Advance Auto Parts 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We’re ready with quality parts at value prices. We’re

ready with friendly Team Members who know their

stuff. We’re ready with clean, conveniently located

stores.

We’re ready in Advance. Advance Auto Parts offers one

of the largest selections of brand name and private

label auto parts, accessories, and maintenance items in

the automotive aftermarket. More than 120,000 items

in all.

But it isn’t enough to have the right products. We have to

provide customers great value. Our recent category man-

agement initiatives are optimizing our pricing, increasing

our product selection, improving our merchandising, and

enhancing our inventory productivity.

We’re ready in Advance. Our entire team is focused on our

customers’ needs. “Ring, ring” is our way of reminding

Team Members to answer all calls within three rings. And

a customer has to be greeted within 10 feet of entering our

store for us to earn a “Perfect 10.”

Once we make our customers feel welcome, we focus on

solving their problem. Trained Team Members ask the

right questions and give sound advice. They’re also eager to

test batteries, starters, alternators, sensors, and ignition

modules. Whatever the customers’ problem, we have a

solution. No wonder they keep coming back.

We now have more than 2,400 attractive locations in 37

states. During 2002, we opened 110 new stores. And we

also relocated 39 to more convenient sites in existing mar-

kets. Because it’s more important to us to be a neighbor-

hood store than a national one. That’s why we’re always

improving our stores, making them brighter, and more

inviting. We’ve always attracted the smart DIYers; now

current initiatives include educating more customers to

help them maintain a safe fuel-efficient vehicle.

But what really sets us apart is that we’re a big company

with small town values. Founded in 1929, Advance Auto

Parts is built on honesty and integrity. Our team members

care about their communities, proved by the $8 million

we’ve raised, with the help of our customers, for the

Juvenile Diabetes Research Foundation since 1995. But

they also care about their customers. And about each

other. We’re ready to take the next step to an even higher

level of success!

23

In 2002, more than 190 million

customers chose Advance Auto Parts

for their automotive needs. Proof that

when customers come through our doors,

we have what it takes to win them over –

and keep them coming back.

We’re

ready

with a

winning

team!

We’re ready.

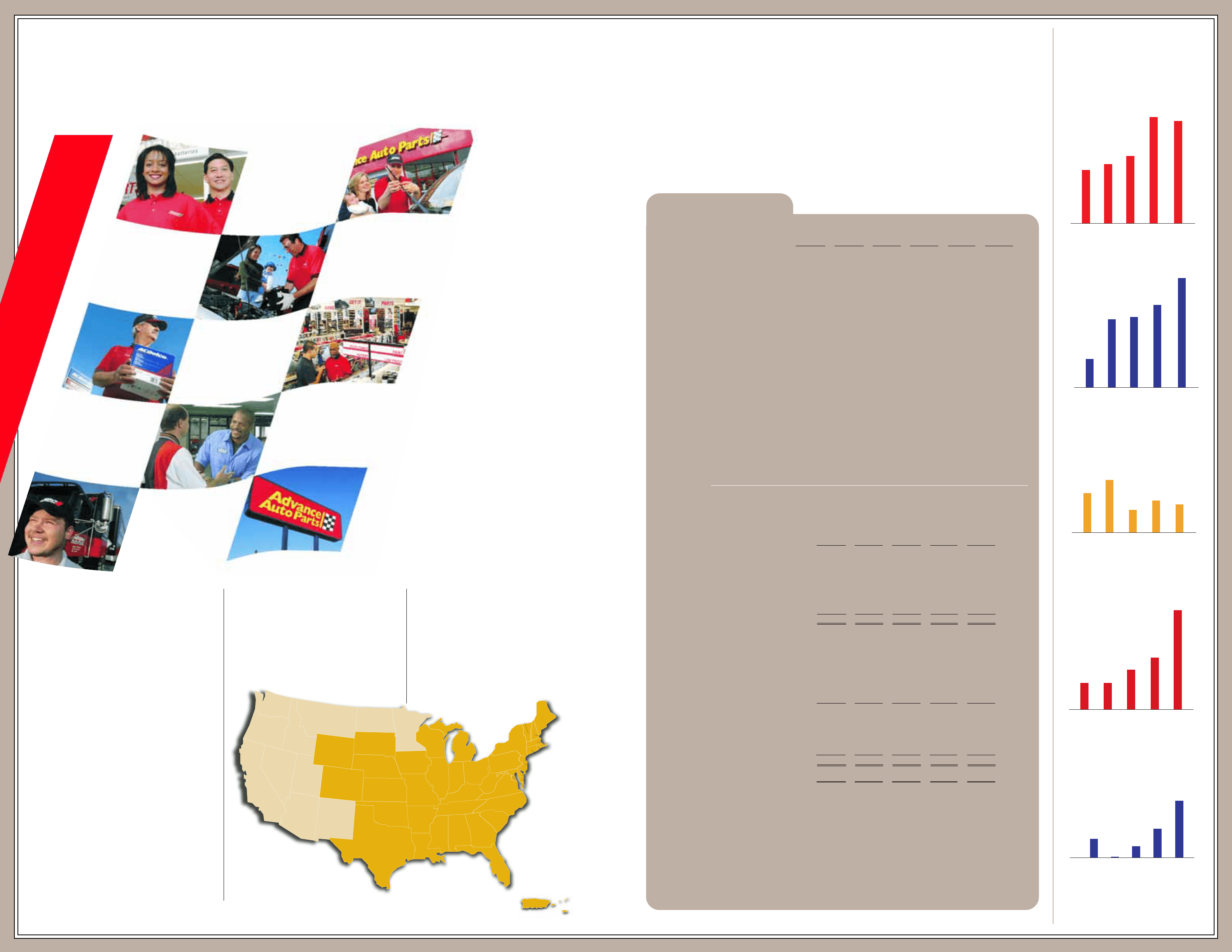

5 Year Financials

5-Year

Compounded

Growth 2002 2001 2000 1999 1998

(in thousands, except per share data)

Statement of Operations Data:

Net sales……………………………………………………...28.1% $ 3,287,883 $ 2,517,639 $ 2,288,022 $2,206,945 $ 1,220,759

Gross profit (1) ……………………………………………… 33.6% 1,447,994 1,076,026 895,895 802,832 454,561

Comparable operating income (2) ……………………………39.8% 237,517 123,770 94,374 62,351 62,208

Comparable net income (3)…………………………………...56.5% $ 97,138 $ 38,088 $ 17,596 $ 154 $ 16,197

Comparable net income per diluted share (3)…………………. $ 2.68 $ 1.31 $ 0.62 $ 0.01 $ 0.87

Weighted average diluted shares outstanding…………………. 36,188 29,158 28,611 28,269 18,606

Selected Store Data:

Comparable store sales growth ………………………………. 5.5% 6.2% 4.4% 10.3% 7.8%

Number of stores, end of period………………………………. 2,435 2,484 1,729 1,617 1,567

Stores with commercial delivery

program, end of period …………………………………… 1,411 1,370 1,210 1,094 532

Total retail store square footage, end

of period (in thousands) …………………………………... 18,108 18,717 13,325 12,476 12,084

Average net retail sales per store (4) …………………………. $ 1,303 $ 1,346 $ 1,295 $ 1,267 $ 1,270

Average net retail sales per square foot (5)…………………… $ 174 $ 175 $ 168 $ 164 $ 172

Balance Sheet Data:

Inventory……………………………………………………… $1,048,803 $ 982,000 $ 788,914 $ 749,447 $ 726,172

Net working capital …………………………………………… 462,896 442,099 318,583 355,608 310,113

Total assets……………………………………………………. 1,965,225 1,950,615 1,356,360 1,348,629 1,265,355

Total net debt (6) ……………………………………………… 722,506 972,368 582,539 627,467 485,476

Total stockholders' equity …………………………………….. 468,356 288,571 156,271 133,954 159,091

(1) Gross profit for fiscal 2001 excludes the non-recurring charge of $9,099 associated with our supply chain initiatives recorded in the fourth quarter.

(2) Comparable operating income excludes certain non-recurring charges as included in the following reconciliation of this measurement to our operating

income presented under generally accepted accounting policies in our financial statements included in the accompanying annual report on form 10-K.

2002 2001(a) 2000 1999 1998

Comparable operating income $ 237,517 $ 123,770 $ 94,374 $ 62,351 $ 62,208

Supply chain initiatives - (10,492) - - -

Impairment of assets held for sale - (10,700) (856) - -

Recapitalization expenses - - - - (14,277)

Merger related restructuring (597) (3,719) - - (6,774)

Merger and integration (34,935) (1,135) - (41,034) (7,788)

Private company expenses - - - - (845)

Stock option compensation - (8,611) (729) (1,082) (695)

Operating income $ 201,985 $ 89,113 $ 92,789 $ 20,235 $ 31,829

(a) Fiscal 2001 excludes only the non-recurring charges taken during the fourth quarter.

For more information see the fiscal 2001 financial statements and accompanying footnotes.

(3) Comparable net income excludes the nonrecurring items in footnote (1) and (2) above and the extraordinary items and cumulative effect of a change

in accounting principle. The following is a reconciliation of comparable net income to net income presented under generally accepted accounting policies in

our financial statements included in the accompanying annual report on form 10-K.

2002 2001(a) 2000 1999 1998

Comparable net income $ 97,138 $ 38,088 $ 17,596 $ 154 $ 16,197

Add back non-recurring items from footnote (1) and (2) (35,532) (34,657) (1,585) (42,116) (30,379)

Tax impact of non-recurring items 13,786 13,758 615 16,636 12,000

Extraordinary items, net of tax (10,373) (3,682) 2,933 - -

Cumulative effect of a change in accounting principle,

net of tax - (2,065) - - -

Net income $ 65,019 $ 11,442 $ 19,559 $ (25,326) $ (2,182)

Net income per diluted share $ 1.80 $ 0.39 $ 0.68 $ (0.90) $ (0.12)

(a) Fiscal 2001 excludes only the non-recurring charges taken during the fourth quarter.

For more information see the fiscal 2001 financial statements and accompanying footnotes.

(4) Average net retail sales per store is calculated as net sales of the retail segment divided by the average of the beginning and ending number of stores

for the respective period. The 1998 amounts were calculated giving effect to the Parts America net retail sales and the number of stores for the period

from November 1, 1998 through January 2, 1999. The 2001 amounts were calculated giving effect to the Discount net retail sales and the number of

stores for the period from December 2, 2001 through December 29, 2001.

(5) Average net retail sales per square foot is calculated as net sales of the retail segment divided by the average of the beginning and ending square footage

for the respective period. The 1998 amounts were calculated giving effect to the Parts America net retail sales and square footage for the period from

November 1, 1998 through January 2, 1999. The 2001 amounts were calculated giving effect to the Discount net retail sales and square footage for the period

from December 2, 2001 through December 29, 2001.

(6) Net debt includes total debt and bank overdrafts, less cash and cash equivalents.

1998 1999 2000

2,435

2,484

1,729

1,617

1,5 67

2001

Number of Stores

2002

1998 1999 2000

$3.3

$2.5

$2.3

$2.2

$1.2

2001

Sales

(in billions)

2002

1998 1999 2000

5.5%

6.2%

4.4%

10.3%

7.8%

2001 2002

Comparable Store SalesComparable Store Sales

1998 1999 2000 2001

Comparable Earnings Per Share

2002

$1.31

.87

.01

.62

$2.68

Number of Stores

Net Sales (in billions)

Comparable Store Sales

Comparable Earnings per Share

Connecticut

23

New Jersey

22

Delaware

5

Maryland

60

Michigan

49

Missouri

35

Nebraska

17

Rhode Island

3

Massachusetts

2

1

Maine

7

New Hampshire

4

Vermont

3

New York

98

Pennsylvania

135

West

Virginia

63

Ohio

145

Kentucky

66

Virginia

150

North Carolina

179

South Carolina

103

Georgia

191

Alabama

104

Arkansas

21

Texas

54

Colorado

15

Florida

430

Puerto Rico

34

Virgin Islands

2

Illinois

23

Iowa

24

Louisiana

58

Indiana

71

Kansas

26

Oklahoma

1

South Dakota

6

Wisconsin

18

Wyoming

2

California

1

Mississippi

47

Tennessee

118

Washington, DC

1

We’re ready with quality parts at value prices. We’re

ready with friendly Team Members who know their

stuff. We’re ready with clean, conveniently

located stores.

We’re ready in Advance. Advance Auto Parts offers

one of the largest selections of brand name and

private label auto parts, accessories, and mainte-

nance items in the automotive aftermarket. More

than 120,000 items in all.

But it isn’t enough to have the right products. We have

to provide customers great value. Our recent category

management initiatives are optimizing our pricing,

increasing our product selection, improving our mer-

chandising, and enhancing our inventory productivity.

We’re ready in Advance. Our entire team is focused

on our customers’ needs. “Ring, ring” is our way of

reminding Team Members to answer all calls within

three rings. And a customer has to be greeted within 10

feet of entering our store for us to earn a “Perfect 10.”

Once we make our customers feel welcome, we focus

on solving their problem. Trained Team Members ask

the right questions and give sound advice. They’re also

eager to test batteries, starters, alternators, sensors, and

ignition modules. Whatever the customers’ problem,

we have a solution. No wonder they keep coming back.

We now have more than 2,400 attractive locations in

37 states. During 2002, we opened 110 new stores.

And we also relocated 39 to more convenient sites in

existing markets. We keep our stores looking great

with our GOLD standard, having a “Grand Opening

Look Daily.”

But what really sets us apart is that we’re a big com-

pany with small town values. Founded in 1929,

Advance Auto Parts is built on honesty and integrity.

Our Team Members care about their communities,

proved by the $8 million we’ve raised, with the help

of our customers, for the Juvenile Diabetes Research

Foundation since 1995. But they also care about their

customers. And about each other.

We’re ready in Advance.

Advance Auto Parts, Inc. is

based in Roanoke, Virginia and

is the second largest auto parts

retailer in the United States. At

December 28, 2002, the Company

had 2,435 stores in 37 states, Puerto

Rico, and the Virgin Islands. The

Company serves both the do-it-

yourself and professional

installer markets.

Puerto Rico 34

Virgin Islands 2

California 1

1998 1999 2000 2001

Comparable Operations Income

(in millions)

2002

$62,208 $62,351

$94,374

$123,770

$237,517

Comparable Operating Income

(in millions)

Footnotes

$62.2 $62.4

$94.4

$123.8

$237.5

$.87

$.01 $.62