Western Union 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

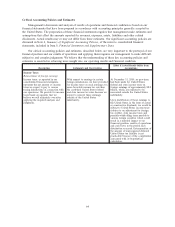

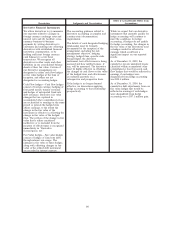

Description Judgments and Uncertainties

Effect if Actual Results Differ from

Assumptions

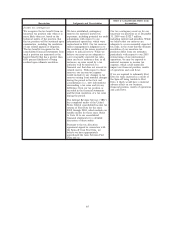

Acquisitions—Purchase Price

Allocation

We allocate the purchase price of an

acquired business to its identifiable

assets and liabilities based on

estimated fair values. The excess of

the purchase price over the amount

allocated to the assets and liabilities is

recorded as goodwill.

For most acquisitions, we engage

outside appraisal firms to assist in the

fair value determination of identifiable

intangible assets such as agent

networks, customer relationships,

tradenames and any other significant

assets or liabilities. We adjust the

preliminary purchase price allocation,

as necessary, after the acquisition

closing date through the end of the

measurement period of one year or

less as we finalize valuations for the

assets acquired and liabilities assumed.

Purchase price allocation methodology

requires management to make

assumptions and apply judgment to

estimate the fair value of acquired

assets and liabilities. Management

estimates the fair value of assets and

liabilities primarily using discounted

cash flows and replacement cost

analysis.

During the last three years, we

completed the following significant

acquisitions:

• In September 2009, we acquired

Custom House for $371.0 million.

• In February 2009, we acquired the

money transfer business of FEXCO

for $243.6 million.

• In 2008, we acquired an 80%

interest in our existing money

transfer agent in Peru and the

money transfer assets of an agent

in Panama for a total of $53.3

million.

See Note 3, Acquisitions, to the Notes

to the Consolidated Financial

Statements, included in Item 8, of this

Annual Report on Form 10-K, for

more information related to the

purchase price allocations for

acquisitions completed during the last

three years.

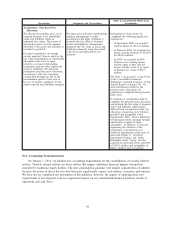

If estimates or assumptions used to

complete the purchase price allocation

and estimate the fair value of acquired

assets and liabilities significantly

differed from assumptions made, the

allocation of purchase price between

goodwill and intangibles could

significantly differ. Such a difference

would impact future earnings through

amortization expense of these

intangibles. In addition, if forecasts

supporting the valuation of the

intangibles or goodwill are not

achieved, impairments could arise, as

discussed further in “Goodwill

Impairment Testing” and “Other

Intangible Assets” above. For the

acquisitions discussed above, goodwill

of $504.1 million and intangibles of

$208.7 million were recognized.

New Accounting Pronouncements

On January 1, 2010, we adopted new accounting requirements for the consolidation of variable interest

entities. Variable interest entities are those entities that require additional financial support beyond that

provided by traditional equity holders. The new consolidation guidance will require consideration of whether

we have the power to direct the activities that most significantly impact each entities’ economic performance.

We have not yet completed our assessment of this guidance; however, the impact of adopting these new

requirements is not expected to have a significant impact on our consolidated financial position, results of

operations and cash flows.

68