Alcoa 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

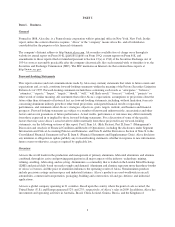

CASH SUSTAINABILITY PROGRAM

Operational Achievements

• Procurement Effi ciencies

• Overhead Rationalizations

• CapEx Reductions

Annual CapEx post 2009

• Working Capital Initiatives

Financial Achievements

• Asset Dispositions

Net Proceeds

• Dividend Reduction

Annual Cash Savings

• Equity and Equity-Linked

Financings

Gross Proceeds

$1,998M

$412M

$850M

$1,100M

$430M

$1,400M

$1,302M

Klaus Kleinfeld

President and Chief Executive Offi cer

✓

✓

✓

✓

✓

✓

✓

TURNING CRISIS INTO OPPORTUNITY

In reviewing Alcoa’s performance in 2009, it’s clear that we

not only weathered the economic storm of the past year

and a half, we capitalized on the crisis to reposition Alcoa to

succeed in a changed economic landscape.

By early 2009, the price of aluminum had dropped more

than 50% since its peak in 2008; we were witnessing broad

demand destruction in our key end markets; and the credit

market had virtually dried up. This “triple threat” demanded

that we take rapid and bold action to build cash reserves to

weather the crisis.

We had the commitment and energies of the global team of

Alcoans, the leaders and workers who responded quickly to

keep Alcoa on course. They ensured the sustainable success

of our Company through their many actions that enabled us

to conserve cash, reduce our cost structure and reshape

our portfolio to focus on the most profi table businesses.

Because of that swift action, today Alcoa is stronger

operationally and fi nancially, and better prepared to lead

our industry in the future.

In 2009, the Alcoa team truly went the extra mile – applying

ingenuity and old-fashioned hard work to pull our Company

through the economic storm. They were motivated by the

confi dence that comes from working for a very special

company, and by the knowledge that they had the steadfast

support of our shareholders.

Early in 2009, when the crisis was at its worst, we

determined that managing for cash must be our top priority.

We realized that strengthening liquidity represented the

most promising way to address the economic uncertainty

and the continuing credit crunch, and to ensure we had the

means to move quickly when the economy recovered and

demand picked up. We developed a holistic solution –

the Cash Sustainability Program (CSP) – that included seven

fi nancial and operational goals that, when achieved together,

would strengthen our balance sheet, restore liquidity and

make our Company free-cash-fl ow neutral by the end of

2009. We considered those goals to be “seven promises” to

our investors. By the end of 2009, we kept every one of those

promises and in several areas we over-delivered.

By applying the fi nancial levers, we secured:

• $1.1 billion from asset dispositions. We divested low-

growth assets and businesses where we had a small

market share and we redeemed our shares in Rio Tinto

for a premium.

• $430 million from our dividend reduction.

• $1.4 billion in equity and equity-linked fi nancings.

Despite extremely tight markets, the promise of the

Cash Sustainability Program resulted in offerings that

were quickly over-subscribed during the dark days of

March 2009.

We also over-delivered on the operational levers:

• $1.998 billion in procurement savings, from raw materials

to services to maintenance and transportation. By the end

of 2009, our spend reduction teams had already met our

2010 target.

• $412 million in overhead cost reductions – surpassing our

2009 target by more than $200 million.