Windstream 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

3. Acquisitions and Dispositions, Continued:

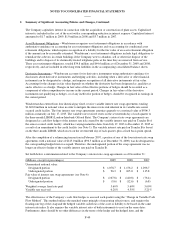

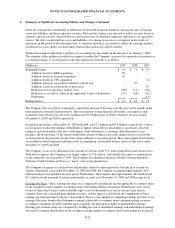

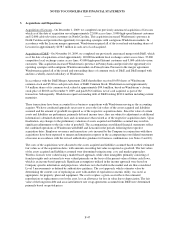

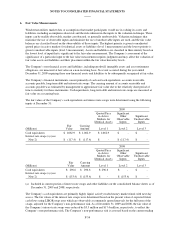

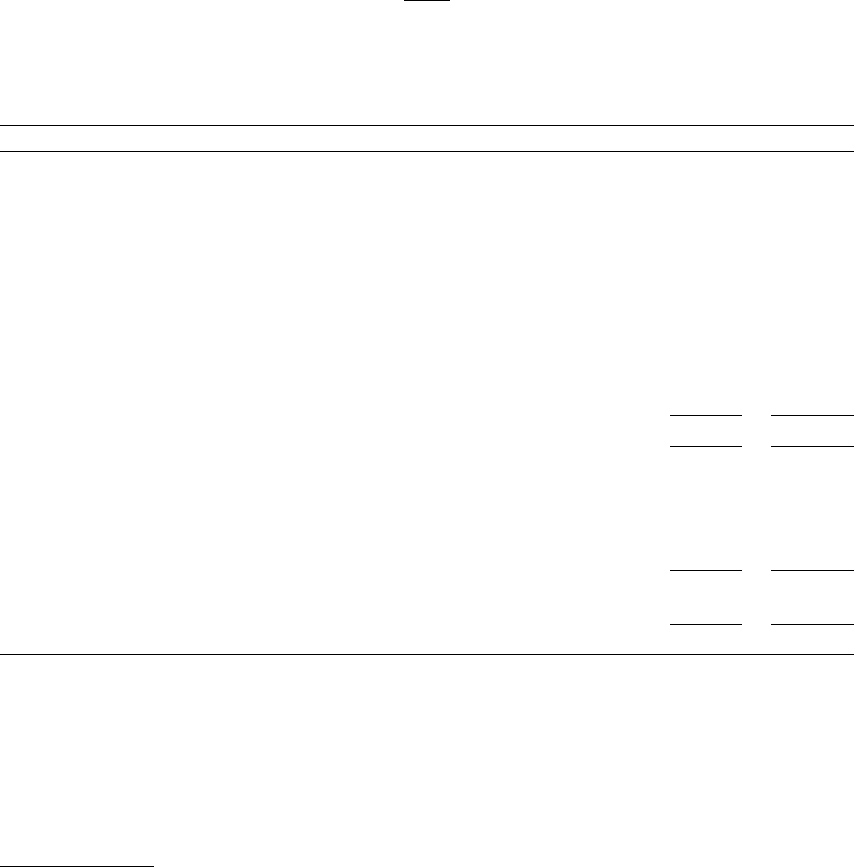

The following table summarizes the preliminary allocation to the assets acquired and liabilities assumed:

(Millions) Lexcom D&E

Fair value of assets acquired:

Current assets $ 5.1 $ 16.7

Property, plant and equipment 73.1 195.1

Goodwill (a) 58.1 88.1

Franchise rights 20.1 80.0

Cable franchise rights 11.6 -

Customer lists 10.5 60.0

Wireless licenses - 16.6

Non compete agreements - 1.7

Trade names 0.3 1.2

Other assets 1.3 2.6

Total assets acquired 180.1 462.0

Fair value of liabilities assumed:

Current liabilities (3.3) (26.3)

Deferred income taxes established on acquired assets (37.6) (94.0)

Long-term debt - (175.3)

Other liabilities (0.5) (15.2)

Total liabilities assumed (41.4) (310.8)

Common stock issued (inclusive of additional paid in capital) - (94.6)

Cash paid, net of cash acquired $ 138.7 $ 56.6

(a) Goodwill associated with the acquired companies is attributable to the workforce of the acquired businesses

and synergies expected to arise with contiguous Windstream markets after the acquisitions. None of the

goodwill recognized in these transactions is expected to be deductible for income tax purposes.

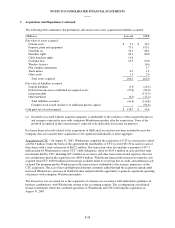

Pro forma financial results related to the acquisitions of D&E and Lexcom have not been included because the

Company does not consider these acquisitions to be significant individually or in the aggregate.

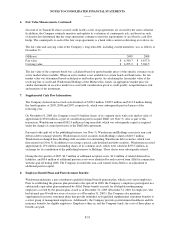

Acquisition of CTC – On August 31, 2007, Windstream completed the acquisition of CTC in a transaction valued

at $584.3 million. Under the terms of the agreement the shareholders of CTC received $31.50 in cash for each of

their shares with a total cash payout of $652.2 million. The transaction value also includes a payment of $37.5

million made by Windstream to satisfy CTC’s debt obligations, offset by $105.4 million in cash and short-term

investments held by CTC. Including $25.3 million in severance and other transaction-related expenses, the total

net consideration paid in the acquisition was $609.6 million. Windstream financed the transaction using the cash

acquired from CTC, $250.0 million in borrowings available under its revolving line of credit, and additional cash

on hand. The premium paid by Windstream in this transaction is attributable to the strategic importance of the

CTC acquisition. The access lines and high-speed Internet customers added through the acquisition significantly

increased Windstream’s presence in North Carolina and provided the opportunity to generate significant operating

efficiencies with contiguous Windstream markets.

The transaction was accounted for as the acquisition of a business in accordance with authoritative guidance on

business combinations, with Windstream serving as the accounting acquirer. The accompanying consolidated

financial statements reflect the combined operations of Windstream and CTC following the acquisition on

August 31, 2007.

F-48