iRobot 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 iRobot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

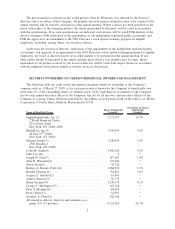

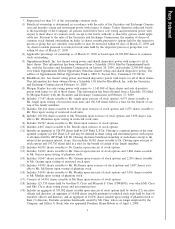

* Represents less than 1% of the outstanding common stock.

(1) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commis-

sion and includes voting and investment power with respect to shares. Unless otherwise indicated below,

to the knowledge of the Company, all persons listed below have sole voting and investment power with

respect to their shares of common stock, except to the extent authority is shared by spouses under appli-

cable law. Pursuant to the rules of the Securities and Exchange Commission, the number of shares of

common stock deemed outstanding includes (i) shares issuable pursuant to options held by the respective

person or group that are currently exercisable or may be exercised within 60 days of March 27, 2009 and

(ii) shares issuable pursuant to restricted stock units held by the respective person or group that vest

within 60 days of March 27, 2009.

(2) Applicable percentage of ownership as of March 27, 2009 is based upon 24,941,889 shares of common

stock outstanding.

(3) OppenheimerFunds, Inc. has shared voting power and shared dispositive power with respect to all of

these shares. This information has been obtained from a Schedule 13G/A filed by OppenheimerFunds,

Inc. with the Securities and Exchange Commission on January 26, 2009, and includes 2,500,000 shares

over which Oppenheimer Global Opportunity Fund has shared voting and shared dispositive power. The

address of Oppenheimer Global Opportunity Fund is 6803 S. Tucson Way, Centennial, CO 80112.

(4) BlackRock, Inc. has shared voting power and shared dispositive power with respect to all of these shares.

This information has been obtained from a Schedule 13G filed by BlackRock, Inc. with the Securities

and Exchange Commission on February 10, 2009.

(5) Morgan Stanley has sole voting power with respect to 1,143,868 of these shares and sole dispositive

power with respect to all of these shares. This information has been obtained from a Schedule 13G filed

by Morgan Stanley with the Securities and Exchange Commission on February 17, 2009.

(6) Includes 17,167 shares issuable to Mr. Angle upon exercise of stock options, 4,075 shares issuable to

Mr. Angle upon vesting of restricted stock units and 190,549 shares held in a trust for the benefit of cer-

tain of his family members.

(7) Includes 200,416 shares issuable to Mr. Dyer upon exercise of stock options and 2,875 shares issuable to

Mr. Dyer upon vesting of restricted stock units.

(8) Includes 104,202 shares issuable to Mr. Weinstein upon exercise of stock options and 1,838 shares issu-

able to Mr. Weinstein upon vesting of restricted stock units.

(9) Includes 28,567 shares issuable to Ms. Dean upon exercise of stock options.

(10) Includes 4,667 shares issuable to Dr. Brooks upon exercise of stock options.

(11) Includes an aggregate of 526,970 shares held by iD5 Fund, L.P. Dr. Chwang is a general partner of the man-

agement company for iD5 Fund, L.P. and may be deemed to share voting and investment power with respect

to all shares held by iD5 Fund, L.P. Dr. Chwang disclaims beneficial ownership of such shares except to the

extent of his pecuniary interest, if any. Also includes 34,001 shares issuable to Dr. Chwang upon exercise of

stock options and 193,710 shares held in a trust for the benefit of certain of his family members.

(12) Includes 60,001 shares issuable to Dr. Gansler upon exercise of stock options.

(13) Includes 34,001 shares issuable to Mr. Geisser upon exercise of stock options and 3,868 shares issuable

to Mr. Geisser upon vesting of phantom stock.

(14) Includes 10,667 shares issuable to Ms. Greiner upon exercise of stock options and 2,200 shares issuable

to Ms. Greiner upon vesting of restricted stock units.

(15) Includes 34,001 shares issuable to Mr. McNamee upon exercise of stock options and 3,487 shares issu-

able to Mr. McNamee upon vesting of phantom stock.

(16) Includes 34,001 shares issuable to Mr. Meekin upon exercise of stock options and 3,481 shares issuable

to Mr. Meekin upon vesting of phantom stock.

(17) Consists of 34,001 shares issuable to Mr. Kern upon exercise of stock options.

(18) Includes 123,350 shares held by Geoffrey P. Clear and Marjorle P. Clear (JTWROS), over which Mr. Clear

and Mrs. Clear share voting power and investment power.

(19) Includes an aggregate of 595,692 shares issuable upon exercise of stock options held by twelve (12) executive

officers and directors, an aggregate of 10,988 shares issuable pursuant to restricted stock units held by four (4)

executive officers and directors, and an aggregate of 10,836 shares issuable upon vesting of phantom stock to

three (3) directors. Excludes securities beneficially owned by Mr. Clear, who is no longer employed by the

Company, and Jeffrey A. Beck, who was appointed President, Home Robots as of April 1, 2009.

3

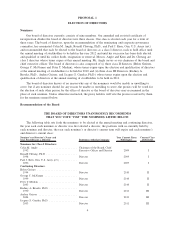

Proxy Statement