Alcoa 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Alcoa 2009 Annual Report and Form 10-K 3

• $1.816 billion reduction in capital expenditures over

2008, which brought the total down to $1.622 billion,

beating our $1.8 billion target. We focused on completing

those projects that lower our cost position and provide the

greatest opportunity for future growth.

• $1.302 billion reduction in working capital – exceeding our

2009 target by 63%.

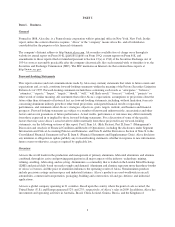

By fulfi lling the seven promises, executing on all these

fi nancial and operational levers, Alcoa has reinforced the

confi dence of the fi nancial markets. The Company’s closing

share price recovered from its low of $5.22 (March 6, 2009)

to $16.12 on December 31, 2009 – a 209% increase during a

period when the Dow increased 57%. Affi rming the impact

of our fi nancial actions on Alcoa’s liquidity, our Company’s

credit default risk decreased signifi cantly during this period.

Even with so much of our energies and attention focused on

managing for cash throughout 2009, we also maintained a

parallel focus on Alcoa’s growth. We reshaped the Company’s

portfolio so that today roughly 90% of our businesses hold

the #1 or #2 competitive position in their markets. And, we

made several strategic investments that improve Alcoa’s cost

position within the industry.

We organically grew our businesses and with that,

strengthened our strategic and operational fundamentals

and positioned Alcoa in high-growth regional markets.

• In Russia, our Samara plant commissioned a state-of-

the-art coating line for high-quality aluminum sheet.

Alcoa is the only company that can produce can sheet

as well as end and tab material in Russia. We are now

uniquely positioned to supply Russia’s growing beverage

packaging, construction and aerospace markets.

• In China, our Bohai plant in Qinhuangdao launched

the largest lithographic sheet line in China. Alcoa now

produces the highest quality aluminum sheet in China for

the printing, transportation, electronics and packaging

industries.

• In Brazil, we commissioned the new bauxite mine in Juruti

and completed the expansion of our Alumar alumina

refi nery in São Luís, Brazil, more than doubling capacity

to 3.5 million tons per year. These two Brazilian expansion

projects increase Alcoa’s competitiveness by reducing cost

and moving our refi ning system down to the top quartile on

the global cost curve in terms of low-cost production.

In addition, we made several strategic transactions:

• We completed a cashless asset swap with our joint venture

partner, Orkla, divesting our minority position in soft

alloy extrusions, and strengthening our smelting position

by adding the two smelters at Mosjøen and Lista, and

the Mosjøen anode plant in Norway. This increased our

global smelting capacity to more than 4.8 million metric

tons, bringing Alcoa back as the world’s largest primary

aluminum producer.

• Obtained full ownership of an asset with long-term value,

we bought out BHP Billiton’s 45% share in the bauxite and

alumina refi ning interests in Suriname.

• We redeemed our investment in the Shining Prospect joint

venture with Chinalco, which yielded Alcoa $1.021 billion, a

premium of more than three times the then-present value.

• We sold our wire harness and electrical distribution business.

• We signed a joint venture agreement with Ma’aden,

the Saudi Arabian Mining Company, to develop a fully

integrated, world-class aluminum complex in the Kingdom

of Saudi Arabia. It will consist of a mine, refi nery, smelter

and rolling mill all connected by a solid infrastructure

provided by the Saudi government. When completed, the

complex will be the world’s preeminent and lowest-cost

supplier of primary aluminum, alumina and aluminum

products. The enterprise will be built so it can expand as

the Saudis complete their plan for industry clusters and

as the markets in the Middle East realize their future

growth potential.

We continued our initiatives to secure low-cost power for

our existing facilities. For our Intalco facility in the U.S.

Northwest region, federal and state offi cials supported

Alcoa in obtaining a heavily contested power contract. At our

Massena smelter, the Governor of New York supported an

agreement that ensured competitive rates for Alcoa from

the New York Power Authority. In return, we committed to

curtail only half of our local smelting capacity and to retain

part of the workforce to keep the plant ready for re-start and

prepare it for future modernization.

ALCOA DEBT & EQUITY

Source: Bloomberg

ALCOA DEBT & EQUITY

CO & QU

ALCOA DEBT & EQUITY

AL

CO

A

DE

BT

&

E

QU

IT

Y

Y

Y

T

I

U

U

Q

E

&

&

T

B

B

E

D

A

A

O

O

C

L

L

A

A

Source: Bloomber

g

g

Source Bloomberg

g

e

b

m

o

l

B

e

c

u

o

S

Alcoa Share Price ($)

Alcoa July 2013 Debt Yield (%)

1/1/09

2/1/09

3/1/09

4/1/09

5/1/09

6/1/09

7/1/09

8/1/09

9/1/09

10/1/09

11/1/09

12/1/09

12/31/09

4.00

5.00

6.00

7.00

8.00

9.00

10.00

11.00

12.00

13.00

14.00

15.00

16.00

17.00