Vtech 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

VTech Holdings Ltd Annual Report 2005

04

Touch TabletTM

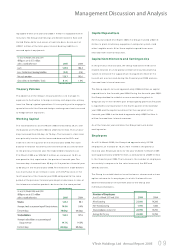

New Manufacturing Facilities

Manufacturing facilities in mainland China

have been increasingly migrating inland to

be closer to untapped labour pools, which

ultimately reduces operational costs.

During the financial year 2005, the

Group decided to establish its third

manufacturing plant in Qingyuan city in

the northern part of Guangdong province.

The new 49,000 square metre facility will

initially be used for supplying the plastics

needs of our telecommunication products

business. The plant is expected to start

operations in the fourth quarter of the

calendar year 2005.

Although VTech has currently not been

affected by the tight supply of labour and

electric power in the Pearl River Delta,

where its manufacturing facilities are

located, the Qingyuan facility offers the

ability to relocate som e processes to an

area of lower cost if required.

Outlook - Cautiously Optimistic

VTech's mission is to be the most cost

effective designer and manufacturer of

innovative, high quality consumer

electronics products and to distribute

them to markets worldw ide in the m ost

efficient m anner. We remain optimistic

about the outlook of the financial year

2006, but this is tempered with caution in

view of a number of factors.

The US economy appears to be on a

reasonably firm footing, but rising short

term interest rates and stubbornly high oil

prices may at som e point dampen

consum er spending. The Group also faces

potential challenges from rising resin

prices and from RoHS compliance, which

will increase the cost of m anufacturing for

products shipping to Europe and Japan.

In addition, a potential upward revaluation

of the RMB would increase our operating

costs, while a weakening of the Euro

and Sterling may also affect our

results, although forward foreign

exchange contracts are used to hedge

certain exposures.

Nonetheless, the Group's three core

businesses are well placed for the future,

albeit with fundamentally different

challenges and opportunities. The

telecommunication products business is

now on much more stable footing, with a

lower cost structure and a pipeline of more

competitive products under development.

We will continue to leverage our dual

brand strategy, using both the AT&T and

VTech brands to develop products for

different market segments.

Follow ing the re-engineering measures,

we expect the profitability of the

VTech's mission is to be

the most cost effective

designer and

manufacturer of

innovative, high quality

consumer electronics

products and to

distribute them to

markets worldwide in the

most efficient manner.

We remain optimistic

about the outlook of the

financial year 2006, but

this is tempered with

caution in view of a

number of factors.