Air Canada 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2008 Air Canada Annual Report

10

4. OVERVIEW

Air Canada’s results of operations for the fourth quarter of 2008 and the full year 2008 are discussed in sections 6 and 7,

respectively, of this MD&A.

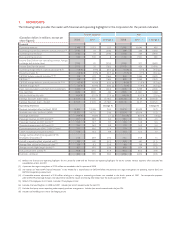

In summary, Air Canada’s results of operations for 2008 compared to 2007 are as follows:

Air Canada recorded a net of loss of $1,025 million or $10.25 per diluted share in 2008 compared to net income of $429

million or $4.27 per diluted share in 2007. The net loss in 2008 included a provision for cargo investigations of $125 million

and net losses on foreign exchange of $655 million.

Air Canada recorded an operating loss (before a provision for cargo investigations) of $39 million, a deterioration of

$472 million from the operating income of $433 million recorded in 2007 and EBITDAR (before the provision for cargo

investigations) of $934 million compared to EBITDAR of $1,263 million in the same period in 2007, a decrease of $329

million.

In response to historically high fuel prices, on June 17, 2008, Air Canada announced capacity and staff reductions for the

fall and winter schedule. In the third quarter of 2008, Air Canada reduced its capacity by 3.5% from the third quarter of

2007 and further reduced its capacity by 7.8% in the fourth quarter of 2008 compared to the same period in 2007. ASM

capacity for the full year 2008 decreased 1.2% from the full year 2007.

Operating revenues increased $436 million or 4% from 2007, mainly due to a passenger revenue increase of $384 million or

4% over the same period in 2007. The growth in passenger revenue was mainly due to increased fares and fuel surcharges

to partially offset higher fuel prices. RASM growth of 5.3% over 2007 reflected a year-over-year yield increase of 4.3% and

a passenger load factor improvement of 0.8 percentage points.

Operating expenses increased $908 million or 9% from 2007 which included an increase in fuel expense of $867 million or

34% compared to the same period in 2007. Ownership costs, comprised of aircraft rent and depreciation and amortization

expense, increased $143 million or 17%, reflecting Air Canada’s investment in new aircraft and its aircraft interior

refurbishment program.

In 2008, CASM increased 10.2% from 2007 largely due to higher fuel expense. Excluding fuel expense, CASM increased

1.7% from 2007 on a capacity reduction of 1.2%. The key factor in the increase was the higher unit cost of ownership

which reflected Air Canada’s investment in new aircraft and the aircraft interior refurbishment program.

Along with many airline carriers globally, Air Canada faced a number of significant challenges in 2008, including as a

result of volatile fuel prices, foreign exchange, liquidity requirements and the weakening demand for air travel. With the

expectation of a continuing recession in 2009, the industry, including Air Canada, will continue to face significant challenges

throughout 2009. The recession is expected to put significant pressures on passenger and cargo revenues for many airlines,

including Air Canada. At the same time, it is expected that lower fuel prices in 2009 and capacity adjustments made in

2008 as a result of the high fuel prices will provide some relief. Air Canada continues to be significantly leveraged requiring

continuing interest payments and debt payments, which are largely denominated in foreign currencies. Further, the funding

of employee benefit plans for many companies, including Air Canada, will be impacted during 2009 by the declines in

the value of plan assets. In 2009, a number of the Corporation’s collective agreements expire and uncertainties exist with

respect to the outcome of their negotiation. In addition, the credit markets continued to be constrained throughout the

latter part of 2008 raising concerns about available funding for a number of companies, including Air Canada. These factors

have had an impact on the liquidity risk of Air Canada during 2008 and are continuing challenges for Air Canada as well as

other airline industry companies. Refer to section 9.3 of this MD&A for a further discussion on liquidity risks. These risks

may have an impact on future operating results and liquidity.

While management believes it has developed planned courses of action and identified other opportunities to overcome

these challenges and mitigate the operating and liquidity risks, there is no assurance that management will be able to

successfully conclude these initiatives and maintain sufficient liquidity, including if events or conditions develop, that are

not consistent with management’s expectations and planned courses of action.