iHeartMedia 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

acquisitions or dispositions could be material.

Public Offerings

On June 14, 2000, we completed a debt offering of $250.0 million floating rate notes due June 15,

2002 and $750.0 million 7.875% notes due June 15, 2005. The net proceeds of approximately $993.9

million were used to reduce the outstanding balance on our credit facilities.

On July 3, 2000, we completed a debt offering of Euro 650.0 million 6.50% notes due July 7,

2005. Interest on the notes is payable annually in arrears on July 7 of each year. The net proceeds of

approximately $610.8 million were used to reduce the outstanding balance on our credit facilities.

On September 7, 2000, we completed a debt offering of $750.0 million 7.25% senior notes due

September 15, 2003 and $750.0 million 7.65% senior notes due on September 15, 2010. Interest is

payable on both series of notes on March 15 and September 15 of each year. The net proceeds of

approximately $1.5 billion were used to reduce the outstanding balance of our credit facilities.

Shelf Registration Statement

To facilitate possible future acquisitions as well as public offerings, we filed a shelf registration

statement on Form S-3 on July 21, 2000 covering a combined $3.0 billion of debt securities, junior

subordinated debt securities, preferred stock, common stock, warrants, stock purchase contracts and stock

purchase units. The shelf registration statement also covers preferred securities that may be issued from

time to time by our three Delaware statutory business trusts and guarantees of such preferred securities.

After completing the debt offering during September 2000, the amount of securities available under the

shelf registration statement at December 31, 2000 was $1.5 billion.

Employees

At February 28, 2001 we had approximately 31,850 domestic employees and 4,500 international

employees: approximately 36,000 in operations and approximately 350 in corporate and other activities.

In addition, our live entertainment operations hire approximately 20,000 seasonal employees during peak

time periods.

Operating Segments

Clear Channel consists of three reportable operating segments: radio broadcasting, outdoor

advertising, and live entertainment. The radio broadcasting segment includes radio stations for which we

are the licensee and for which we program and/or sell air time under local marketing agreements or joint

sales agreements. The radio broadcasting segment also operates radio networks. The outdoor advertising

segment includes advertising display faces for which we own or operate under lease management

agreements. The live entertainment segment includes venues that we own or operate, the production of

Broadway shows and theater operations.

Information relating to the operating segments of our radio broadcasting, outdoor advertising and

live entertainment operations for 2000, 1999 and 1998 are included in “Note M: Segment Data” in the

Notes to Consolidated Financial Statements in Item 8 filed herewith.

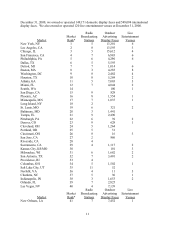

The following table sets forth certain selected information with regard to our radio broadcasting

stations, outdoor advertising display faces and live entertainment venues that we own or operate. At

December 31, 2000, we owned, programmed, or sold airtime for 346 AM and 761 FM radio stations. At