Vtech 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

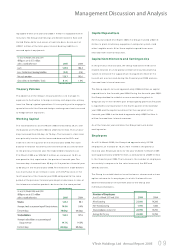

Management Discussion and Analysis

>>

>>

>>

>>

>>

>>

VTech Holdings Ltd Annual Report 2005 07

Highlights

Group revenue increased by 11.7% to US$1,022.0 million

Profit attributable to shareholders* increased by 22.9% to US$56.9 million

Final dividend of US12.0 cents per ordinary share, total dividend for the year up 30.0%

Strong rebound in electronic learning products business

Outperformance by contract manufacturing services business

Unsatisfactory results of telecommunication products business in the

United States

Rationalisation of the telecommunication products business contributing to

more efficient operations

* including US$6.7 million non-recurring income arising from settlement of an indemnification claim

>>

Revenue

For the year ended 31st March 2005, the Group reported a revenue

of US$1,022.0 million, representing a growth of US$106.8 million or

11.7% over the previous financial year. In contrast to the severe

challenges faced by the telecom m unication products business in

the US market, the ELP business recorded substantial grow th with

a 115.1% year on year increase in revenue to US$281.1 million. The

grow th was attributable to the success of its revamped product

lines, in particular the exceptionally strong demand for the new

V.Smile TV Learning System.

strong demand from existing customers and its ability to offer

comprehensive R&D services to customers. The rise in revenue w as

mainly driven by the power supply and professional audio

equipm ent segments.

The Group's revenue continues to derive from the three core

businesses as follows: 59.9% from telecommunication products,

27.5% from ELP and 12.6% from CMS.

North America continues to be the largest m arket for the Group.

Revenue from this market accounted for 60.8% of the Group

revenue for the financial year 2005. Europe and Asia Pacific

accounted for 32.9% and 4.5% respectively.

The revenue from the telecommunication products business

declined by 10.9% to US$612.5 million due to underperformance

in the US market, although the situation was partly alleviated by

further progress in its development of the European market, where

sales increased by 102.2% over the previous financial year.

For the CMS business, revenue increased by 32.0% over the

previous financial year, reaching US$128.4 million as a result of

Group Revenue by Product Line

Group Revenue by Region