iHeartMedia 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

[x] Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2005, or

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to _________.

Commission File Number

1-9645

CLEAR CHANNEL COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

Texas

(State of Incorporation) 74-1787539

(I.R.S. Employer Identification No.)

200 East Basse Road

San Antonio, Texas 78209

Telephone (210) 822-2828

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.10 par value per share New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [X]

NO [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition

of “accelerate filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer [X] Accelerated filer [ ]

Non-accelerated filer [ ]

Indicate by checkmark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). YES [ ] NO [X]

As of June 30, 2005, the aggregate market value of the Common Stock beneficially held by non-affiliates of the registrant was

approximately $10.8 billion based on the closing sale price as reported on the New York Stock Exchange. (For purposes hereof,

directors, executive officers and 10% or greater shareholders have been deemed affiliates).

On February 28, 2006, there were 516,831,938 outstanding shares of Common Stock, excluding 21,760,838 shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2006 Annual Meeting, expected to be filed within 120 days of our fiscal year end,

are incorporated by reference into Part III.

Table of contents

-

Page 1

...As of June 30, 2005, the aggregate market value of the Common Stock beneficially held by non-affiliates of the registrant was approximately $10.8 billion based on the closing sale price as reported on the New York Stock Exchange. (For purposes hereof, directors, executive officers and 10% or greater... -

Page 2

... and Financial Statement Schedules ...95 Directors and Executive Officers of the Registrant ...93 Executive Compensation ...94 Security Ownership of Certain Beneficial Owners and Management ...94 Certain Relationships and Related Transactions...94 Principal Accountant Fees and Services...94 Other... -

Page 3

...or sell air time under local marketing agreements or joint sales agreements. The radio broadcasting segment also operates radio networks. Our Americas outdoor advertising segment consists of our operations in the United States, Canada and Latin America, with approximately 94% of our 2005 revenues in... -

Page 4

...of our radio broadcasting, Americas outdoor advertising and international outdoor advertising operations for 2005, 2004 and 2003 is included in "Note O - Segment Data" in the Notes to Consolidated Financial Statements in Item 8 included elsewhere in this Report. Company Strategy Utilize media assets... -

Page 5

... Strategy Our radio strategy centers on providing programming and services to the local communities in which we operate. By providing listeners with programming that is compelling, we are able to provide advertisers with an effective platform to reach their consumers. In the first quarter of 2005... -

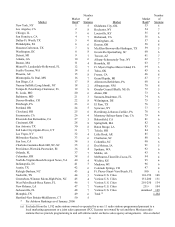

Page 6

Market Market Rank* New York, NY 1 Los Angeles, CA 2 Chicago, IL 3 San Francisco, CA 4 Dallas-Ft. Worth, TX 5 Philadelphia, PA 6 Houston-Galveston, TX 7 Washington, DC 8 Detroit, MI 9 Atlanta, GA 10 Boston, MA 11 Miami-Ft. Lauderdale-Hollywood, FL 12 Seattle-Tacoma, WA 14 Phoenix, AZ 15 Minneapolis-... -

Page 7

... Florida. Outdoor Advertising Strategy We seek to capitalize on our global network and diversified product mix to maximize revenues and increase profits. We believe we can increase our operating margins by spreading our fixed investment costs over our broad asset base. In addition, by sharing best... -

Page 8

... taxis and within the common areas of rail stations and airports. Similar to street furniture, contracts for the right to place our displays on such vehicles or within such transit systems and sell advertising space on them generally are awarded by public transit authorities in competitive bidding... -

Page 9

... Markets United States New York, NY Los Angeles, CA Chicago, IL Philadelphia, PA Boston, MA (Manchester, NH) San Francisco-Oakland-San Jose, CA Dallas-Ft. Worth, TX Washington, DC (Hagerstown, MD) Atlanta, GA Houston, TX Detroit, MI Tampa-St. Petersburg (Sarasota), FL Seattle-Tacoma, WA Phoenix... -

Page 10

... being similar in size to our Americas posters (30sheet and eight-sheet displays). Our international billboards are sold to clients as network packages with contract terms ranging from one to two weeks. Long-term client contracts are also available and typically have terms of up to one year. 10 -

Page 11

... markets sell equipment or provide cleaning and maintenance services as part of a billboard or street furniture contract with a municipality. Production revenue relates to the production of advertising posters usually to small customers. Advertising inventory and markets At December 31, 2005... -

Page 12

... in Clear Media. In addition to our displays owned and operated worldwide as of December 31, 2005, we have made equity investments in various out-of-home advertising companies that operate in the following markets: Equity Investment (1) South Africa(3) ... Market Company Billboards Italy... -

Page 13

... news programming for the majority of our television stations. Media Representation We own the Katz Media Group, a full-service media representation firm that sells national spot advertising time for clients in the radio and television industries throughout the United States. As of December 31, 2005... -

Page 14

... radio and television stations for terms of up to eight years. The 1996 Act requires the FCC to renew a broadcast license if it finds that the station has served the public interest, convenience and necessity; there have been no serious violations of either the Communications Act or the FCC's rules... -

Page 15

... one or more radio or television stations in a market and programs more than 15% of the broadcast time on another station in the same service (radio or television) in the same market pursuant to an LMA is generally required to count the LMA station toward its media ownership limits even though it... -

Page 16

... operators, and newspapers). To the best of our knowledge at present, none of our officers, directors or five percent or greater stockholders holds an interest in another television station, radio station, cable television system or daily newspaper that is inconsistent with the FCC's ownership rules... -

Page 17

... non-commercial radio stations licensed to communities within an Arbitron metro market, as well as stations licensed to communities outside the metro market but considered "home" to that market, are counted as stations in the local radio market for the purposes of applying the ownership limits. For... -

Page 18

... future reviews or any other agency or legislative initiatives upon the FCC's broadcast rules. Further, the 1996 Act's relaxation of the FCC's ownership rules has increased the level of competition in many markets in which our stations are located. Alien Ownership Restrictions The Communications Act... -

Page 19

... in the mass communications industry, such as direct broadcast satellite service, the continued establishment of wireless cable systems and low power television stations, "streaming" of audio and video programming via the Internet, digital television and radio technologies, the establishment of... -

Page 20

...performance of certain key employees. We employ or independently contract with several on-air personalities and hosts of syndicated radio programs with significant loyal audiences in their respective markets. Although we have entered into long-term agreements with some of our executive officers, key... -

Page 21

... that do not comply with the new rules, and require us to terminate within two years (i.e., by September 2006) certain of our agreements whereby we provide programming to or sell advertising on radio stations we do not own. The modified media ownership rules are subject to various further FCC... -

Page 22

... increased costs in the form of fines and a greater risk that we could lose one or more of our broadcasting licenses. Antitrust Regulations May Limit Future Acquisitions Additional acquisitions by us of radio and television stations and outdoor advertising properties may require antitrust review by... -

Page 23

... on the existing inventory of billboards in the outdoor advertising industry. Future Acquisitions Could Pose Risks We may acquire media-related assets and other assets or businesses that we believe will assist our customers in marketing their products and services. Our acquisition strategy involves... -

Page 24

... advertising revenues with other radio stations and outdoor advertising companies, as well as with other media, such as newspapers, magazines, television, direct mail, satellite radio and Internet based media, within their respective markets. Audience ratings and market shares are subject to change... -

Page 25

... acquired companies; shifts in population and other demographics; industry conditions, including competition; fluctuations in operating costs; technological changes and innovations; changes in labor conditions; fluctuations in exchange rates and currency values; capital expenditure requirements... -

Page 26

...,000 square foot data and administrative service center. Operations Radio Broadcasting Certain radio executive corporate operations moved to our executive corporate headquarters in San Antonio, Texas during 2002. The types of properties required to support each of our radio stations include offices... -

Page 27

... us to produce certain information regarding commercial advertising run by us on behalf of offshore and/or online (Internet) gambling businesses, including sports bookmaking and casino-style gambling. We are cooperating with such requirements. On February 7, 2005, the Company received a subpoena... -

Page 28

...sales prices of the common stock as reported on the NYSE. Common Stock Market Price Low High 2004 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...2005 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...Dividend Policy Our Board of Directors declared a quarterly... -

Page 29

ITEM 6. Selected Financial Data (In thousands) 2005 Results of Operations Information: Revenue $ 6,610,418 Operating expenses: Direct operating expenses (excludes non-cash compensation expense and depreciation and amortization) 2,466,755 Selling, general and administrative expenses (excludes non-... -

Page 30

...and cumulative effect of a change in accounting principle Discontinued operations Income (loss) before cumulative effect of a change in accounting principle Cumulative effect of a change in accounting principle Net income (loss) Dividends declared per share For the Years ended December 31, (1) 2004... -

Page 31

... improved pricing on our outdoor inventory during 2005 and internationally, our street furniture inventory experienced improved yields as well. Additionally, we completed the initial public offering of 10% of our outdoor business. Lastly, we completed the spin-off of our live entertainment and... -

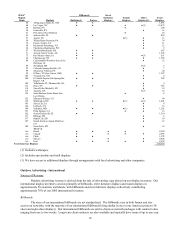

Page 32

...our largest source of advertising revenue, and national advertising revenues are tracked separately, because these revenue streams have different sales forces and respond differently to changes in the economic environment. Management also looks at radio revenue by market size, as defined by Arbitron... -

Page 33

... average rates, average revenues per display, occupancy, and inventory levels of each of our display types by market. In addition, because a significant portion of our advertising operations are conducted in foreign markets, principally France and the United Kingdom, management reviews the operating... -

Page 34

...in the number of commercial minutes broadcast on our radio stations as part of our Less Is More initiative. Our television revenues declined approximately $14.7 million primarily as a result of local and national political advertising revenues in 2004 that did not recur in 2005. Partially offsetting... -

Page 35

... minority interest relate to minority holdings in our Australian street furniture business, Clear Media Limited and CCO, as well as other smaller minority interests. We acquired a controlling majority interest in Clear Media Limited in the third quarter of 2005 and therefore began consolidating its... -

Page 36

... occurred across our markets including strong growth in New York, Miami, Houston, Seattle, Cleveland and Las Vegas. Strong advertising client categories for 2005 included business and consumer services, entertainment and amusements, retail and telecommunications. Direct operating expenses increased... -

Page 37

... in our street furniture and transit revenues. We also experienced improved yield on our street furniture inventory during 2005 compared to 2004. We acquired a controlling majority interest in Clear Media Limited, a Chinese outdoor advertising company, during the third quarter of 2005, which we... -

Page 38

... in revenues during 2004 was primarily driven by our television business, which benefited from political and Olympic advertising. Direct Operating Expenses Our consolidated direct operating expenses grew $189.7 million during 2004 as compared to 2003. Our international outdoor advertising business... -

Page 39

... and bonus expenses related to the increase in television revenue. Selling, General and Administrative Expenses (SG&A) Our consolidated SG&A grew $41.6 million during 2004 as compared to 2003. Our international outdoor advertising business contributed $31.1 million to the increase, primarily related... -

Page 40

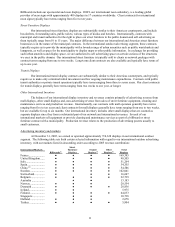

... in accounting principle. Radio Broadcasting Results of Operations Our radio broadcasting operating results were as follows: (In thousands) Revenue Direct operating expenses Selling, general and administrative expenses Non-cash compensation Depreciation and amortization Operating income Years Ended... -

Page 41

...growth in Los Angeles, New York, Miami, San Antonio, Seattle and Cleveland. The client categories leading revenue growth remained consistent throughout the year, the largest being entertainment. Business and consumer services was also a strong client category and was led by advertising spending from... -

Page 42

Reconciliation of Segment Operating Income (Loss) (In thousands) Radio Broadcasting Americas Outdoor Advertising International Outdoor Advertising Other Gain on disposition of assets - net Corporate Consolidated operating income Years Ended December 31, 2003 2004 $ 1,431,881 $ 1,409,236 263,888 215,... -

Page 43

... of stock options. Discontinued Operations We completed the spin-off of Live Nation on December 21, 2005. In accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, we reported the results of operations of these businesses... -

Page 44

... revolving credit facility in the amount of $1.75 billion, which can be used for general working capital purposes including commercial paper support as well as to fund capital expenditures, share repurchases, acquisitions and the refinancing of public debt securities. At December 31, 2005, the... -

Page 45

... international outdoor segment acquired display faces for $17.1 million and a controlling majority interest in Clear Media Limited for $8.9 million. Clear Media is a Chinese outdoor advertising company and as a result of consolidating its operations during the third quarter of 2005, the acquisition... -

Page 46

...and the Company's television business acquired a television station for $5.5 million. Capital Expenditures (In millions) Radio Non-revenue producing Revenue producing $ $ 94.0  94.0 Year Ended December 31, 2005 Capital Expenditures Americas International Corporate and Outdoor Outdoor Other $ $ 35... -

Page 47

... course of business, our broadcasting operations have minimum future payments associated with employee and talent contracts. These contracts typically contain cancellation provisions that allow us to cancel the contract with good cause. The scheduled maturities of our credit facility, other long... -

Page 48

...(R). The SEC would require that registrants that are not small business issuers adopt Statement 123(R)'s fair value method of accounting for share-based payments to employees no later than the beginning of the first fiscal year beginning after June 15, 2005. We will adopt Statement 123(R) on January... -

Page 49

... Policies, of the Notes to Consolidated Financial Statements, included in Item 8 of this Annual Report on Form 10-K. Management believes that the following accounting estimates are the most critical to aid in fully understanding and evaluating our reported financial results, and they require... -

Page 50

...lived assets such as FCC licenses are reviewed annually for possible impairment using the direct method. Under the direct method, it is assumed that rather than acquiring a radio station as a going concern business, the buyer hypothetically obtains a FCC license and builds a new station or operation... -

Page 51

... costs by increasing the effective advertising rates of most of our broadcasting stations and outdoor display faces. Ratio of Earnings to Fixed Charges The ratio of earnings to fixed charges is as follows: Year Ended December 31, 2004 2003 2002 2001 2005 2.32 2.86 3.64 2.59 * *For the year ended... -

Page 52

... the Public Company Accounting Oversight Board (United States) and, accordingly, they have expressed their professional opinion on the financial statements in their report included herein. The Board of Directors meets with the independent registered public accounting firm and management periodically... -

Page 53

... the Company changed its method of accounting for indefinite lived intangibles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Clear Channel Communications, Inc.'s internal control over financial reporting... -

Page 54

... $47,061 in 2005 and $47,400 in 2004 Prepaid expenses Other current assets Income taxes receivable Current assets from discontinued operations Total Current Assets PROPERTY, PLANT AND EQUIPMENT Land, buildings and improvements Structures Towers, transmitters and studio equipment Furniture and other... -

Page 55

...thousands, except share data) December 31, 2005 CURRENT LIABILITIES Accounts payable Accrued expenses Accrued interest Accrued income taxes Current portion of long-term debt Deferred income Other current liabilities Current liabilities from discontinued operations Total Current Liabilities Long-term... -

Page 56

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) Revenue Operating expenses: Direct operating expenses (excludes non-cash compensation expense of $212, $930 and $1,609 in 2005, 2004 and 2003, respectively and depreciation and amortization) Selling, general and ... -

Page 57

... at December 31, 2004 Net income Dividends declared Spin-off of Live Nation Gain on sale of CCO stock Purchase of common shares Treasury shares retired and cancelled Exercise of stock options and other Amortization and adjustment of deferred compensation Currency translation adjustment 567,572,736... -

Page 58

...change in accounting principle, net of tax Depreciation Amortization of intangibles Deferred taxes Amortization of deferred financing charges, bond premiums and accretion of note discounts, net Amortization of deferred compensation (Gain) loss on sale of operating... 1,030,896 Year Ended December 31, ... -

Page 59

... exercise of stock options, stock purchase plan and common stock warrants Dividends paid Proceeds from initial public offering Payments for purchase of common shares Net cash used in financing activities CASH FLOWS FROM DISCONTINUED OPERATIONS Net cash provided by (used in) operating activities Net... -

Page 60

... STATEMENTS NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Business Clear Channel Communications, Inc., incorporated in Texas in 1974, is a diversified media company with three principal business segments: radio broadcasting, Americas outdoor advertising and international outdoor... -

Page 61

..., discount rates, asset lives and market multiples, among other items. In addition, reserves have been established on the Company's balance sheet related to acquired liabilities and qualifying restructuring costs and contingencies based on assumptions made at the time of acquisition. The Company... -

Page 62

... rules of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets ("Statement 142") and D-108, are recorded in amortization expense in the statement of operations. At least annually, the Company performs its impairment test for each reporting unit's goodwill using a discounted... -

Page 63

... during the years ended December 31, 2005, 2004 and 2003, respectively as a component of selling, general and administrative expenses. Use of Estimates The preparation of the consolidated financial statements in conformity with generally accepted accounting principles requires management to make... -

Page 64

... The SEC would require that registrants that are not small business issuers adopt Statement 123(R)'s fair value method of accounting for share-based payments to employees no later than the beginning of the first fiscal year beginning after June 15, 2005. The Company will adopt Statement 123(R) on... -

Page 65

... using the provisions of Financial Accounting Standards No. 123, Accounting for Stock-Based Compensation. The required pro forma disclosures are as follows: (In thousands, except per share data) Income before discontinued operations and cumulative effect of a change in accounting principle: Reported... -

Page 66

... have reported an additional $1.4 million and $-0- of pro forma stock compensation expense, net of tax, for the years ended December 31, 2005 and 2004, respectively. NOTE B - STRATEGIC REALIGNMENT Initial Public Offering ("IPO") of Clear Channel Outdoor Holdings, Inc. ("CCO") The Company completed... -

Page 67

... Live Nation's results of operations in discontinued operations for all years presented. The following table displays financial information for Live Nation's discontinued operations for the years ended December 31, 2005, 2004 and 2003: (In thousands) 2005(1) Revenue (including sales to other Company... -

Page 68

... The Company's indefinite-lived intangible assets consist of FCC broadcast licenses and billboard permits. FCC broadcast licenses are granted to both radio and television stations for up to eight years under the Telecommunications Act of 1996. The Act requires the FCC to renew a broadcast license if... -

Page 69

...by EITF 02-07, Unit of Accounting for Testing Impairment of Indefinite-Lived Intangible Assets. The Company's key assumptions using the direct method are market revenue growth rates, market share, profit margin, duration and profile of the build-up period, estimated start-up capital costs and losses... -

Page 70

... million. Clear Media is a Chinese outdoor advertising company and as a result of consolidating its operations during the third quarter of 2005, the acquisition resulted in an increase in the Company's cash of $39.7 million. Also, the Company's national representation business acquired new contracts... -

Page 71

... significant investments in nonconsolidated affiliates are listed below: Australian Radio Network The Company owns a fifty-percent (50%) interest in Australian Radio Network ("ARN"), an Australian company that owns and operates radio stations in Australia and New Zealand. Grupo ACIR Comunicaciones... -

Page 72

... in Clear Media, a Chinese company that operates street furniture displays throughout China, to a controlling majority ownership interest. As a result, the Company began consolidating the results of Clear Media in the third quarter of 2005. The Company had been accounting for Clear Media as... -

Page 73

... had been accounted for as an equity method investment, for Univision Communications Inc. shares, which were recorded as an available-forsale cost investment. On September 22, 2003, Univision completed its acquisition of HBC in a stock-for-stock merger. As a result, the Company received shares of... -

Page 74

...Funds rate selected at the Company's discretion, plus a margin. The multi-currency revolving credit facility can be used for general working capital purposes including commercial paper support as well as to fund capital expenditures, share repurchases, acquisitions and the refinancing of public debt... -

Page 75

... restrictive covenants that limit the ability of AMFM Operating Inc., a wholly-owned subsidiary of Clear Channel, to incur additional indebtedness, enter into certain transactions with affiliates, pay dividends, consolidate, or affect certain asset sales. At December 31, 2005, the Company was in... -

Page 76

... Contracts On June 5, 2003, Clear Channel Investments, Inc. ("CCI, Inc."), a wholly owned subsidiary of the Company, entered into a five-year secured forward exchange contract (the "contract") with respect to 8.3 million shares of its investment in XM Satellite Radio Holdings, Inc. ("XMSR"). Under... -

Page 77

... of the relevant advertising revenue or a specified guaranteed minimum annual payment. The Company has various contracts in its radio broadcasting operations related to program rights and music license fees. In addition, the Company has commitments relating to required purchases of property... -

Page 78

...026 $ 162,052 Rent expense charged to continuing operations for 2005, 2004 and 2003 was $986.5 million, $925.6 million and $814.7 million, respectively. The Company is currently involved in certain legal proceedings and, as required, has accrued its estimate of the probable costs for the resolution... -

Page 79

..., which are used to hedge net assets in those currencies and provides funds to the Company's international operations for certain working capital needs. Subsidiary borrowings under this sub-limit are guaranteed by the Company. At December 31, 2005, this portion of the $1.75 billion credit facility... -

Page 80

... its tax basis in its FCC licenses, permits and tax deductible goodwill, the deferred tax liability will increase over time. During 2005, the Company recognized a capital loss of approximately $2.4 billion as a result of the spin-off of Live Nation. Of the $2.4 billion capital loss, approximately... -

Page 81

... were generated by certain acquired companies prior to their acquisition by the Company. The utilization of the net operating loss carryforwards reduced current taxes payable and current tax expense as of and for the year ended December 31, 2005. As stated above the Company recognized a capital loss... -

Page 82

NOTE L - SHAREHOLDERS' EQUITY Dividends The Company's Board of Directors declared quarterly cash dividends as follows. (In millions, except per share data) Amount per Common Declaration Share Date 2005: February 16, 2005 0.125 April 26, 2005 0.1875 July 27, 2005 0.1875 October 26, 2005 0.1875 2004: ... -

Page 83

... determined using the intrinsic value method. There were 32.8 million shares available for future grants under the various option plans at December 31, 2005. Vesting dates range from February 1996 to December 2010, and expiration dates range from January 2006 to December 2015 at exercise prices and... -

Page 84

... pricing model. In actuality, because the company's employee stock options are not traded on an exchange, employees can receive no value nor derive any benefit from holding stock options under these plans without an increase in the market price of Clear Channel stock. Such an increase in stock price... -

Page 85

... 36,000 held by employees of Live Nation. All restricted stock awards held by the employees of Live Nation were cancelled upon the spin-off. Other As a result of mergers during 2000, the Company assumed 2.7 million employee stock options with vesting dates that vary through April 2005. To the extent... -

Page 86

Reconciliation of Earnings per Share (In thousands, except per share data) NUMERATOR: Income before discontinued operations and cumulative effect of a change in accounting principle Income from discontinued operations, net Cumulative effect of a change in accounting principle Net income (loss) ... -

Page 87

...common stock may be purchased at 95% of the market value on the day of purchase. The Company changed its discount from market value offered to participants under the plan from 15% to 5% in July 2005. Employees may purchase shares having a value not exceeding 10% of their annual gross compensation or... -

Page 88

...- SEGMENT DATA Following its strategic realignment, the Company changed its reportable operating segments to radio broadcasting, Americas outdoor advertising and international outdoor advertising. The Company has restated all periods presented to conform to the current year presentation. Revenue and... -

Page 89

(In thousands) Radio Broadcasting Americas Outdoor Advertising International Outdoor Advertising Other Corporate and gain on disposition of assets - net Eliminations Consolidated 2004 Revenue $ 3,754,381 $ 1,092,089 $ 1,354,951 $ 548,641 $  $ (115,172) $ Direct operating expenses 900,633 468,... -

Page 90

... per share data) Revenue Operating expenses: Direct operating expenses Selling, general and administrative expenses Non-cash compensation Depreciation and amortization Gain (loss) on disposition of assets - net Corporate expenses Operating income Interest expense Gain (loss) on marketable securities... -

Page 91

... public accounting firm that audited the consolidated financial statements of the Company included in this Annual Report on Form 10-K, has issued an attestation report on management's assessment of the effectiveness of the Company's internal control over financial reporting as of December 31, 2005... -

Page 92

... Registered Public Accounting Firm SHAREHOLDERS AND THE BOARD OF DIRECTORS CLEAR CHANNEL COMMUNICATIONS, INC. We have audited management's assessment, included in the accompanying Management's Report on Internal Control Over Financial Reporting, that Clear Channel Communications, Inc. (the Company... -

Page 93

... Officer - Clear Channel Outdoor Chairman - Clear Channel Television President/Chief Executive Officer - Clear Channel Television President/Chief Executive Officer - Clear Channel Radio Executive Vice President and Chief Legal Officer The officers named above serve until the next Board of Directors... -

Page 94

...", expected to be filed within 120 days of our fiscal year end. ITEM 14. Principal Accountant Fees and Services The information required by this item is incorporated by reference to our Definitive Proxy Statement under the heading "Auditor Fees", expected to be filed within 120 days of our... -

Page 95

...following financial statement schedule for the years ended December 31, 2005, 2004 and 2003 and related report of independent auditors is filed as part of this report and should be read in conjunction with the consolidated financial statements. Schedule II Valuation and Qualifying Accounts All other... -

Page 96

... (In thousands) Balance at Beginning of period Charges to Costs, Expenses and other Write-off of Accounts Receivable Balance at end of Period Description Year ended December 31, 2003 Year ended December 31, 2004 Year ended December 31, 2005 Other $ 52,550 $ 45,168 $ 53,565 $ 838 (1) $ 44... -

Page 97

SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS Deferred Tax Asset Valuation Allowance (In thousands) Balance at Beginning of period Charges to Costs, Expenses and other Balance at end of Period Description Year ended December 31, 2003 Year ended December 31, 2004 Year ended December 31, 2005 ... -

Page 98

... the Company's Registration Statement on Form S-1 (Reg. No. 33-289161) dated April 19, 1984). Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to the Company's Quarterly Report on... -

Page 99

... the quarter ended September 30, 2001). Eleventh Supplemental Indenture dated January 9, 2003, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report... -

Page 100

...the Company's Definitive 14A Proxy Statement dated March 24, 1998). The Clear Channel Communications, Inc. 2000 Employee Stock Purchase Plan (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002) The Clear Channel Communications... -

Page 101

...other shareholders affiliated with Mr. Hicks dated March 10, 2004 (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K filed March 15, 2004). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent... -

Page 102

... Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 10, 2006. CLEAR CHANNEL COMMUNICATIONS, INC. By:/S/ Mark P. Mays Mark P. Mays Chief Executive Officer Power of Attorney Each person whose signature... -

Page 103

Name /S/ Phyllis Riggins Phyllis Riggins /S/ Theodore H. Strauss Theodore H. Strauss /S/ J.C. Watts J. C. Watts /S/ John H. Williams John H. Williams /S/ John B. Zachry John B. Zachry Title Date Director March 10, 2006 Director March 10, 2006 Director March 10, 2006 Director March 10, 2006... -

Page 104

... the Company's Registration Statement on Form S-1 (Reg. No. 33-289161) dated April 19, 1984). Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to the Company's Quarterly Report on... -

Page 105

... the quarter ended September 30, 2001). Eleventh Supplemental Indenture dated January 9, 2003, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report... -

Page 106

...the Company's Definitive 14A Proxy Statement dated March 24, 1998). The Clear Channel Communications, Inc. 2000 Employee Stock Purchase Plan (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002) The Clear Channel Communications... -

Page 107

...other shareholders affiliated with Mr. Hicks dated March 10, 2004 (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K filed March 15, 2004). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent... -

Page 108

... 11 - Computation of Per Share Earnings (In thousands, except per share data) NUMERATOR: Income before discontinued operations and cumulative effect of a change in accounting principle Income from discontinued operations, net Cumulative effect of a change in accounting principle Net income (loss... -

Page 109

... and cumulative effect of a change in accounting principle $ 1,023,143 Dividends and other received from nonconsolidated affiliates 14,696 Total Fixed Charges Interest expense Amortization of loan fees Interest portion of rentals Total fixed charges Preferred stock dividends Tax effect of preferred... -

Page 110

..., Clear Channel Communications, Inc. Name * See note below *1567 Media, LLC *50 2027Th Street LIC, Inc. *701 W. 135th Corp Ackerley Broadcast Operations, LLC Ackerley Broadcasting of Fresno, LLC Ackerley Ventures, Inc. AK Mobile Television, Inc. AMFM Air Services, Inc. AMFM Broadcasting Licenses... -

Page 111

... International, Inc. Clear Channel Company Store, Inc. *Clear Channel Digital Mall Networks, LLC Clear Channel GP, LLC Clear Channel Holdings, Inc. Clear Channel Identity, LP Clear Channel Intangibles, Inc. Clear Channel Investments, Inc. *Clear Channel LA, LLC Clear Channel Management Services, LP... -

Page 112

...City Tower Company Osborn Entertainment Enterprises Corporation *Outdoor Management Services, Inc. Premiere Radio Networks, Inc. Radio-Active Media, Inc. *Shelter Advertising Of America, Inc. TC Aviation, Inc. Terrestrial RF Licensing, Inc. The New Research Group, Inc. *Transportation Media Of Texas... -

Page 113

Name Cc Haidemenos Hellas Societe Anonyme * CC International BV* CC International Holdings BV* CC LP BV* CC Netherlands BV I.O.* CCO Ontario Holding, Inc.* China Outdoor Media Investment (HK) Co., Ltd.* China Outdoor Media Investment, Inc. * City Lights Ltd.* Clear Channel Acir Holdings NV Clear ... -

Page 114

Name Clear Channel Outdoor Mexico, Servicious Corporativos, SA de CV * Clear Channel Outdoor Company Canada* Clear Channel Outdoor Limited * Clear Channel Outdoor Mexico SA de CV * Clear Channel Outdoor Mexico, Operaciones SA de CV * Clear Channel Outdoor Mexico, Servicios Administrativos, SA de CV ... -

Page 115

... Adshel Ltd.* More Communications Ltd.* More Group Australia Pty Ltd.* More Media Ltd.* More O'Ferral Ltd.* More O'Ferrall Ireland Ltd. * Morebus Ltd.* Multimark Ltd.* Nitelites (Ireland) Ltd.* Nueva Leon* Outdoor Advertising BV* Outdoor CCWI BV* Outdoor International Holdings BV* Outstanding Media... -

Page 116

... Ltd.* United Kingdom Trainer Advertising* United Kingdom Urbasur* Spain Van Wagner France SAS* France Vision Posters* United Kingdom Werab Werbung Hugo Wrage GmbH & Co KG* Germany Williams Display Excellence AB * Sweden Zangari* Italy * Following the IPO, Clear Channel Communications owns 90... -

Page 117

... effectiveness of internal control over financial reporting, and the effectiveness of internal control over financial reporting of Clear Channel Communications, Inc. included in this Annual Report (Form 10-K) for the year ended December 31, 2005. /s/ERNST & YOUNG LLP San Antonio, Texas March 9, 2006 -

Page 118

... auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): (a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect... -

Page 119

... auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): (a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect... -

Page 120

... of the Sarbanes-Oxley Act of 2002 and accompanies the Annual Report on Form 10-K (the "Form 10-K") for the year ended December 31, 2005 of Clear Channel Communications, Inc. (the "Issuer"). The undersigned hereby certifies that the Form 10-K fully complies with the requirements of Section 13(a) or... -

Page 121

... of the Sarbanes-Oxley Act of 2002 and accompanies the Annual Report on Form 10-K (the "Form 10-K") for the year ended December 31, 2005 of Clear Channel Communications, Inc. (the "Issuer"). The undersigned hereby certifies that the Form 10-K fully complies with the requirements of Section 13(a) or...