Western Digital 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results of Operations

Summary of 2002, 2001 and 2000 Comparison

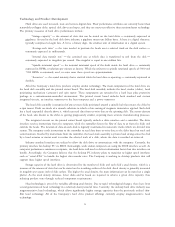

The following table sets forth, for the periods indicated, items in the Company's statements of operations expressed

as a percentage of total revenue. This table and the following discussion exclude the results of the discontinued businesses.

Years ended

June 28, June 29, June 30,

2002 2001 2000

Revenues, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100.0% 100.0% 100.0%

Cost of revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (86.9) (89.4) (99.5)

Gross proÑtÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 13.1 10.6 0.5

Research and development ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (5.6) (5.8) (7.7)

Selling, general and administrative ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (5.2) (5.9) (6.5)

Restructuring charges ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì (4.4)

Total operating expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (10.8) (11.7) (18.6)

Operating income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2.3 (1.1) (18.1)

Net interest and other income (expense) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.1 (2.7) 0.3

Income (loss) from continuing operations before income tax beneÑt ÏÏÏÏÏÏÏÏÏÏÏ 2.4 (3.8) (17.8)

Income tax beneÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.1 Ì 1.0

Income (loss) from continuing operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2.5% (3.8)% (16.8)%

Net Revenues

Consolidated net revenues were $2.2, $2.0 and $2.0 billion in 2002, 2001 and 2000, respectively. The increase in

net revenues in 2002 from 2001 of $0.2 billion, or 10.1%, was primarily due to an increase in unit shipments of 31%,

partially oÅset by a 16% decrease in average selling prices (""ASP's''). The signiÑcant change in units and ASP's in 2002

from 2001 is primarily due to expansion of the Company's hard drive product line into lower-end desktop PC and

consumer electronics markets. Consolidated net revenues in 2001 were Öat with 2000, at approximately $2.0 billion.

Excluding $141.8 million of revenue in 2000 related to the Company's discontinued small computer system interface

(""SCSI'') product line, revenue increased $138.0 million or 7.6% in 2001. This improvement was due to an increase in

EIDE drive unit shipments of approximately 19%, partially oÅset by a 10% decline in ASP's.

Gross ProÑt

Gross proÑt was $281.6 million, or 13.1% of revenue in 2002, $207.7 million, or 10.6% of revenue in 2001, and

$9.6 million, or 0.5% of revenue, in 2000. Gross proÑt for 2000 included $72.5 million of special charges, of which

$34.8 million related to costs associated with exiting the SCSI hard drive product line, and $37.7 million related to costs

to repair recalled drives. Excluding special charges, gross proÑt was $82.1 million, or 4.2% of revenue, for 2000. The

increase in gross proÑt in 2002 from 2001 was primarily the result of more cost-eÅective designs and higher unit volume,

partially oÅset by lower ASP's. The increase in gross proÑt in 2001 from 2000 (excluding the 2000 special charges) was

primarily the result of higher volume and lower manufacturing costs due to 2000 expense reduction eÅorts, partially

oÅset by lower ASP's.

Operating Expenses

Research and development (""R&D'') expense was $120.1, $113.4 and $150.7 million for 2002, 2001 and 2000,

respectively. The increase in R&D expense in 2002 from 2001 of $6.7 million was due to increases in new development

programs and higher employee incentive payments, partially oÅset by expense reduction eÅorts. The decrease in 2001

from 2000 of $37.3 million was primarily due to the Company's exit from the SCSI hard drive market during 2000 and

expense reduction eÅorts in its remaining hard drive operations.

16