Western Union 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

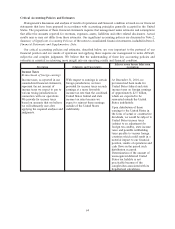

Critical Accounting Policies and Estimates

Management’s discussion and analysis of results of operations and financial condition is based on our financial

statements that have been prepared in accordance with accounting principles generally accepted in the United

States. The preparation of these financial statements requires that management make estimates and assumptions

that affect the amounts reported for revenues, expenses, assets, liabilities and other related disclosures. Actual

results may or may not differ from these estimates. Our significant accounting policies are discussed in Note 2,

Summary of Significant Accounting Policies, of the notes to consolidated financial statements, included in Item 8,

Financial Statements and Supplementary Data.

Our critical accounting policies and estimates, described below, are very important to the portrayal of our

financial position and our results of operations and applying them requires our management to make difficult,

subjective and complex judgments. We believe that the understanding of these key accounting policies and

estimates is essential in achieving more insight into our operating results and financial condition.

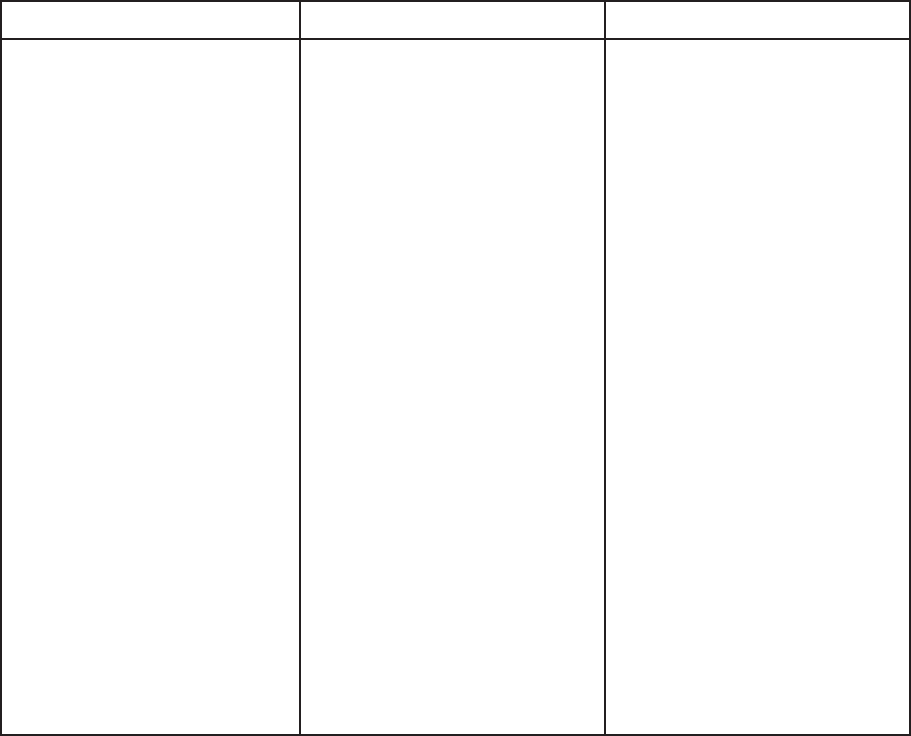

Description Judgments and Uncertainties

Effect if Actual Results Differ from

Assumptions

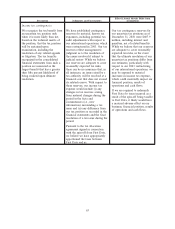

Income Taxes

Reinvestment of foreign earnings

Income taxes, as reported in our

consolidated financial statements,

represent the net amount of

income taxes we expect to pay to

various taxing jurisdictions in

connection with our operations.

We provide for income taxes

based on amounts that we believe

we will ultimately owe after

applying the required analyses and

judgments.

With respect to earnings in certain

foreign jurisdictions, we have

provided for income taxes on such

earnings at a more favorable

income tax rate than the combined

United States federal and state

income tax rates because we

expect to reinvest these earnings

outside of the United States

indefinitely.

At December 31, 2010, no

provision had been made for

United States federal and state

income taxes on foreign earnings

of approximately $2.5 billion,

which are expected to be

reinvested outside the United

States indefinitely.

Upon distribution of those

earnings to the United States in

the form of actual or constructive

dividends, we would be subject to

United States income taxes

(subject to an adjustment for

foreign tax credits), state income

taxes and possible withholding

taxes payable to various foreign

countries which could result in a

material impact to our financial

position, results of operations and

cash flows in the period such

distribution occurred.

Determination of the amount of

unrecognized deferred United

States tax liability is not

practicable because of the

complexities associated with its

hypothetical calculation.

64