World Fuel Services 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 World Fuel Services annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under the provisions of the 2001 Plan, the Compensation Committee is authorized to grant common stock, which can be

restricted, or stock options which can be "qualified" or "nonqualified" under the Internal Revenue Code of 1986, as

amended, or stock appreciation rights, or other stock or non-stock-based awards, including but not limited to stock units,

performance units, or dividend equivalent payments. The 2001 Plan is unlimited in duration and, in the event of its

termination, the 2001 Plan will remain in effect as long as any of the above items granted by the Compensation Committee

are outstanding; provided, however, that no awards may be granted under the 2001 Plan after August 2006. The term and

vesting period of awards granted under the 2001 Plan is established by the Compensation Committee, but in no event shall

stock options or stock appreciation rights remain exercisable after the five-year anniversary of the date of grant. Outstanding

options at December 31, 2002 under the 2001 Plan expire between September 2006 and December 2007.

In 1994, our shareholders approved the 1993 Non-Employee Directors Stock Option Plan (the “Directors Plan”), as

amended. The Directors Plan permits the issuance of options to purchase up to an aggregate of 150 thousand shares of our

common stock. Additional options to purchase shares of our common stock may be granted under the Directors Plan for any

options that are forfeited, expired or canceled without delivery of shares of our common stock or which result in the

forfeiture of the shares of our common stock back to us. Under the Directors Plan, members of the Board of Directors who

are not our employees receive a non-qualified option to purchase five thousand shares, on a pro-rata basis, when such person

is first elected to the Board of Directors and will receive a non-qualified option to purchase five thousand shares each year

that the individual is re-elected. Options granted are fully exercisable one year after the date of grant. All options under the

Directors Plan expire five years after the date of grant. Outstanding options at December 31, 2002 under the Directors Plan

expire between August 2003 and August 2007.

In addition to the above stock option plans, in 1995, we issued certain non-qualified options to various employees.

These options expire in January 2005.

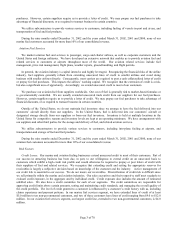

As of December 31, 2002, the following table summarizes the outstanding stock options which were issued pursuant to

the plans described above, and the options issued outside the plans in 1995 (in thousands, except weighted-average exercise

price):

(a) (c)

Number of securities (b) Number of securities

to be issued upon Weighted-average remaining available for

exercise of exercise price of future issuance under equity

outstanding options, outstanding options, compensation plans (excluding

Plan name or description and warrant and warrant securities reflected in column (a))

2001 Plan 117 16.21$ 559

1996 Plan 923 13.11 -

1986 Plan 57 6.89 -

Directors Plan 80 15.33 6

1995 non-qualified options (1) 26 6.89 -

1,203 13.13$ 565

(1) These options were not approved by shareholders. All other plans shown in the table were approved

by shareholders.

Restricted Common Stock

Under the 2001 Omnibus Plan, we granted 25 thousand restricted shares in October 2001 and 96 thousand restricted

shares during the nine months ended December 31, 2002. At December 31, 2002, there were 115 thousand shares of

unvested restricted stock, which will vest between October 2003 and September 2007.

Warrant

In July 2000, we granted a warrant to an investment-banking firm in connection with the engagement of such firm to

provide advisory services to us. The warrant entitles the holder to purchase up to 50,000 shares of our common stock at an

exercise price of $9.50 per share, for a period of three years. This warrant expires in July 2003.

Page 13 of 70