Windstream 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

conditions were to result in a significant decline in the return on assets in the overall plan asset portfolio. See the

“Pension and Other Postretirement Benefits” caption below in our discussion of critical accounting policies and

estimates for the results of the sensitivity analysis.

Foreign Currency Risk

Although the Company does not operate in foreign countries, the Windstream pension plan invests in international

securities. Windstream has a well diversified pension plan, with a target asset allocation for international investments

of 15 to 20 percent of the total pension assets. As of December 31, 2007 approximately $152.3 million or 15 percent of

total pension assets is invested in debt or equity securities denominated in foreign currencies. The investments are

diversified in terms of country, industry and company risk, limiting the overall foreign currency exposure. A

hypothetical decrease of 10 percent in the value of the dollar relative to all other currencies would reduce the value of

these securities by $15.2 million. As previously noted, the pension plan is over funded and is expected to be adequately

funded for the near term. Future contributions to the plan, however, may be required if economic conditions were to

result in a significant decline in the return on assets in the overall plan asset portfolio.

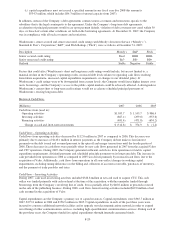

Interest Rate Risk

The Company is exposed to market risk through changes in interest rates, primarily as it relates to the variable interest

rates it is charged under its senior secured credit facilities. Under its current policy, the Company enters into interest

rate swap agreements to obtain a targeted mixture of variable and fixed interest rate debt such that the portion of debt

subject to variable rates does not exceed 25 percent of Windstream’s total debt outstanding. The Company has

established policies and procedures for risk assessment and the approval, reporting, and monitoring of interest rate

swap activity. Windstream does not enter into interest rate swap agreements, or other derivative financial instruments,

for trading or speculative purposes. Management periodically reviews Windstream’s exposure to interest rate

fluctuations and implements strategies to manage the exposure.

Due to the interest rate risk inherent in its variable rate senior secured credit facilities, the Company entered into four

pay fixed, receive variable interest rate swap agreements on notional amounts totaling $1,600.0 million at July 17, 2006

to convert variable interest rate payments to fixed. The four interest rate swap agreements amortize quarterly to a

notional value of $906.3 million at maturity on July 17, 2013, and have an unamortized notional value of

$1,412.5 million as of December 31, 2007. The variable rate received by Windstream on these swaps is the three-

month LIBOR (London-Interbank Offered Rate), which was 5.21 percent at December 31, 2007. The weighted-average

fixed rate paid by Windstream is 5.60 percent. The interest rate swap agreements are designated as cash flow hedges of

the interest rate risk created by the variable interest rate paid on the senior secured credit facilities pursuant to the

guidance in SFAS No. 133, “Accounting for Derivative Financial Instruments and Hedging Activities”, as amended.

After the completion of a refinancing transaction in February 2007, a portion of one of the four interest rate swap

agreements with a notional value of $125.0 million was de-designated and is no longer considered an effective hedge

as the portion of the Company’s senior secured credit facility that it was designated to hedge against was repaid.

Changes in the market value of this portion of the swap, which has an unamortized notional value of $115.8 million as

of December 31, 2007, are recognized in net income, including a $3.1 million loss in 2007. Changes in the market

value of the designated portion of the swaps are recognized in other comprehensive income.

As of December 31, 2007, the unhedged portion of the Company’s variable rate senior secured credit facilities were

$363.8 million, or approximately 6.8 percent of its total outstanding long-term debt. Windstream has estimated its

interest rate risk using a sensitivity analysis. For variable rate debt instruments, market risk is defined as the potential

change in earnings resulting from a hypothetical adverse change in interest rates. A hypothetical increase of 100 basis

points in variable interest rates would reduce annual pre-tax earnings by approximately $3.6 million. Actual results

may differ from this estimate.

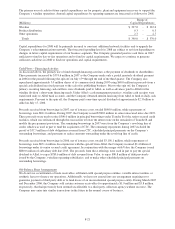

Critical Accounting Policies and Estimates

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the

United States. Our significant accounting policies are discussed in detail in Note 2. Certain of these accounting policies

as discussed below require management to make estimates and assumptions about future events that could materially

affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets and

liabilities. We believe that the estimates, judgments and assumptions made when accounting for the items described

below are reasonable, based on information available at the time they are made. However, there can be no assurance

that actual results will not differ from those estimates.

Revenue Recognition – We recognize revenues and sales as services are rendered or as products are sold in accordance

with Staff Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition”.Service revenues are primarily derived from

F-23