iRobot 2011 Annual Report Download - page 7

Download and view the complete annual report

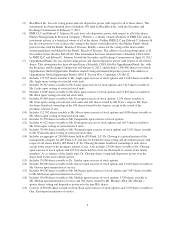

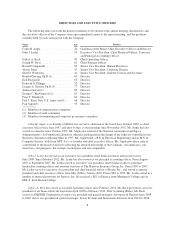

Please find page 7 of the 2011 iRobot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(3) BlackRock Inc. has sole voting power and sole dispositive power with respect to all of these shares. This

information has been obtained from a Schedule 13G filed by BlackRock Inc. with the Securities and

Exchange Commission on February 9, 2012.

(4) FMR LLC and Edward C. Johnson 3d each have sole dispositive power with respect to all of the shares.

Fidelity Management & Research Company (“Fidelity”), a wholly owned subsidiary of FMR LLC and an

investment adviser, is a beneficial owner of all of the shares. Neither FMR LLC nor Edward C. Johnson 3d

has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which

power resides with the Funds’ Boards of Trustees. Fidelity carries out the voting of the shares under

written guidelines established by the Funds’ Boards of Trustees. The address of each reporting entity is 82

Devonshire Street, Boston, MA 02109. This information has been obtained from a Schedule 13G/A filed

by FMR LLC and Edward C. Johnson 3d with the Securities and Exchange Commission on April 10, 2012.

(5) OppenheimerFunds, Inc. has shared voting power and shared dispositive power with respect to all of these

shares. This information has been obtained from a Schedule 13G/A filed by OppenheimerFunds, Inc. with

the Securities and Exchange Commission on February 6, 2012, and includes 1,500,000 shares over which

Oppenheimer Global Opportunity Fund has shared voting and shared dispositive power. The address of

Oppenheimer Global Opportunity Fund is 6803 S. Tucson Way, Centennial, CO 80112.

(6) Includes 175,595 shares issuable to Mr. Angle upon exercise of stock options and 13,263 shares issuable to

Mr. Angle upon vesting of restricted stock units.

(7) Includes 38,367 shares issuable to Mr. Leahy upon exercise of stock options and 5,413 shares issuable to

Mr. Leahy upon vesting of restricted stock units.

(8) Includes 14,069 shares issuable to Mr. Beck upon exercise of stock options and 11,863 shares issuable to

Mr. Beck upon vesting of restricted stock units.

(9) Includes 45,489 shares issuable to Mr. Dyer upon exercise of stock options, 5,250 shares issuable to

Mr. Dyer upon vesting of restricted stock units and 100 shares owned by Mr. Dyer’s stepson. Mr. Dyer

disclaims beneficial ownership of the 100 shares owned by his stepson, except to the extent of his

pecuniary interest, if any.

(10) Includes 112,762 shares issuable to Mr. Moses upon exercise of stock options and 4,096 shares issuable to

Mr. Moses upon vesting of restricted stock units.

(11) Includes 31,250 shares issuable to Mr. Campanello upon exercise of stock options.

(12) Includes 41,912 shares issuable to Ms. Dean upon exercise of stock options and 1,657 shares issuable to

Ms. Dean upon vesting of restricted stock units.

(13) Includes 78,940 shares issuable to Mr. Weinstein upon exercise of stock options and 3,013 shares issuable

to Mr. Weinstein upon vesting of restricted stock units.

(14) Includes an aggregate of 240,000 shares held by iD5 Fund, L.P. Dr. Chwang is a general partner of the

management company for iD5 Fund, L.P. and may be deemed to share voting and investment power with

respect to all shares held by iD5 Fund, L.P. Dr. Chwang disclaims beneficial ownership of such shares

except to the extent of his pecuniary interest, if any. Also includes 53,000 shares issuable to Dr. Chwang

upon exercise of stock options and 107,210 shares held in a trust for the benefit of certain of his family

members. As co-trustees of the family trust, Dr. Chwang shares voting and dispositive power over the

shares held by the trust with his spouse.

(15) Includes 55,000 shares issuable to Dr. Gansler upon exercise of stock options.

(16) Includes 80,000 shares issuable to Mr. Geisser upon exercise of stock options and 12,643 shares issuable to

Mr. Geisser upon termination of service.

(17) Includes 90,000 shares issuable to Mr. McNamee upon exercise of stock options and 3,487 shares issuable

to Mr. McNamee upon termination of service.

(18) Includes 50,000 shares issuable to Mr. Meekin upon exercise of stock options, 9,780 shares issuable to

Mr. Meekin upon termination of service and 500 shares owned by Mr. Meekin’s IRA. Mr. Meekin’s

spouse shares voting and dispositive power over the non-IRA shares.

(19) Consists of 80,000 shares issuable to Gen. Kern upon exercise of stock options and 7,003 shares issuable to

Gen. Kern upon termination of service.

4