Windstream 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2. Summary of Significant Accounting Policies and Changes, Continued:

Based on these material factors impacting its operations, Windstream determined in the third quarter of 2006 that

it was no longer appropriate to continue the application of SFAS No. 71 for reporting its financial results.

Accordingly, Windstream recorded a non-cash extraordinary gain of $99.7 million, net of taxes of $74.5 million,

upon discontinuance of the provisions of SFAS No. 71, as required by the provisions of SFAS No. 101,

“Regulated Enterprises – Accounting for the Discontinuation of the Application of FASB Statement No. 71”. In

addition, the Company began eliminating all affiliated revenues and related expenses. Previously, certain affiliated

revenues earned and expenses incurred by the Company’s regulated subsidiaries were not eliminated because they

were priced in accordance with Federal Communications Commission guidelines and were recovered through the

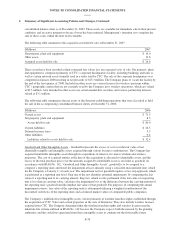

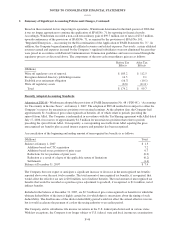

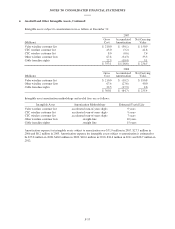

regulatory process as discussed above. The components of the non-cash extraordinary gain are as follows:

Before Tax

Effects

After Tax

Effects

(Millions)

Write off regulatory cost of removal $ 185.2 $ 112.5

Recognize deferred directory publishing revenue 14.5 9.1

Establish asset retirement obligation (16.7) (10.1)

Write off regulatory assets (8.8 ) (11.8 )

Total $ 174.2 $ 99.7

Recently Adopted Accounting Standards

Adoption of FIN 48 - Windstream adopted the provisions of FASB Interpretation No. 48 (“FIN 48”), “Accounting

for Uncertainty in Income Taxes”, on January 1, 2007. The adoption of FIN 48 resulted in no impact to either the

Company’s reserves for uncertain tax positions or to retained earnings. At the adoption date, the Company had

approximately $1.3 million of gross unrecognized tax benefits, all of which relate to periods preceding the

spin-off from Alltel. The Company is indemnified in accordance with the Tax Sharing agreement with Alltel dated

July 17, 2006, for reserves of approximately $1.3 million for uncertain tax positions that relate to periods

preceding the spin off from Alltel. Consequently, a corresponding receivable from Alltel equaling the gross

unrecognized tax benefits plus accrued interest expense and penalties has been recognized.

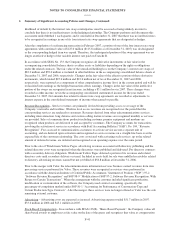

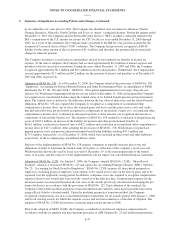

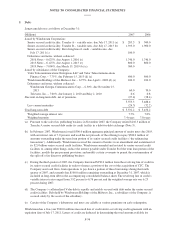

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

(Millions) Total

Balance at January 1, 2007 $ 1.3

Additions based on CTC acquisition 7.2

Additions based on tax positions of prior years 0.7

Reductions for tax positions of prior years (0.2)

Reduction as a result of a lapse of the applicable statute of limitations (0.2)

Settlements (1.4)

Balance at December 31, 2007 $ 7.4

The Company does not expect or anticipate a significant increase or decrease in the unrecognized tax benefits

reported above over the next twelve months. The total amount of unrecognized tax benefits, if recognized, that

would affect the effective tax rate is $0.8 million, net of indirect benefits. The total amount of unrecognized tax

benefits that would be recorded as a purchase price adjustment to goodwill, if recognized, is $1.6 million, net of

indirect benefits.

Included in the balance at December 31, 2007, are $3.7 million of gross unrecognized tax benefits for which the

ultimate deductibility of the item is highly certain but, for which there is uncertainty about the timing of such

deductibility. The disallowance of the shorter deductibility period would not affect the annual effective tax rate,

but it would accelerate the payment of cash to the taxing authority to an earlier period.

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction and in various states.

With few exceptions, the Company is no longer subject to U.S. federal, state and local income tax examinations

F-46