iHeartMedia 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

[x] Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2000, or

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to _________.

Commission File Number

1-9645

CLEAR CHANNEL COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

Texas

(State of Incorporation) 74-1787539

(I.R.S. Employer Identification No.)

200 East Basse Road

San Antonio, Texas 78209

Telephone (210) 822-2828

(Address, including zip code, and telephone number,

including area code, of registrant’ s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $.10 par value per share.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. YES X NO___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of registrant’ s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ___

On March 9, 2001, the aggregate market value of the Common Stock beneficially held by non-affiliates of

the Company was approximately $32.4 billion. (For purposes hereof, directors, executive officers and

10% or greater shareholders have been deemed affiliates).

On March 9, 2001, there were 587,320,053 outstanding shares of Common Stock, excluding 121,491

shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2001 Annual Meeting, expected to be filed within 120

days of our fiscal year end, are incorporated by reference into Part III.

Table of contents

-

Page 1

... year ended December 31, 2000, or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from _____ to _____. Commission File Number 1-9645 CLEAR CHANNEL COMMUNICATIONS, INC. (Exact name of registrant as specified in its charter) Texas... -

Page 2

CLEAR CHANNEL COMMUNICATIONS, INC. INDEX TO FORM 10-K Page Number PART I. Item 1. Item 2. Item 3. Item 4. PART II. Item 5. Item 6. Item 7. Market for Registrant' s Common Stock and Related Stockholder Matters...32 Selected Financial Data...33 Management' s Discussion and Analysis of Financial ... -

Page 3

... Advertising Live Entertainment Other Total Percentage of Revenues 45% 32% 17% 6% 100% Our principal executive offices are located at 200 East Basse Road, San Antonio, Texas 78209 (telephone: 210-822-2828). Radio Broadcasting Radio Stations As of December 31, 2000, we owned, programmed or sold... -

Page 4

... Limbaugh, Dr. Laura Schlessinger, Jim Rome, and music programming including such talent as Rick Dees and Casey Kasem. We also operated several news and agricultural radio networks serving Oklahoma, Texas, Iowa, Kentucky, Virginia, Alabama, Tennessee, Florida and Pennsylvania. Outdoor Advertising... -

Page 5

...15 years. Tenders are won on the basis of revenues and community-related products offered to municipalities, including bus shelters, public toilets and information kiosks. Live Entertainment We significantly expanded our presence in the live entertainment industry with our August 2000 acquisition of... -

Page 6

... stations. Katz Media representation operations generate revenues primarily through contractual commissions realized from the sale of national spot advertising air time. National spot advertising is commercial air time sold to advertisers on behalf of radio and television stations and cable systems... -

Page 7

... promote our broadcasting assets, or the sharing of on-air talent across our broadcasting assets to promote one of our live entertainment events or venues. To support our radio broadcasting, outdoor advertising and live entertainment strategies, we have decentralized our operating structure in order... -

Page 8

... the performance of our existing stations through effective programming, reduction of costs, and aggressive promotion, marketing, and sales. By complementing our radio operations with our other businesses, we are able to increase revenue and profitability through synergies such as cross selling and... -

Page 9

... Channel divestitures Restricted cash purchased in AMFM merger Restricted cash used in acquisitions Interest, net of fees Restricted cash balance at December 31, 2000 $ 839,717 439,896 (670,228) 18,756 $ 628,141 In addition, we agreed to sell AMFM' s 26.2 million shares in Lamar Advertising Company... -

Page 10

... Operating Segments Clear Channel consists of three reportable operating segments: radio broadcasting, outdoor advertising, and live entertainment. The radio broadcasting segment includes radio stations for which we are the licensee and for which we program and/or sell air time under local marketing... -

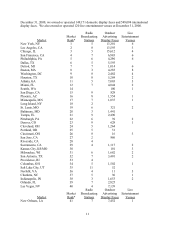

Page 11

...WA San Diego, CA Phoenix, AZ Minneapolis, MN Long Island, NY St. Louis, MO Baltimore, MD Tampa, FL Pittsburgh, PA Denver, CO Cleveland, OH Portland, OR Cincinnati, OH San Jose, CA Riverside, CA Sacramento, CA Kansas City, KS/MO Milwaukee, WI San Antonio, TX Providence, RI Columbus, OH Salt Lake City... -

Page 12

... Rank* 90 4 5 5 6 5 8 8 11 8 8 7 6 6 6 5 7 7 5 6 2 9 7 4 2 5 5 8 4 6 5 4 6 6 5 4 6 5 4 6 7 6 6 Radio Broadcasting Stations 6 17 2,465 10 13 594 1,065 18 1,079 8 12 8 1 2 1 2 2 1 1 1,498 1,121 35 39 286 1,007 13 1,386 1,026 32 27 6 1,052 36 1 1 20 891 685 56 200 10 Outdoor Live Advertising... -

Page 13

...for Winter 2000 _____ (a) Includes 79 radio stations programmed pursuant to a local marketing agreement (FCC licenses not owned by Clear Channel), 21 radio stations for which we sell airtime pursuant to a joint sales agreement (FCC license not owned by Clear Channel), one radio station programmed by... -

Page 14

... radio programs and services for more than 7,800 radio stations including Rush Limbaugh, The Dr. Laura Show and The Rick Dees Weekly Top 40 , which are three of the top rated radio programs in the United States. We also own various sports, news and agriculture networks. Outdoor Advertising... -

Page 15

... for audiences and advertising revenues with other radio stations and outdoor advertising companies, as well as with other media, such as newspapers, magazines, cable television, and direct mail, within their respective markets. Audience ratings and market shares are subject to change, which could... -

Page 16

... barriers to telephone company entry into the video programming delivery business, to cable company provision of telephone service, and to common ownership of broadcast television and cable properties. The 1996 Act also significantly changed both the process for renewal of broadcast station licenses... -

Page 17

... interest" in broadcast stations and other specified mass media entities. Prior to the passage of the 1996 Act, these rules included limits on the number of radio and television stations that could be owned on both a national and local basis. On a national basis, the rules generally precluded any... -

Page 18

... broadcast stations. The 1996 Act and the FCC' s implementing rules also greatly eased local radio ownership restrictions. The maximum allowable number of radio stations that may be commonly owned in a market varies depending on the total number of radio stations in that market, as determined using... -

Page 19

... in that market. A number of cross-ownership rules pertain to licensees of television and radio stations. FCC rules, the Communications Act or both generally prohibit an individual or entity from having an attributable interest in both a television station and a cable television system that is... -

Page 20

... concluded on June 20, 2000, with the FCC' s issuance of a report retaining the 35% national television reach limitation, the cable system/television station cross-ownership rule, and the limits on the number of radio stations a company may own in a given market. In its report, however, the FCC... -

Page 21

... programming hours) or a same-market media owner (including broadcasters, cable operators, and newspapers). To the best of our knowledge at present, none of our officers, directors or five percent stockholders holds an interest in another television station, radio station, cable television system... -

Page 22

... and satellite systems' carriage of syndicated and network programming on distant stations, political advertising practices, application procedures and other areas affecting the business or operations of broadcast stations. Public Interest Programming. Broadcasters are required to air programming... -

Page 23

... standard definition television programming, audio, data, and other types of communications, subject to the requirement that each broadcaster provide at least one free video channel equal in quality to the current technical standard. Digital television channels will generally be located in the... -

Page 24

... in the mass communications industry, such as direct broadcast satellite service, the continued establishment of wireless cable systems and low power television stations, "streaming" of audio and video programming via the Internet, digital television and radio technologies, the establishment 24 -

Page 25

of a low power FM radio service, and the advent of telephone company participation in the provision of video programming service. The foregoing is a brief summary of certain provisions of the Communications Act, the 1996 Act, the 1992 Cable Act, and specific regulations and policies of the FCC ... -

Page 26

... in our direct revenue from such advertisements and a simultaneous increase in the available space on the existing inventory of billboards in the outdoor advertising industry. Antitrust Matters An important element of our growth strategy involves the acquisition of additional radio stations, outdoor... -

Page 27

... We currently derive a portion of our revenues from international radio broadcasting, outdoor advertising and live entertainment operations in Europe, Asia, Mexico, South America, Canada, Australia and New Zealand. The risks of doing business in foreign countries which could result in losses against... -

Page 28

... concerns; and we may lose key employees of acquired companies or stations. Capital Requirements Necessary for Additional Acquisitions. We will face stiff competition from other radio broadcasting, outdoor advertising and live entertainment companies for acquisition opportunities. If the prices... -

Page 29

...regulatory requirements; interest rates; the effect of leverage on our financial position and earnings; taxes; access to capital markets; and certain other factors set forth in our SEC filings. This list of factors that may affect future performance and the accuracy of forward-looking statements is... -

Page 30

...several years or in leasing other space, if required. We own substantially all of the equipment used in our radio broadcasting, outdoor advertising and live entertainment businesses. As noted in Item 1 above, as of December 31, 2000, we own or program 1,107 radio stations, own or lease approximately... -

Page 31

... arising out of currently pending claims and lawsuits will not have a material effect on our financial condition or operations. ITEM 4. Submission of Matters to a Vote of Security Holders. There were no matters submitted to a vote of security holders in the fourth quarter of fiscal year 2000. 31 -

Page 32

... number of beneficial holders whose shares may be held of record by brokerage firms and clearing agencies. The following table sets forth, for the calendar quarters indicated, the reported high and low sales prices of the common stock as reported on the NYSE. Clear Channel Common Stock Market... -

Page 33

... (In thousands, except per share data) 2000 Results of Operations Information: Gross revenue Net revenue Operating expenses Non-cash compensation expense Depreciation and amortization Corporate expenses Operating income Interest expense Gain on sale of assets related to mergers Equity in earnings... -

Page 34

...live music, theatrical, family entertainment and motor sports events. Included in the "other" segment is television broadcasting, sports representation, our media representation business, Katz Media, and Internet businesses as well as corporate expenses. We continued our strong financial performance... -

Page 35

... 1, 2000, we completed the acquisition of the assets of Donrey Media Group for $372.6 million in cash consideration. The Donrey acquisition added ten additional markets to our outdoor advertising business, including Las Vegas, Nevada; Albuquerque, New Mexico; Columbus, Ohio; Oklahoma City, Oklahoma... -

Page 36

... Jacor Communications in May 1999 and Dame Media Inc. and Dauphin OTA in July 1999. Also included in our fiscal year 2000 reported basis amounts are the net revenues and operating expenses of our 2000 acquisitions for the time period that we operated them in fiscal year 2000. Our 2000 acquisitions... -

Page 37

... rates in our radio and outdoor businesses as well as increased inventory demand within the advertising industry. The increase in the number of live entertainment events and the number of show dates in fiscal year 2000 also contributed to the increase of net revenue on a pro forma basis. Operating... -

Page 38

... Radio Broadcasting (In thousands) As Reported Years Ended December 31, 2000 1999 $2,431,544 $1,230,754 1,385,848 731,062 $1,045,696 $ 499,692 % Change As Reported 2000 v. 1999 98% 90% 109% % Change Pro Forma 2000 v. 1999 15% 9% 22% Net Revenue Operating Expenses EBITDA Net revenues and operating... -

Page 39

... markets. On a pro forma basis, operating expenses increased primarily due to incremental selling costs associated with the increase in net revenue. Live Entertainment (In thousands) As Reported Years Ended December 31, 2000 1999 $902,374 $  830,717  $ 71,657 $  % Change As Reported 2000... -

Page 40

...revenue and operating expenses was primarily due to the acquisit ions of Universal Outdoor in April of 1998, More Group in July 1998, Jacor in May 1999 and Dame Media and Dauphin in July 1999. The acquisitions of Jacor and Dame Media added approximately 230 radio stations and Premiere Radio Networks... -

Page 41

... the acquisitions of Jacor in May 1999 and Dame Media in July 1999. Net revenue also increased due to increased advertising rates associated with improved ratings within our radio stations. Outdoor Advertising (In thousands) Reported Basis: Net Revenue Operating Expenses EBITDA Years Ended December... -

Page 42

... in various foreign currencies, which are used to hedge net assets in those currencies and provides funds to our international operations for certain working capital needs and smaller acquisitions. At December 31, 2000, approximately $31.7 million was available for future borrowings and $118... -

Page 43

... was $1.4 billion at December 31, 2000. Chancellor Media Corporation, Capstar Radio Broadcasting Partners, Capstar Broadcasting Partners, Inc. and AMFM Operating Inc., or their successors are all indirect wholly-owned subsidiaries of Clear Channel Communications. The debt redemptions were financed... -

Page 44

... from AMFM related to the divestiture of AMFM radio stations in connection with the merger. The following table details the reconciliation of divestiture and acquisition activity in the restricted trust accounts: (In thousands) Restricted cash resulting from Clear Channel divestitures Restricted... -

Page 45

... included non-recurring expenditures relating to the implementation of Year 2000 compliant systems and integration of the Jacor stations. (In millions) 2000 Capital Expenditures Radio Recurring $ 23.6 Non-recurring projects 116.3 Revenue producing - $ 139.9 Outdoor Entertainment $ 84.8 12.8 152... -

Page 46

... in 2000 are related primarily to the construction of new revenue producing advertising displays as well as replacement expenditures on our existing advertising displays. Our live entertainment capital expenditures in 2000 include expenditures primarily related to a consolidated sales and operations... -

Page 47

...the closing date of the merger, which was significantly higher than AMFM' s historical purchase price. We will be exposed to changes in Lamar' s market price, which may result in large gains and losses related to this disposition in future periods. Foreign Currency We have operations in 43 countries... -

Page 48

... applying APB Opinion No. 25 "Accounting for Stock Issued to Employees." FIN 44 applies specifically to new awards, exchanges of awards in a business combination, modification to outstanding awards, and changes in grantee status that occur on or after July 1, 2000, except for the provisions related... -

Page 49

...believe we have offset these higher costs by increasing the effective advertising rates of most of our broadcasting stations and outdoor display faces. Ratio The ratio of earnings to fixed charges is as follows: 2000 2.20 1999 2.04 Year Ended December 31, 1998 1997 1.83 2.32 1996 3.63 The ratio of... -

Page 50

... in conformity with accounting principles generally accepted in the United States and include amounts based upon management's best estimates and judgments. It is management's objective to ensure the integrity and objectivity of its financial data through systems of internal controls designed to... -

Page 51

... at December 31, 2000 and 1999, and the consolidated results of their operations and their cash flows for each of the three years in the period ended December 31, 2000, in conformity with accounting principles generally accepted in the United States. ERNST & YOUNG LLP San Antonio, Texas February 23... -

Page 52

...,631 in 2000 and $26,095 in 1999 Prepaid expenses Other current assets Total Current Assets $ 196,838 308,691 1,557,048 146,767 133,873 2,343,217 $ 76,724  724,900 35,791 87,694 925,109 PROPERTY, PLANT AND EQUIPMENT Land, buildings and improvements Structures and site leases Transmitter and... -

Page 53

... issued and outstanding Preferred Stock, - Class B, par value $1.00 per share, authorized 8,000,000 shares, no shares issued and outstanding Common Stock, par value $.10 per share, authorized 1,500,000,000 and 900,000,000 shares, issued and outstanding 585,766,166 and 338,609,503 shares in 2000... -

Page 54

... thousands, except per share data) 2000 Year Ended December 31, 1999 $ 2,992,018 313,858 2,678,160 1,632,115  722,233 70,146 253,666 179,404 138,659 18,183 7,292 238,396 152,741 85,655 (13,185) 72,470 (47,814) 182,315  $ (14,904) 192,067 $ 1998 REVENUE Gross revenue Less: agency commissions... -

Page 55

...,957 252,862 Net income Common Stock, stock options and common stock warrants issued for business acquisitions 24,497 20,258,721 Deferred compensation acquired Purchase of treasury shares Conversion of Liquid Yield Option Notes 76 Exercise of stock options and common stock warrants 219 83,154 (3,550... -

Page 56

...) 2000 Year Ended December 31, 1999 1998 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Reconciling Items: Depreciation Amortization of intangibles Deferred taxes Amortization of deferred financing charges, bond premiums and accretion of note discounts Amortization of deferred compensation... -

Page 57

... Purchases of property, plant and equipment Proceeds from disposal of assets Proceeds from divestitures placed in restricted cash Acquisition of radio broadcasting assets Acquisition of radio broadcasting assets with restricted cash Acquisition of outdoor advertising assets Acquisition of live... -

Page 58

... of Business Clear Channel Communications, Inc., incorporated in Texas in 1974, is a diversified media company with three principal business segments: radio broadcasting, outdoor advertising and live entertainment. The Company owns, programs and sells airtime for various radio stations. The Company... -

Page 59

... The Company accounts for income taxes using the liability method. Under this method, deferred tax assets and liabilities are determined based on differences between financial reporting bases and tax bases of assets and liabilities and are measured using the enacted tax rates expected to apply to... -

Page 60

... in highly inflationary countries, are included in operations. Stock Based Compensation The Company accounts for its stock-based award plans in accordance with Accounting Principles Board ("APB") Opinion No. 25, Accounting for Stock Issued to Employees, and related interpretations, under which... -

Page 61

... related to repricings and the definition of an employee which apply to awards issued after December 15, 1998. The requirements of FIN 44 are consistent with the Company's existing accounting policies. NOTE B - BUSINESS ACQUISITIONS 2000 Acquisitions: Ackerley's South Florida Outdoor Advertising... -

Page 62

... of AMFM have been included in the financial statements of the Company beginning August 30, 2000. In connection with the AMFM merger and governmental directives, the Company divested 39 radio stations for $1.2 billion, resulting in a gain on sale of $805.2 million and an increase in income tax... -

Page 63

... 2000. Other In addition to the acquisitions discussed above, the Company acquired substantially all of the assets of 148 radio stations, 66,286 outdoor display faces and the live entertainment segment acquired sporting, music and theatrical events promotions, racing promotion, and venue management... -

Page 64

...) Year Ended December 31, 2000 1999 $ 7,997,849 $ 6,615,391 $ (711,133) $ (502,044) $ (1.22) $ (.86) Net revenue Net loss Net loss per common share: Basic and Diluted The pro forma information above is presented in response to applicable accounting rules relating to business acquisitions and... -

Page 65

... international markets. The aggregate cash paid for these acquisitions was approximately $739.3 million. The results of operations for 1999 and 1998 include the operations of each station, for which the Company purchased the license, as well as all other businesses acquired, from the respective date... -

Page 66

... to restructure the AMFM and SFX operations. The Company communicated to all effected employees that the AMFM corporate offices in Dallas and Austin, Texas would close by March 31, 2001 and that the SFX corporate office in New York would close by June 30, 2001. Other operations of AMFM have or will... -

Page 67

...and operates radio stations, a narrowcast radio broadcast service and a radio representation company in Australia. Hispanic Broadcasting Corporation The Company owns 26% of the total number of shares of Hispanic Broadcasting Corporation ("HBC"), a leading domestic Spanish-language radio broadcaster... -

Page 68

.... As a result, the Company does not exercise significant influence and has accounted for this investment under the cost method of accounting. During 2000, a loss of $5.8 million was realized on the sale of 1.3 million shares of Lamar, which was recorded in "Gain on sale of assets related to mergers... -

Page 69

..., LIBOR, or Federal funds rates at the Company' s discretion. The first is a $1.9 billion revolving long-term line of credit facility payable to banks, which converted into a reducing revolving line of credit on the last business day of September 2000, with quarterly repayment of the principal to... -

Page 70

... in AMFM Merger: On September 29, 2000, the Company redeemed all of the outstanding 9% Senior Subordinated Notes due 2008, originally issued by Chancellor Media Corporation or one of its subsidiaries, for $829.0 million subject to change of control provisions in the indentures. In October, the... -

Page 71

... changes in the underlying exposures being hedged. The Company does not hold or issue derivative financial instruments for trading purposes. Interest Rate Management The Company' s policy is to manage interest cost using a mix of fixed and variable rate debt. To manage this mix in a cost... -

Page 72

...foreign currency exchange risks related to its net assets in foreign countries. To manage the risk, from time to time the Company enters into foreign denominated debt to hedge movements in currency exchange rates. The Company' s major foreign currency exposure involves markets operating in Euros and... -

Page 73

... The Company leases office space, certain broadcasting facilitie s, equipment and the majority of the land occupied by its outdoor advertising structures under long-term operating leases. Some of the lease agreements contain renewal options and annual rental escalation clauses (generally tied... -

Page 74

...,196 Included in current - federal for 1999 is $8.1 million of benefit related to the extraordinary loss resulting from early extinguishment of long-term debt. Significant components of the Company's deferred tax liabilities and assets as of December 31, 2000 and 1999 are as follows: (In thousands... -

Page 75

... represents the right to receive .2355422 shares of the Company' s common stock, at an exercise price of $24.19 per full share of the Company' s common stock. The Company issued 220 and 5,850 shares of common in 2000 and 1999, respectively, on exercises of these common stock warrants. At December... -

Page 76

... exceeding ten years and are forfeited in the event the employee or director terminates his or her employment or relationship with the Company or one of its affiliates. All option plans contain anti-dilutive provisions that require the adjustment of the number of shares of the Company common stock... -

Page 77

... compensation expense of $16.0 million was recorded in 2000, which relates primarily to options held by employees within the Company' s radio broadcasting operations. (3) The Company recognized an income tax benefit of $30.6 million, $48.2 million and $5.3 million relating to the options exercised... -

Page 78

...net income and earnings per share, assuming that the Company had accounted for its employee stock options using the fair value method and amortized such to expense over the options' vesting period is as follows: 2000 Net income before extraordinary item (in thousands) As reported $ 248,808 Pro forma... -

Page 79

..., except per share data) 2000 NUMERATOR: Net income before extraordinary item Extraordinary item Net income Effect of dilutive securities: Eller put/call option agreement Convertible debt - 2.625% issued in 1998 Convertible debt - 1.5% issued in 1999 LYONs - 1996 issue LYONs - 1998 issue Less: Anti... -

Page 80

...) For the year ended December 31, 2000 1999 1998 The following details the components of "Other income (expense) - net": Gain (loss) on sale of marketable securities Reimbursement of capital cost Gain (loss) on disposal of fixed assets Minority interest Compensation expense relating to subsidiary... -

Page 81

... As a result of the fiscal year 2000 acquisitions of SFX and AMFM, the Company determined that three reportable operating segments - radio broadcasting, outdoor advertising and live entertainment best reflect how the Company is currently managed. Prior years presented have been reclassified to be... -

Page 82

...) 2000 Net revenue Radio Broadcasting Outdoor Advertising Live Entertainment Other Eliminations Consolidated Operating expenses Radio Broadcasting Outdoor Advertising Live Entertainment Other Eliminations Consolidated Depreciation Radio Broadcasting Outdoor Advertising Live Entertainment Other... -

Page 83

... and $1.2 billion derived from the Company' s foreign operations are included in the data above for the years ended December 31, 2000, 1999 and 1998, respectively. NOTE N - QUARTERLY RESULTS OF OPERATIONS (Unaudited) (In thousands, except per share data) Gross revenue March 31, June 30, September... -

Page 84

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Not Applicable 84 -

Page 85

...President/Chief Accounting Officer Senior Vice President/General Counsel and Secretary Executive Vice President/Chief Operating Officer - Television Chief Executive Officer - Eller Media Chief Executive Officer - Clear Channel International President/Chief Operating Officer - Eller Media Senior Vice... -

Page 86

..., Inc. from November 1996 to May 1999 and he was President and Company Chief Operating Officer of Jacor Communications, Inc. for the remainder of the relevant five-year period. Mr. Becker was appointed Chairman/Chief Executive Officer - Live Entertainment in October 2000. Prior thereto he was... -

Page 87

...information set forth under the caption "Executive Compensation" in our Definitive Proxy Statement, expected to be filed within 120 days of our fiscal year end. ITEM 12. Security Ownership of Certain Beneficial Owners and Management The information required by this item is incorporated by reference... -

Page 88

... statement schedules for the years ended December 31, 2000, 1999 and 1998 and related report of independent auditors are filed as part of this report and should be read in conjunction with the consolidated financial statements. Schedule II Valuation and Qualifying Accounts All other schedules... -

Page 89

... ended December 31, 1999 Year ended December 31, 2000 Other (1) $ 9,850 $ 6,031 $ 7,840 $ 5,467 $ 13,508 $ 13,508 $ 12,975 $ 15,640 $ 15,252 $ 26,095 $ 26,095 $ 34,168 $ 36,065 $ 36,433 $ 60,631 (1) Allowance for accounts receivable acquired in acquisitions net of deletions related... -

Page 90

... 31, 1999 Year ended December 31, 2000 Deletions (2) Other (1) $ - $ - $ - $ 19,837 $ 19,837 $ 19,837 $ - $ - $ 17,780 $ 37,617 $ 37,617 $ - $ 37,617 $ - $ - (1) Related to allowance for net operating loss carryforwards assumed in acquisitions. (2) Based on the Company... -

Page 91

...to Clear Channel' s Quarterly Report on Form 10-Q for the quarter ended May 31, 2000). Buy-Sell Agreement by and between Clear Channel Communications, Inc., L. Lowry Mays, B. J. McCombs, John M. Schaefer and John W. Barger, dated May 31, 1977 (incorporated by reference to the exhibits of the Company... -

Page 92

...Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York, as Trustee (incorporated by reference to the exhibits to Clear Channel' s Quarterly Report on Form 10-Q for the quarter ended September 30, 2000). Incentive Stock Option Plan of Clear Channel... -

Page 93

... Incentive Plan (incorporated by reference to Appendix A to the Company' s Definitive 14A Proxy Statement dated March 24, 1998). Voting Agreement dated as of October 8, 1998, by and among Jacor Communications, Inc. and L. Lowry Mays, Mark P. Mays and Randall T. Mays and certain related family trusts... -

Page 94

...exhibits to Clear Channel' s Quarterly Report on Form 10-Q for the quarter ended September 30, 1999). Employment Agreement by and between Clear Channel Communications, Inc. and Mark P. Mays dated October 1, 1999. (incorporated by reference to the exhibits to Clear Channel' s Quarterly Report on Form... -

Page 95

... that we extended our offer to exchange Euro 650,000,000 6.5% Notes due 2005 issued by us in July 2000. We filed a report on Form 8-K dated December 20, 2000 that reported that we had issued a press release that day announcing that we extended our offer to exchange Euro 650,000,000 6.5% Notes... -

Page 96

... the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on i ts behalf by the undersigned, thereunto duly authorized, on March 15, 2001. CLEAR CHANNEL COMMUNICATIONS, INC. By:/S/ L. Lowry Mays L. Lowry Mays Chairman and Chief Executive Officer Power of Attorney... -

Page 97

Karl Eller /S/ Alan D. Feld Alan D. Feld /S/ Thomas O. Hicks Thomas O. Hicks /S/ Vernon E. Jordan, Jr. Vernon E. Jordan, Jr. /S/ Michael J. Levitt Michael J. Levitt /S/ Perry J. Lewis Perry J. Lewis /S/ B. J. McCombs B. J. McCombs /S/ Theodore H. Strauss Theodore H. Strauss /S/ John H. Williams John...