. The

most directly comparable GAAP meas-

ure is the combined ratio. We believe

that this ratio is useful to investors and

it is used by management to reveal the

trends in our property-liability business

that may be obscured by catastrophe

losses, which cause our loss trends to

vary significantly between periods as a

result of their rate of occurrence and

magnitude. We believe it is useful for

investors to evaluate these components

separately and in the aggregate when

reviewing our underwriting perform-

ance. The combined ratio excluding

the effect of catastrophe losses should

not be considered a substitute for the

combined ratio and does not reflect the

overall underwriting profitability of our

business. The following table shows the

reconciliation for the years ended

December 31.

17

Definitions of Non-GAAP and Operating Measures

2004 2005

Combined ratio 93.0 102.4

Effect of catastrophes on the combined ratio 9.5 21.0

Combined ratio, excluding the effect of

catastrophe losses 83.5 81.4