Air Canada 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Management’s Discussion and Analysis

CI

ANNUAL REPORT 2008

Table of contents

-

Page 1

2008 Management's Discussion and Analysis ANNUAL REPORT 2008 CI -

Page 2

...employees at Jazz. (6) Excludes chartered freighters in 2008 and 2007. Includes Jazz aircraft covered under the Jazz CPA. (7) Excludes third party carriers operating under capacity purchase arrangements. Includes Jazz aircraft covered under the Jazz CPA. (8) Includes fuel handling and is net of fuel... -

Page 3

......9. Financial and Capital Management ...9.1 Financial Position ...9.2 Adjusted Net Debt ...9.3 Liquidity ...9.4 Consolidated Cash Flow Movements ...9.5 Contractual Obligations ...9.6 Pension Funding Obligations ...9.7 Capital Expenditures and Related Financing Arrangements ...9.8 Share Information... -

Page 4

2008 Air Canada Annual Report MESSAGE FROM THE PRESIDENT AND CEO OF AIR CANADA ew in business will lament the passing of 2008, and Air Canada is no exception. During the year, our company faced an unprecedented spike in the price of fuel, adverse ï¬,uctuations in foreign exchange and the onset of a... -

Page 5

... appropriate debt levels and work to further strengthen the company ï¬nancially. While credit markets remain difï¬cult, we are guardedly optimistic about new ï¬nancing opportunities. At year-end Air Canada owned aircraft and other assets which, based on current values, may support additional... -

Page 6

... Air Canada Annual Report positioned to manage through the current difï¬culties and become a stronger company. Safety will remain our central core value and this unshakeable commitment will be coupled with a renewed emphasis on customer service, good relationships with our employees and building... -

Page 7

... The Corporation issued a news release dated February 13, 2009 reporting on its results for the fourth quarter of 2008. This news release is available on www.sedar.com and on www.aircanada.com. For further information on Air Canada's public disclosure ï¬le, including Air Canada's Annual Information... -

Page 8

... industry, market, credit and economic conditions, the ability to reduce operating costs and secure ï¬nancing, pension issues, energy prices, currency exchange and interest rates, employee and labour relations, competition, war, terrorist acts, epidemic diseases, insurance issues and costs, changes... -

Page 9

... international cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia using cargo capacity on Boeing 777 and other wide-body aircraft operated by Air Canada. Air Canada Vacations is one of Canada's leading tour operators. Based in Montreal and Toronto... -

Page 10

... and debt payments, which are largely denominated in foreign currencies. Further, the funding of employee beneï¬t plans for many companies, including Air Canada, will be impacted during 2009 by the declines in the value of plan assets. In 2009, a number of the Corporation's collective agreements... -

Page 11

... Tango, Air Canada's lowest fare (46% in 2007). Further developing its innovative revenue strategy to generate additional revenues In order to provide its customers with more travel options, geographical reach and purchase ï¬,exibility, in early 2008, Air Canada began to offer its customers a new... -

Page 12

... using the web check-in facility provided on the Air Canada website. This has allowed Air Canada to generate cost savings while increasing its customer satisfaction. Web penetration for domestic Canada sales in 2008 was 66%, an increase of 3 percentage points from 2007 (63% in 2007). Web penetration... -

Page 13

... its business processes and enhance the travel experience for its customers while generating cost savings. In 2008, 56% of Air Canada's customers used self-service products worldwide (55% in 2007). In Canada, self-service increased from 59% in 2007 to 61% in 2008. Mobile check-in and web check-in... -

Page 14

... vote by union members. The CAW represents approximately 5,000 customer sales and service agents employed by Air Canada. The tentative agreement also provided for a detailed plan for Air Canada employees currently working in the Aeroplan call centres to transition to employment at Aeroplan or remain... -

Page 15

...", this program provides participants with knowledge, skills and tools to build and maintain authentic and constructive relationships with union representatives and unionized employees in accordance with Air Canada's labour relations philosophy. Substantially all executive, senior management and... -

Page 16

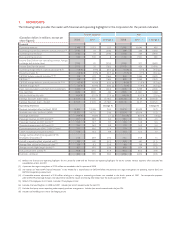

... of 2007. (Canadian dollars in millions, except per share ï¬gures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz Depreciation and amortization Aircraft maintenance Food, beverages... -

Page 17

2008 Management's Discussion and Analysis System passenger revenues decreased 0.6% from the fourth quarter of 2007 In response to historically high fuel prices, on June 17, 2008, Air Canada announced capacity reductions for the fall and winter schedule. In the fourth quarter of 2008, Air Canada ... -

Page 18

2008 Air Canada Annual Report The system ASM capacity decrease of 7.8% in the fourth quarter of 2008 compared to the fourth quarter of 2007 was in line with the 7.0% to 8.0% ASM capacity reduction projected in the Corporation's news release dated November 7, 2008. Domestic passenger revenues ... -

Page 19

... of 2.0 percentage points in passenger load factor compared to the fourth quarter of 2007. Trafï¬c growth in these markets mainly reï¬,ected the addition of a new non-stop service from Vancouver to Sydney, Australia which is now being operated with a Boeing 777-200 aircraft. For the majority... -

Page 20

... of 2007. As Air Canada incurs signiï¬cant expenses in US dollars such as fuel, aircraft maintenance and airport user fees, the signiï¬cantly weaker Canadian dollar versus the US dollar was a major contributing factor to the increase in operating expenses in the fourth quarter of 2008, accounting... -

Page 21

... per ASM) Wages and salaries Beneï¬ts Ownership (DAR) (1) Airport user fees Capacity purchase with Jazz Aircraft maintenance Food, beverages and supplies Communications and information technology Commissions Other Operating expense, excluding fuel expense (2) Aircraft fuel Total operating expense... -

Page 22

... of 2008 increased $52 million or 26% from the fourth quarter of 2007. Factors contributing to the year-over-year change in fourth quarter ownership costs included: • • The addition of new Boeing 777 and Embraer aircraft to Air Canada's operating fleet which accounted for an increase of... -

Page 23

... in other expenses: Fourth Quarter 2008 2007 $ 49 45 44 35 30 30 115 348 $ 34 37 45 33 27 30 141 347 $ Change $ 15 8 (1) 2 3 (26) 1 (Canadian dollars in millions) Other expenses Air Canada Vacations' land costs Terminal handling Credit card fees Building rent and maintenance Crew expenses (meals... -

Page 24

... related to new aircraft and a decrease in interest income due to both lower cash balances and lower rates of return. A decrease in interest expense, largely driven by lower ï¬nancing costs on the Boeing 777 aircraft commitments due to the favourable impact of the pre-delivery ï¬nancing arranged... -

Page 25

... Air Canada Services segment, which excluded the consolidation of Jazz, for 2007. (Canadian dollars in millions, except per share ï¬gures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz... -

Page 26

... full year 2008 decreased 1.2% from the full year 2007. Compared to 2007, passenger revenues increased $384 million or 4.1% to $9,713 million in 2008 mainly due to increased fares and fuel surcharges to partially offset higher fuel prices. Passenger revenue growth was reï¬,ected in all markets with... -

Page 27

... of 0.1 percentage points in passenger load factor from 2007. Passenger demand on Air Canada's short-haul routes was particularly impacted by the softening economy. In 2008, yield improved 7.5% from 2007 largely due to increased fares and fuel surcharges to partially offset higher fuel prices. In... -

Page 28

... In 2007, this one-stop service via Hawaii was previously served by a Boeing 767-300 aircraft and the Vancouver-Hawaii segment was recorded in US transborder passenger revenues. Higher capacity mainly reï¬,ected increased ï¬,ying on Air Canada Vacations routes, and to South America. Air Canada's one... -

Page 29

... of 2008 and unit cost savings related to the Boeing 777 aircraft partially offset the overall unit cost increase, excluding fuel expense. The 1.7% increase in CASM, excluding fuel expense, was in line with the projected CASM, excluding fuel expense, provided in the Corporation's news release dated... -

Page 30

... 2007. Change (cents per ASM) Wages and salaries Beneï¬ts Ownership (DAR) (1) Airport user fees Capacity purchase with Jazz Aircraft maintenance Food, beverages and supplies Communications and information technology Commissions Other Operating expense, excluding fuel expense (2) Aircraft fuel Total... -

Page 31

2008 Management's Discussion and Analysis The reductions in unionized ranks announced in June only took effect in November 2008. Additional FTE employee reductions are anticipated in early 2009. Average wages increased 1.0% over 2007. In 2008, Air Canada recorded a provision of $8 million related... -

Page 32

...insurance, joint venture and cargo trucking expenses. The following table provides a breakdown of the signiï¬cant items included in other expenses: Change (Canadian dollars in millions) Other expenses Air Canada Vacations' land costs Credit card fees Terminal handling Building rent and maintenance... -

Page 33

2008 Management's Discussion and Analysis • In 2007, Air Canada recorded a gain on disposal of $14 million from insurance proceeds related to a CRJ-100 aircraft owned by Air Canada and leased to Jazz which was damaged beyond repair and gains of $5 million mainly pertaining to the sale of one ... -

Page 34

... with International Lease Finance Corporation ("ILFC"). In 2008, Air Canada retired its ï¬,eet of Boeing 767-200 aircraft, consisting of 10 aircraft. These older aircraft are high unit cost aircraft from both a fuel consumption and maintenance perspective. Pursuant to the Jazz CPA, Jazz operates an... -

Page 35

2008 Management's Discussion and Analysis In response to record high fuel prices, on June 17, 2008, Air Canada announced a reduction in capacity. This capacity reduction, particularly the parking of the Boeing 767-200 aircraft, has impacted its ï¬,eet. The Corporation is continually evaluating its ... -

Page 36

2008 Air Canada Annual Report 9. FINANCIAL AND CAPITAL MANAGEMENT 9.1 FINANCIAL POSITION The following table provides the ï¬nancial position of Air Canada as at December 31, 2008 and as at December 31, 2007. Condensed Statement of Financial Position (Canadian dollars in millions) Assets Cash, cash... -

Page 37

2008 Management's Discussion and Analysis 9.2 ADJUSTED NET DEBT The table reï¬,ects Air Canada's adjusted net debt balances and net debt to net debt plus equity ratio as at December 31, 2008 and as at December 31, 2007. (Canadian dollars in millions) Total long-term debt and capital leases Current ... -

Page 38

... and debt payments, which are largely denominated in foreign currencies. Further, the funding of employee beneï¬t plans for many companies, including Air Canada, will be impacted during 2009 by the declines in the value of plan assets. In 2009, a number of the Corporation's collective agreements... -

Page 39

... has curtailed its capital expenditures program for 2009. Management continues to consider strategies to monetize its parked aircraft and aircraft leased to others. Entered into new financial arrangements which provided aggregate net proceeds of $641 million during 2008 and, subject to the ful... -

Page 40

2008 Air Canada Annual Report - Sale and leaseback arrangements for ï¬ve Boeing 777 aircraft which generated net proceeds of $144 million. Future lease payments required under these operating leases are disclosed in section 9.5 of this MD&A. Management will continue to consider other opportunities ... -

Page 41

2008 Management's Discussion and Analysis The Government of Canada has proposed certain amendments to the general pension funding requirements for federally registered pension plans to address concerns over the impact of the 2008 decline in value of pension assets. These proposals include increasing... -

Page 42

... the Corporation's pension plans, and a decrease in the fair market value of outstanding derivatives. The accounts payable balance increase reï¬,ected an increase in the current portion of pension funding payments and the provision for cargo investigations. The increase in other current liabilities... -

Page 43

... the amount owing by Air Canada therefore no additional cash outï¬,ows resulted. The decision to terminate positions in late 2008 and early 2009 has been beneï¬cial to the Corporation as fuel prices have continued to drop. Refer to section 12 of this MD&A for a discussion on fuel price risk. 43 -

Page 44

...was primarily driven by the requirement to fund the fuel hedge collateral deposits and, to a lesser extent, a deterioration in Air Canada's operating results and the impact of higher past service cost contributions under the Corporation's pension plans. Operating cash ï¬,ows also included the impact... -

Page 45

2008 Management's Discussion and Analysis 9.5 CONTRACTUAL OBLIGATIONS The table below provides Air Canada's current contractual obligations for 2009, for the next four years and after 2013. (Canadian dollars in millions) Long-term debt obligations Debt consolidated under AcG-15 Capital lease ... -

Page 46

... Air Canada Annual Report 9.6 PENSION FUNDING OBLIGATIONS Air Canada's cash pension funding contributions in 2008 and 2007 were as follows: (Canadian dollars in millions) Past service domestic registered plans Current service domestic registered plans Other pension arrangements (1) Pension funding... -

Page 47

2008 Management's Discussion and Analysis Given the economic uncertainty and the uncertain outcome of the pension funding regulations, Air Canada's actual funding obligations for 2009 cannot be determined with any reasonable degree of certainty however they will rise signiï¬cantly over 2008 levels.... -

Page 48

2008 Air Canada Annual Report 9.7 CAPITAL EXPENDITURES AND RELATED FINANCING ARRANGEMENTS Boeing In November 2005, Air Canada concluded agreements with Boeing for the acquisition of Boeing 777 and Boeing 787 aircraft. As at December 31, 2008, 15 of the 16 Boeing 777 ï¬rm aircraft under the purchase... -

Page 49

2008 Management's Discussion and Analysis 9.8 SHARE INFORMATION An aggregate of 100 million Class A variable voting shares and Class B voting shares in the capital of Air Canada are issued and outstanding. The issued and outstanding shares of Air Canada, along with shares potentially issuable, are ... -

Page 50

2008 Air Canada Annual Report 10. QUARTERLY FINANCIAL DATA Prior to May 24, 2007, Air Canada had two reportable segments: Air Canada Services (which is now referred to as Air Canada) and Jazz. Segment information provided useful information to shareholders as it enabled them to distinguish between ... -

Page 51

2008 Management's Discussion and Analysis The table below summarizes quarterly ï¬nancial results for Jazz for the ï¬rst and second quarter of 2007. Effective May 24, 2007, Jazz results are no longer consolidated within Air Canada. Q1 2007 $ 364 (40) (288) (328) 36 (1) $ 35 $ $ ($ millions) Jazz ... -

Page 52

...Canada's consolidated results for 2008 are not directly comparable to its consolidated results for 2007, which included consolidation of Jazz only up to May 24, 2007, and for 2006, which included full-year consolidation of Jazz. Consolidated total Operating revenues Special charge for Aeroplan miles... -

Page 53

...tickets to individuals, often through the use of major credit cards, through geographically dispersed travel agents, corporate outlets, or other airlines, often through the use of major credit cards. Credit rating guidelines are used in determining counterparties for fuel hedging. In order to manage... -

Page 54

... fuel hedge accounting and are recorded within current liabilities on Air Canada's consolidated statement of ï¬nancial position. In 2008, the total decrease in the fair value of the Corporation's fuel derivatives amounted to $531 million in 2008 (a gain of $160 million in 2007). Of the fair value... -

Page 55

...million and are expected to cover the hedging losses from maturing contracts throughout 2009 and a portion of 2010, if oil prices remain at current levels. At January 31, 2009, approximately 34% of Air Canada's anticipated purchases of jet fuel for 2009 are hedged at an average WTI-equivalent capped... -

Page 56

... value of US$414 million to receive ï¬,oating rates and pay a weighted average ï¬xed rate of 5.81% for the debt to be arranged in relation to the ï¬nancing of Embraer 190 aircraft between June 2006 and February 2008. The swaps had 15-year terms from the expected delivery date of the aircraft... -

Page 57

...) on Air Canada's consolidated statement of operations: Fourth Quarter ($ millions) Ineffective portion of fuel hedges Fuel derivatives not under hedge accounting Cross-currency interest rate swaps Other Gain (loss) on ï¬nancial instruments recorded at fair value $ $ 2008 59 (40) (2) 15 32 $ $ 2007... -

Page 58

2008 Air Canada Annual Report Market risk Market risk is the risk that the fair value or future cash ï¬,ows of a ï¬nancial instrument will ï¬,uctuate because of changes in market prices. Market risk comprises three types of risk: foreign exchange risk; interest rate risk; and other price risk, ... -

Page 59

.... Each contracting airline participating in a Fuel Facility Corporation shares pro-rata, based on system usage, in the guarantee of this debt. Indemniï¬cation Agreements Air Canada enters into real estate leases or operating agreements, which grant a license to Air Canada to use certain premises... -

Page 60

... as the compensation amount. Until such future time as the assets and obligations under the Air Canada Beneï¬t Arrangements pertaining to non-unionized employees are to be transferred to Aveos, the current service pension cost and the current service and interest costs for other employee beneï¬ts... -

Page 61

... time as the assets and obligations under the Air Canada Beneï¬t Arrangement pertaining to unionized employees may be transferred to Aveos, the current service pension cost and the current service and interest costs for other employee beneï¬ts in respect of Air Canada employees providing services... -

Page 62

... return of the letters of credit to Aveos. By October 2009, the letters of credit would be reinstated to the levels then required under the Pension and Beneï¬ts Agreement between the two parties. Maintenance Agreements Aveos and Air Canada are parties to a general terms and related services... -

Page 63

... Corporation at the Vancouver, Winnipeg, Toronto and Montreal airports. The Relationship between the Corporation and ACE Master Services Agreement Air Canada provides certain administrative services to ACE in return for a fee. Such services relate to ï¬nance and accounting, information technology... -

Page 64

2008 Air Canada Annual Report The related party balances resulting from the payment obligations in respect of the application of the related party agreements were as follows: December 31, 2008 $ $ Prepaid Maintenance Aveos Accounts payable and accrued liabilities Aveos $ $ $ $ 2 120 122 5 5 99 99 (... -

Page 65

... on a straight-line basis over the period during which the travel pass is valid. Air Canada has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and ï¬,ight schedules. Revenues are... -

Page 66

... Air Canada Annual Report Discount Rate The discount rate used to determine the pension obligation was determined by reference to market interest rates on corporate bonds rated "AA" or better with cash ï¬,ows that approximately match the timing and amount of expected beneï¬t payments. An increase... -

Page 67

...(28) Impact on 2008 pension expense in $ millions Discount rate on obligation assumption Long-term rate of return on plan assets assumption Assumed health care cost trend rates have a signiï¬cant effect on the amounts reported for the health care plans. An 8.25% annual rate of increase in the per... -

Page 68

...of the assets. Discount rates are determined with reference to estimated risk adjusted market rates of return for similar cash ï¬,ows and were increased in 2008 reï¬,ecting a higher risk premium. The Corporation performs sensitivity analysis on the discount rates applied. The discount rates used are... -

Page 69

... consolidated ï¬nancial statements relating to ï¬scal years beginning on or after January 1, 2011. International Financial Reporting Standards The Canadian Accounting Standards Board has conï¬rmed January 1, 2011 as the changeover date for Canadian publicly accountable enterprises to start using... -

Page 70

2008 Air Canada Annual Report As a result, the Corporation has developed a plan to convert its consolidated ï¬nancial statements to IFRS establishing a cross-functional IFRS team represented by managers in the areas of Accounting, Taxation, IT and Data Systems, Internal Control and Processes, ... -

Page 71

2008 Management's Discussion and Analysis • Compensation arrangements - Key activities: • Identification of impact on compensation arrangements; • Assessment of required changes. - Status: • The Corporation is in the process of analyzing any compensation policies that rely on indicators ... -

Page 72

2008 Air Canada Annual Report 17. SENSITIVITY OF RESULTS Air Canada's ï¬nancial results are subject to many different internal and external factors which can have a signiï¬cant impact on operating results. In order to provide a general guideline, the following table describes, on an indicative ... -

Page 73

... business, including in relation to economic conditions, pension plan funding, volatile fuel prices, contractual covenants which could require the Corporation to deposit cash collateral with third parties, foreign exchange rates and increased competition from international, transborder and low-cost... -

Page 74

... total operating costs of the Corporation in 2008. Fuel prices ï¬,uctuate widely depending on many factors including international market conditions, geopolitical events and the Canada/US dollar exchange rate. Air Canada cannot accurately predict fuel prices. During 2006, 2007 and 2008, fuel prices... -

Page 75

...including in relation to wages or other labour costs or work rules may result in increased labour costs or other charges which could have a material adverse effect on the Corporation's business, results from operations and ï¬nancial condition. Most of the Corporation's employees are unionized. With... -

Page 76

.... The Corporation also encounters substantial price competition. The expansion of low-cost carriers in recent years, along with the advent of Internet travel websites and other travel products distribution channels, has resulted in a substantial increase in discounted and promotional fares initiated... -

Page 77

... Aeroplan, the Corporation is able to offer its customers who are Aeroplan members the opportunity to earn Aeroplan miles. Based on customer surveys, management believes that rewarding customers with Aeroplan miles is a signiï¬cant factor in customers' decision to travel with Air Canada and Jazz... -

Page 78

2008 Air Canada Annual Report Interruptions or Disruptions in Service The Corporation's business is signiï¬cantly dependent upon its ability to operate without interruption at a number of hub airports, including Toronto Pearson International Airport. Delays or disruptions in service, including ... -

Page 79

2008 Management's Discussion and Analysis Risks Relating to the Airline Industry Terrorist Attacks and Security Measures The September 11, 2001 terrorist attacks and subsequent terrorist activity, notably in the Middle East, Southeast Asia and Europe, caused uncertainty in the minds of the traveling... -

Page 80

...international operations. The Corporation is subject to domestic and foreign laws regarding privacy of passenger and employee data, including advance passenger information and access to airline reservation systems, which are not consistent in all countries in which the Corporation operates. The need... -

Page 81

... a public offering of shares that ACE holds in speciï¬ed circumstances. In addition, Air Canada could issue and sell shares. Any sale by ACE or Air Canada of shares in the public market, or the perception that sales could occur could adversely affect the prevailing market prices of the shares. 81 -

Page 82

... the design of internal controls over ï¬nancial reporting. The Corporation's Audit Committee reviewed this MD&A, and the audited consolidated ï¬nancial statements, and the Corporation's Board of Directors approved these documents prior to their release. Management's Report on Disclosure Controls... -

Page 83

2008 Management's Discussion and Analysis 20. NON-GAAP FINANCIAL MEASURES EBITDAR EBITDAR (earnings before interest, taxes, depreciation, amortization and aircraft rent) is a non-GAAP ï¬nancial measure commonly used in the airline industry to view operating results before aircraft rent and ... -

Page 84

...by multiplying the total number of seats available for passengers by the miles ï¬,own. CASM - Operating expense per ASM. EBITDAR - EBITDAR is earnings before interest, taxes, depreciation and amortization and aircraft rent and is a non-GAAP ï¬nancial measure commonly used in the airline industry to... -

Page 85

... external auditor; and, pre-approves audit and audit-related fees and expenses. The Board of Directors approves the Corporation's consolidated ï¬nancial statements, management's discussion and analysis and annual report disclosures prior to their release. The Audit, Finance and Risk Committee meets... -

Page 86

2008 Air Canada Annual Report INDEPENDENT AUDITORS' REPORT TO THE SHAREHOLDERS OF AIR CANADA We have audited the consolidated statements of ï¬nancial position of Air Canada as at December 31, 2008 and December 31, 2007 and the consolidated statements of operations, changes in shareholders' equity,... -

Page 87

... per share ï¬gures) Operating revenues Passenger Cargo Other 2008 2007* $ 9,713 515 854 11,082 $ 9,329 550 720 10,599 Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz Depreciation and amortization Aircraft maintenance Food... -

Page 88

2008 Air Canada Annual Report CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at December 31 (Canadian dollars in millions) ASSETS Current Cash and cash equivalents Short-term investments 2008 2007 Note 2o Note 2p $ 499 506 1,005 45 702 97 328 226 2,403 7,469 997 495 11,364 $ 527 712 1,239 ... -

Page 89

... Common shares Total share capital Contributed surplus Balance, beginning of year Fair value of stock options issued to Corporation employees recognized as compensation expense (recovery) Proceeds from intercompany agreements Purchase of Air Canada Vacations Deconsolidation of Jazz Total contributed... -

Page 90

...of assets Foreign exchange (gain) loss Future income taxes Excess of employee future beneï¬t funding over expense Provision for cargo investigations Non-controlling interest Fuel and other derivatives Fuel hedge collateral deposits, net Changes in non-cash working capital balances Other 2008 2007... -

Page 91

... operated by Air Canada and Jazz in these markets. Air Canada offers international cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia using cargo capacity on Boeing 777 and other wide body aircraft operated by Air Canada. Air Canada Ground Handling... -

Page 92

2008 Air Canada Annual Report largely denominated in foreign currencies. Further, the funding of employee beneï¬t plans for many companies, including Air Canada, will be impacted during 2009 by the declines in the value of plan assets. In 2009, a number of the Corporation's collective agreements ... -

Page 93

... in December 2013 bearing interest at 5.13%. - An agreement with Aeroplan Limited Partnership ("Aeroplan") to accelerate payments for purchase of seats for the period from October 2008 to May 2009. Payments by Air Canada to Aeroplan for Miles earned by passengers continue based on the original terms... -

Page 94

... for 2009 will be paid in the second half of the year as the funding in the ï¬rst half of the year is based upon the January 1, 2008 actuarial valuation reports. Covenants in Credit Card Agreements The Corporation has various agreements with companies that process customer credit card transactions... -

Page 95

Consolidated Financial Statements and Notes Under the terms of the credit card processing agreement, beginning at the end of the second quarter of 2009, the triggering events for deposits will change and be based upon a matrix of unrestricted cash and a debt service coverage ratio. The ratio is ... -

Page 96

... on a straight-line basis over the period during which the travel pass is valid. The Corporation has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and ï¬,ight schedules. Revenues are... -

Page 97

... revenues when the points are issued, which is upon the qualifying air travel being provided to the customer. In November 2008 the Corporation reached agreement with Aeroplan to have the loyalty management company accelerate payment terms on Air Canada redemption tickets issued through to May... -

Page 98

...on service, market interest rates, and management's best estimate of expected plan investment performance, salary escalation, retirement ages of employees and expected health care costs. A market-related valuation method is used to value plan assets for the purpose of calculating the expected return... -

Page 99

...of the aircraft. K) OTHER OPERATING EXPENSES Included in Other operating expenses are expenses related to building rent and maintenance, terminal handling, professional fees and services, crew meals and hotels, advertising and promotion, insurance costs, credit card fees, ground costs for Air Canada... -

Page 100

... payable, credit facilities, and bank loans are classified as other financial liabilities and are measured at amortized cost using the effective interest rate method. Interest income is recorded in net income, as applicable. • • • Fuel Derivatives Under Hedge Accounting... -

Page 101

... assets, representing funds held in trust by Air Canada Vacations in accordance with regulatory requirements governing advance ticket sales, recorded under Current liabilities, for certain travel related activities. Restricted cash with maturities greater than one year from the balance sheet date... -

Page 102

...nite lives are amortized on a straight line basis to nil over their estimated useful lives. Estimated Useful Life International route rights and slots Air Canada trade name Other marketing based trade names Star Alliance membership Other contract and customer based intangible assets Technology based... -

Page 103

... of the Fuel Facility Corporations in which Air Canada participates in Canada that have not been consolidated have assets of approximately $150 and debt of approximately $127, which is the Corporation's maximum exposure to loss without taking into consideration any cost sharing and asset retirement... -

Page 104

2008 Air Canada Annual Report Section 1582 replaces section 1581, and establishes standards for the accounting for a business combination. It provides the Canadian equivalent to International Financial Reporting Standard IFRS 3 - Business Combinations. The section applies prospectively to business ... -

Page 105

...Brasileira de Aeronautica S.A. ("Embraer") aircraft, $58 (2007 - $205) for the aircraft interior refurbishment program and $34 (2007 - $26) for equipment purchases and internal projects. Refer to Note 6(l) relating to the ï¬nancing of Boeing pre-delivery payments. (d) Net book value of Property and... -

Page 106

...sale of $2 (loss of $2 net of tax). The Corporation sold a building to Aveos for proceeds of $28 which was equal to the carrying value of the asset (Note 18). A CRJ-100 aircraft owned by Air Canada and leased to Jazz was damaged beyond repair. As a result of insurance proceeds of $21, Air Canada... -

Page 107

... Statements and Notes 4. INTANGIBLE ASSETS 2008 Indeï¬nite life assets International route rights and slots Air Canada trade name Other marketing based trade names 2007 $ 327 298 31 656 $ 327 298 31 656 Finite life assets Star Alliance membership Other contract and customer based Technology... -

Page 108

2008 Air Canada Annual Report 5. DEPOSITS AND OTHER ASSETS 2008 Aircraft related deposits (a) Restricted cash Deposit related to the Pension and Beneï¬ts Agreement Asset backed commercial paper (b) Aircraft lease payments in excess of rent expense Other deposits Other $ Note 18 Note 2w 203 65 42 ... -

Page 109

... Jet (j) Short-term loan due 2009 (k) Direct Corporation debt Boeing pre-delivery payments (l) Aircraft and engine leasing entities - debt (m) Fuel facility corporations - debt (n) Debt consolidated under AcG-15 Capital lease obligations (o) Total debt and capital leases Current portion Long-term... -

Page 110

... the Boeing Purchase Agreement. The PDP ï¬nancing is a series of loans that are aircraft speciï¬c with a maximum aggregate commitment of up to $568 (US$575). The PDP loans have a term of ï¬ve years, but may be prepaid upon the delivery of the aircraft without penalty. During 2008, the Corporation... -

Page 111

Consolidated Financial Statements and Notes expected to be delivered in February 2009. At year-end 2008, the balance outstanding on the PDP loans was $81 (US$66) (2007 - $521 (US$528)). The year to date capitalized interest relating to this ï¬nancing is $10 (2007 - $5) at an interest rate of 30 day... -

Page 112

2008 Air Canada Annual Report 7. FUTURE INCOME TAXES The following income tax related amounts appear in the Corporation's Consolidated Statement of Financial Position: 2008 Liability Long-term tax payable (a) Future income tax liability (c) 2007 $ $ (10) (88) (98) $ $ (10) (88) (98) a) Taxes... -

Page 113

... schemes and non-compete agreement with ACTS (Note 18). Refer to Note 15 for future income taxes recorded in Other comprehensive income related to fuel derivatives designated under fuel hedge accounting. Income taxes paid in 2008 by the Corporation were less than $1 (2007 - $6). The balances of tax... -

Page 114

... health care and life insurance beneï¬ts available to eligible retired employees. Certain Corporation employees perform work for ACE and others are contractually assigned to Aveos or Aeroplan. These employees are members of Corporation-sponsored deï¬ned beneï¬t pension plans and also participate... -

Page 115

... was $1,012 (2007 - $403). The increase in the accounting deï¬cit is mainly the result of the signiï¬cant losses on the market value of plan assets offset by the gains resulting from the increase in the discount rate used to value pension obligations along with the funding of past service employer... -

Page 116

...Net defined benefit pension and other employee benefits expense (1) Weighted average assumptions used to determine the accrued benefit cost Discount rate Expected long-term rate of return on plan assets Rate of compensation increase (2) (1) (2) Other Employee Future Beneï¬ts 2008 2007 $ 203... -

Page 117

...Financial Statements and Notes Other Beneï¬ts - Sensitivity Analysis Assumed health care cost trend rates have a signiï¬cant effect on the amounts reported for the health care plans. An 8.25% annual rate of increase in the per capita cost of covered health care beneï¬ts was assumed for 2008 (2007... -

Page 118

2008 Air Canada Annual Report payments of $605 include the estimated impact of funding changes to current service costs as well as other pension arrangements which amount to a reduction of approximately $10. Management is monitoring the government's actions and dialoguing with government ofï¬cials ... -

Page 119

... Financial Statements and Notes Defined Contribution Plans The Corporation's management, administrative and certain unionized employees may participate in deï¬ned contribution plans. Contributions range from 3% to 6% for those employees in Canada and 3% to 7% for those participants in the United... -

Page 120

2008 Air Canada Annual Report 9. OTHER LONG-TERM LIABILITIES 2008 2007 $ 29 54 54 47 45 107 336 Aeroplan Miles obligations (a) Unfavourable contract liability on aircraft leases (b) Aircraft rent in excess of lease payments Long-term employee liabilities (c) Workplace safety and insurance board ... -

Page 121

... Corporation's employees participate in the Air Canada Long-term Incentive Plan (the "Long-term Incentive Plan") administered by the Board of Directors of Air Canada. The Long-term Incentive Plan provides for the grant of options and performance share units to senior management and ofï¬cers of Air... -

Page 122

... During 2008, previously recorded stock based compensation expense, related to PSUs, of $2 was reversed as management has determined that the performance vesting criteria will not be met. Employee Share Purchase Plans Employee share purchase plans have been established for shares of Air Canada under... -

Page 123

... ACE stock options held by Air Canada employees: 2008 Outstanding and Exercisable Options Range of Exercise Prices $ 11.05 $ 19.23 Expiry Dates 2011 2013 Number of Options Outstanding 38,319 22,911 61,230 Weighted Average Remaining Life (Years) 3 5 $ $ Weighted Average Exercise Price/Share 11... -

Page 124

2008 Air Canada Annual Report 11. SHAREHOLDERS' EQUITY Share capital (net of issue costs) consists of the following: 2008 Common shares $ $ 274 274 $ $ 2007 274 274 Common Shares As at December 31, 2008, the common shares issuable by Air Canada consist of an unlimited number of Class A Variable ... -

Page 125

Consolidated Financial Statements and Notes Accumulated Other Comprehensive Income (Loss) The following table outlines the components of Accumulated other comprehensive income (loss) as at December 31: 2008 Accumulated other comprehensive income (loss) Unrealized change in fair value of derivatives ... -

Page 126

... assumed to be used to purchase Class B Voting Shares. Excluded from the 2008 calculation of diluted earnings per share were 1,701,447 (2007 - 1,606,820) outstanding options where the options' exercise prices were greater than the average market price of the common shares for the year. The 1,671,068... -

Page 127

... statements is as follows: 2008 Air Canada Operating revenues Passenger Cargo Other External revenue Inter-segment Total revenues Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz Depreciation and amortization Aircraft maintenance... -

Page 128

2008 Air Canada Annual Report Passenger revenues Canada US Transborder Atlantic Paciï¬c Other $ 2008 4,108 1,876 1,883 995 851 9,713 $ 2007 3,970 1,884 1,806 967 702 9,329 $ $ Cargo revenues Canada US Transborder Atlantic Paciï¬c Other $ 2008 97 18 212 142 46 515 $ 2007 108 25 219 159 39 ... -

Page 129

... delivery of one Boeing 777-300ER on a 10-year operating lease with International Lease Finance Corporation ("ILFC"). Embraer As of December 31, 2008, the Corporation had 7 Embraer 190 series exercisable options remaining. Aircraft Interior Refurbishment Program In addition to acquiring new aircraft... -

Page 130

2008 Air Canada Annual Report Operating Lease Commitments As at December 31, 2008 the future minimum lease payments under existing operating leases of aircraft and other property amount to $2,652 (2007 - $2,108) using year end exchange rates. 2009 Aircraft Other property Total $ $ 367 49 416 $ $ ... -

Page 131

... the Corporation to purchase a minimum number of Aeroplan Miles from Aeroplan. The estimated minimum requirement for 2009 is $208. The annual commitment is based on 85% of the average total Miles actually issued in respect of Air Canada ï¬,ights or Air Canada airline afï¬liate products and services... -

Page 132

2008 Air Canada Annual Report 15. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT Summary of Financial Instruments Carrying Amounts December 31, 2008 Financial instruments classiï¬cation Liabilities at amortized cost December 31, 2007 Held for trading Financial Assets Cash and cash equivalents ... -

Page 133

...Corporation is returned to the lessee or sub-lessee, as the case may be, at the end of the lease or sublease term provided there have been no events of default under the leases or sub-leases. Summary of Gain on Financial Instruments Recorded at Fair Value 2008 Ineffective portion of fuel hedges Fuel... -

Page 134

...a notional value of US$414 to receive ï¬,oating rates and pay a weighted average ï¬xed rate of 5.81% for the debt to be arranged in relation to the ï¬nancing of Embraer 190 aircraft between June 2006 and February 2008. The swaps had 15 year terms from the expected delivery date of the aircraft and... -

Page 135

Consolidated Financial Statements and Notes The majority of the Corporation's outstanding debt is denominated in US dollars. The US dollar debt acts as an economic hedge against the related aircraft, which is routinely purchased, leased or sub-leased to third parties, and sold by Air Canada in US ... -

Page 136

2008 Air Canada Annual Report Under the terms of the credit card processing agreement, beginning at the end of the second quarter of 2009, the triggering events for deposits will change and be based upon a matrix of unrestricted cash and a debt service coverage ratio. The ratio is based upon an ... -

Page 137

... the result of sales of tickets to individuals, often through the use of major credit cards, through geographically dispersed travel agents, corporate outlets, or other airlines. Credit rating guidelines are used in determining counterparties for fuel hedging. In order to manage its exposure to... -

Page 138

... value of outstanding fuel derivatives may be recorded as ineffective under the current policy. Ineffectiveness is inherent in hedging diversiï¬ed jet fuel purchases with derivative positions in crude oil and related commodities and in the differences between intrinsic values and fair market values... -

Page 139

...ï¬,ected within Current liabilities on the Consolidated Statement of Financial Position due to the counterparty's ability to terminate the derivatives at fair value at any time prior to maturity. The change in fair value of fuel derivatives under hedge accounting during 2008 was $(522) (2007 - $134... -

Page 140

2008 Air Canada Annual Report Financial Instrument Fair Values in the Consolidated Statement of Financial Position The carrying amounts reported in the Consolidated Statement of Financial Position for short term ï¬nancial assets and liabilities, which includes Accounts receivable and Accounts ... -

Page 141

... versus investor supplied capital as measured by the adjusted net debt to net debt plus equity ratio; and to maintain the Corporation's credit ratings to facilitate access to capital markets at competitive interest rates. • • • In order to maintain or adjust the capital structure, the... -

Page 142

... including high fuel prices during most of 2008, the requirement to fund $322 in fuel collateral deposits (Note 15), higher past service pension funding payments and deteriorating economic conditions impacting travel demand. To offset these factors, the Corporation has been actively pursuing cost... -

Page 143

..., are investigating alleged anti-competitive cargo pricing activities, including the levying of certain fuel surcharges, of a number of airlines and cargo operators, including the Corporation. Competition authorities have sought or requested information from the Corporation as part of their... -

Page 144

.... Each contracting airline participating in a Fuel Facility Corporation shares pro rata, based on system usage, in the guarantee of this debt. Indemniï¬cation Agreements The Corporation enters into real estate leases or operating agreements, which grant a license to the Corporation to use certain... -

Page 145

Consolidated Financial Statements and Notes 18. RELATED PARTY TRANSACTIONS At December 31, 2008, ACE has a 75% ownership interest in Air Canada. Air Canada has various related party transactions with ACE and Aveos (formerly called ACTS Aero Technical Support & Services Inc. ("ACTS Aero")), which ... -

Page 146

... to as the compensation amount. Until such future time as the assets and obligations under the Air Canada Beneï¬t Arrangements pertaining to non-unionized employees may be transferred to Aveos, the current service pension cost and the current service and interest costs for other employee beneï¬ts... -

Page 147

... current amount of the letters of credit related to the Pension and Beneï¬ts Agreement. During 2008, Air Canada, Aveos, and the union representing the employees assigned to Aveos continued discussions regarding the options under which certain unionized employees would commence employment directly... -

Page 148

... return of the letters of credit to Aveos. By October 2009 the letters of credit would be re-instated to the levels then required under the Pension and Beneï¬ts Agreement between the two parties. Maintenance Agreements Aveos and Air Canada are parties to a general terms and related services... -

Page 149

... Corporation at the Vancouver, Winnipeg, Toronto and Montreal airports. The Relationship between the Corporation and ACE Master Services Agreement Air Canada provides certain administrative services to ACE in return for a fee. Such services relate to ï¬nance and accounting, information technology... -

Page 150

...President, Marketing Vice President, Labour Relations Vice President, Global Sales Vice President and General Counsel Vice President, Network Planning Vice President, Customer Service, In-Flight, Call Centres and Customer Relations Corporate Secretary Controller President and Chief Executive Officer... -

Page 151

... service and call upon our employees linguistic skills at all times. Our consideration to bilingualism not only makes good sense customer-wise, but also supports our legal obligations to serve the public in the two ofï¬cial languages of Canada. Air Canada puts great efforts to better serve clients... -

Page 152

2008 Air Canada Annual Report Corporate Profile Air Canada is Canada's largest domestic and international full-service airline and the largest provider of scheduled passenger services in the domestic market, the transborder market and each of the Canada-Europe, Canada-Pacific, Canada-Caribbean/...