iHeartMedia 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Included in the purchase price of AMFM is $439.9 million of restricted cash related to the

disposition of AMFM assets in connection with the merger. In addition, we swapped assets valued at

$228.0 million and received proceeds of $839.7 million in transactions with third parties in order to

comply with governmental directives regarding the AMFM merger, which resulted in a gain of $805.2

million and an increase in income tax expense (at our statutory rate of 38%) of $306.0 million in 2000.

We deferred a portion of this tax expense based on our ability to replace the majority of the stations sold

with qualified assets. A portion of the proceeds from divestitures is being held in restricted trusts until

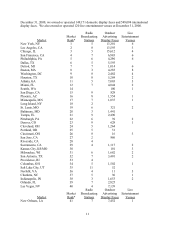

suitable replacement properties are identified. The following table details the reconciliation of divestiture

and acquisition activity in the restricted trust accounts.

(In thousands)

Restricted cash resulting from Clear Channel divestitures $ 839,717

Restricted cash purchased in AMFM merger 439,896

Restricted cash used in acquisitions (670,228)

Interest, net of fees 18,756

Restricted cash balance at December 31, 2000 $ 628,141

In addition, we agreed to sell AMFM’ s 26.2 million shares in Lamar Advertising Company by

December 31, 2002. Furthermore, our investment must be passive while we hold any interest in Lamar.

As such, we account for this investment under the cost method of accounting.

SFX Merger

On August 1, 2000, we consummated our merger with SFX Entertainment, Inc. Pursuant to the

terms of the merger agreement, each share of SFX Class A common stock was exchanged for 0.6 shares

of our common stock and each share of SFX Class B common stock was exchanged for one share of our

common stock. Approximately 39.2 million shares of our common stock were issued in the SFX merger.

Based on the average market price of our common stock at the signing of the merger agreement, the

merger was valued at $2.9 billion plus the assumption of SFX’ s outstanding debt of $1.5 billion.

Additionally, we assumed all outstanding SFX options and warrants with a fair value of $211.8 million,

whic h are exercisable for approximately 5.6 million shares of our common stock. We refinanced $815.8

million of SFX’ s $1.5 billion of long-term debt at the closing of the merger using our credit facilities.

The SFX merger was accounted for as a purchase with resulting goodwill of approximately $4.1 billion,

which is being amortized over 20 years on a straight-line basis. This purchase price allocation is

preliminary pending completion of appraisals and other fair value analysis of assets and liabilities. The

results of operations of SFX have been included in our financial statements beginning August 1, 2000.

A number of lawsuits were filed by holders of SFX Class A common stock alleging, among other

things, that the difference in consideration for the Class A and Class B shares constituted unfair

consideration to the Class B holders and that the SFX board breached its fiduciary duties and that we

aided and abetted the actions of the SFX board. On September 28, 2000, we issued approximately .4

million shares of our common stock, valued at $29.3 million, as settlement of these lawsuits and have

included the value of such shares as part of the purchase price.

Future Acquisitions

We frequently evaluate strategic opportunities both within and outside our existing lines of

business and from time to time enter into letters of intent to purchase assets. Although we have no

definitive agreements with respect to significant acquisitions not set forth in this report, we expect from

time to time to pursue additional acquisitions and may decide to dispose of certain businesses. Such