Western Union 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Spin-off from First Data

We were incorporated in Delaware as a wholly-owned subsidiary of First Data on February 17, 2006. On

September 29, 2006, First Data distributed all of its money transfer and consumer payments businesses and its

interest in a Western Union money transfer agent, as well as its related assets, including real estate, through a tax-

free distribution to First Data shareholders (“Spin-off ”) through this previously owned subsidiary.

Basis of Presentation

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include

the accounts of our Company and its majority-owned subsidiaries. All significant intercompany transactions and

accounts have been eliminated.

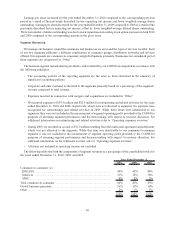

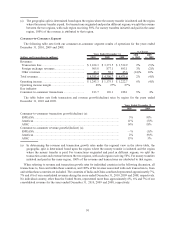

Components of Revenues and Expenses

The following briefly describes the components of revenues and expenses as presented in the consolidated

statements of income. Descriptions of our revenue recognition policies are included in Note 2—“Summary of

Significant Accounting Policies” in our consolidated financial statements.

Transaction fees—Transaction fees are charged for sending money transfers and for global business payments

services. Consumer-to-consumer transaction fees generally vary according to the principal amount of the money

transfer and the locations from and to which the funds are sent and received. Transaction fees represented 78% of

our total consolidated revenues for the year ended December 31, 2010.

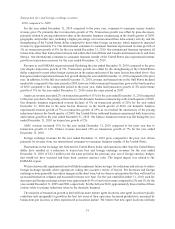

Foreign exchange revenues—In certain consumer money transfer and global business payments transactions

involving different currencies, we generate revenues based on the difference between the exchange rate set by us to

the customer and the rate at which we or our agents are able to acquire currency. Foreign exchange revenues growth

has historically been primarily driven by growth in international cross-currency transactions. As a result of the

acquisition of Custom House, our foreign exchange revenues have increased. Foreign exchange revenues

represented 20% of our total consolidated revenues for the year ended December 31, 2010.

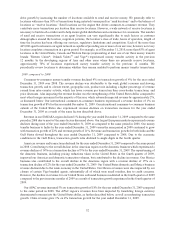

Commission and other revenues—Commission and other revenues primarily consist of commissions and fees we

receive in connection with the sale of money orders, investment income primarily derived from interest generated

on money transfer, money order and payment services settlement assets as well as realized net gains and losses from

such assets and enrollment fees received when consumers enroll in our Equity Accelerator program (a recurring

mortgage payment service program). Commission and other revenues represented 2% of our total consolidated

revenue for the year ended December 31, 2010. As described above, prior to October 1, 2009, our money orders

were issued by IPS, from whom we received a commission. Effective October 1, 2009, we assumed the

responsibility for issuing money orders and no longer receive a commission from IPS. We now recognize fees

and investment income derived from interest generated on money order settlement assets as well as realized net

gains and losses from such assets similar to our money transfer and payment services settlement assets.

Cost of services—Cost of services primarily consists of agent commissions, which represent approximately 70%

of total cost of services, and expenses for call centers, settlement operations, and related information technology

costs. Expenses within these functions include personnel, software, equipment, telecommunications, bank fees,

depreciation and amortization and other expenses incurred in connection with providing money transfer and other

payment services.

Selling, general and administrative—Selling, general and administrative, or “SG&A,” primarily consists of

salaries, wages and related expenses paid to sales and administrative personnel, as well as certain advertising and

promotional costs and other selling and administrative expenses.

Interest income—Interest income consists of interest earned on cash balances not required to satisfy settlement

obligations and in connection with loans previously made to several existing agents.

Interest expense—Interest expense represents interest incurred in connection with outstanding borrowings,

including applicable amounts associated with interest rate swaps.

42