Windstream 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-28

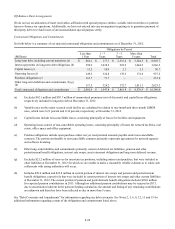

We perform our impairment analysis on January 1st of each year. During 2012, 2011 and 2010, no write-down in the carrying

value was required. Effective January 1, 2012, we determined that we had one reporting unit to test for impairment. Reducing

our January 1, 2012 market capitalization by 82.0 percent would not have resulted in an impairment of the carrying value of

goodwill. Changes in the key assumptions used in the impairment analysis due to changes in market conditions could adversely

affect the calculated fair value of goodwill, materially affecting the carrying value and our future consolidated operating results.

See Notes 2 and 4 for additional information on goodwill.

Derivative Instruments

We enter into interest rate swap agreements to mitigate the interest rate risk inherent in our variable rate senior secured credit

facilities. We account for our derivative instruments using authoritative guidance for recognition, measurement and disclosures

about derivative instruments and hedging activities, including when a derivative or other financial instrument can be designated

as a hedge. This guidance requires recognition of all derivative instruments at fair value, and accounting for the changes in fair

value depends on whether the derivative has been designated as, qualifies as and is effective as a hedge. We record changes in

fair value of the effective portions of cash flow hedges as a component of other comprehensive income (loss) in the current

period. Any ineffective portion of our hedges is recognized in earnings in the current period.

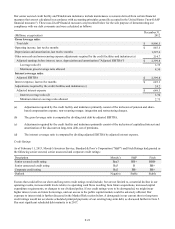

In 2006, we entered into four pay fixed, receive variable interest rate swap agreements to serve as cash flow hedges of the

interest rate risk inherent in our senior secured credit facilities. We renegotiated the four interest rate swap agreements on

December 3, 2010, and again on August 21, 2012, each time lowering the fixed interest rate paid and extending the maturity.

The current swaps are designated as cash flow hedges of the interest rate risk created by the variable rate cash flows paid on our

senior secured credit facilities, which have varying maturity dates from July 17, 2013 to August 8, 2019. We are hedging

probable variable cash flows which extend up to four years beyond the maturity of certain components of our variable rate debt.

Consistent with past practice, we expect to extend or otherwise replace these components of our debt with variable rate debt.

We recognize all derivative instruments at fair value in the accompanying consolidated balance sheets as either assets or

liabilities, depending on the rights or obligations under the related contracts. Changes in value of the effective portion are

charged to accumulated other comprehensive income (loss) and reclassified into earnings as the hedged transaction affects

earnings. Changes in value of the ineffective portion are charged to other income (expense), net. See note 2 for additional

information.

See Note 2 for additional information on derivative instruments.

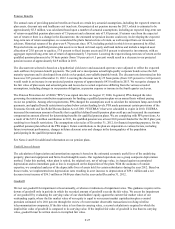

Income Taxes

Our estimates of income taxes and the significant items resulting in the recognition of deferred tax assets and liabilities are

disclosed in Note 12 and reflect our assessment of future tax consequences of transactions that have been reflected in our

financial statements or tax returns for each taxing jurisdiction in which we operate. Actual income taxes to be paid could vary

from these estimates due to future changes in income tax law or the outcome of audits completed by federal and state taxing

authorities. Included in the calculation of our annual income tax expense are the effects of changes, if any, to our income tax

reserves for uncertain tax positions. We maintain income tax reserves for potential assessments from the IRS or other taxing

authorities. The reserves are determined in accordance with authoritative guidance and are adjusted, from time to time, based

upon changing facts and circumstances. Changes to the income tax reserves could materially affect our future consolidated

operating results in the period of change. In addition, a valuation allowance is recorded to reduce the carrying amount of

deferred tax assets unless it is more likely than not that such assets will be realized.

Recently Issued Authoritative Guidance

The following authoritative guidance will be adopted by us in the reporting period indicated. This authoritative guidance,

together with our evaluation of the related impact to the consolidated financial statements, is more fully described in Note 2.

• Balance Sheet Offsetting (first quarter of 2013)

• Comprehensive Income (first quarter of 2013)