Whole Foods 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

While we expect higher-than-average total sales

growth, we do not expect to produce operating

leverage for the year due primarily to a decrease

in store contribution as well as flat G&A expense

year over year as a percentage of sales. Store

contribution is expected to be negatively impacted

by a higher percentage of sales coming from

new and acquired stores which have a lower

contribution than our existing stores, and

continued, though more moderate, increases

in health care costs as a percentage of sales,

as well as investments in labor and benefits

at the Wild Oats stores. G&A is expected to

be flat as a percentage of sales primarily due

to costs related to the Wild Oats acquisition,

including integration costs and costs related

to fully staffing our three smallest regions

which gained the greatest number of stores

as a percentage of their existing store base.

We have produced very consistent gross margin,

direct store expenses, and G&A as a percentage

of sales over time and believe that, over the long

term, we will continue to deliver healthy earnings

growth through strong sales growth rather than

through significant operating leverage. We believe

the investments we are making today in our

new, acquired and existing stores will result in

substantial earnings growth in the near future.

We are well positioned to achieve our goal

of $12 billion in sales in fiscal year 2010.

With fewer than 300 stores, the majority of

which are in the top metro markets, we have

significant growth opportunities ahead of us.

None of our current markets are saturated; the

top markets allow for a dense concentration

of stores, the majority of which are still

underserved; the success we are seeing in

some of our new markets indicates there are

a lot of opportunities in secondary markets,

and we are very excited about what lies ahead

of us in terms of international expansion.

Given our recent merger, solid historical sales

growth, significant store development pipeline,

and acceleration in store openings, we believe

we are well positioned to achieve our goal of $12

billion in sales in the year 2010. Over the longer

term, however, we believe the sales potential

for Whole Foods Market is much greater than

$12 billion as the market continues to grow

and as our company continues to improve.

We have grown our stock price at an average

compound annual rate of 22% since going

public, and we encourage our shareholders to

stay focused on the long term. We are constantly

evolving, innovating and maturing and have

a demonstrated track record of competing,

executing and delivering compelling results.

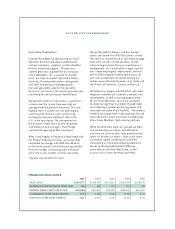

GROWTH SINCE IPO

9/30/07 9/29/91* CAGR

NUMBER OF STORES 276 10 23%

SALES $6.6 B $92.5 M 30%

EARNINGS PER SHARE $1.29 $0.08 18%

TEAM MEMBERS 52,6 00 1,100 27%

STOCK PRICE $48.96 $2.13 22%

* 1991 results do not include the impact of subsequent pooling

transactions and accounting restatements. Stock price is

split-adjusted IPO price in January 1992.

Our motto—Whole Foods, Whole People, Whole

Planet™—emphasizes that our vision reaches

far beyond just food retailing. We look forward

to sharing our vision with the rest of the world.

With warmest regards,

John Mackey

Chairman of the Board, Chief Executive Officer,

and Co-Founder