Vtech 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 11

Management Discussion and Analysis

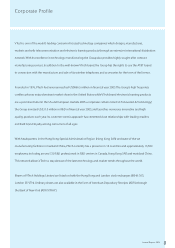

TELECOMMUNICATION PRODUCTS REVENUE BY REGION (US$ million)

North America 569.0

Europe 29.2

Asia Pacific 7.6

Others 4.0

ELECTRONIC LEARNING PRODUCTS REVENUE BY REGION (US$ million)

North America 64.1

Europe 88.0

Asia Pacific 6.3

Others 3.5

US$ million

99 00 01 02 03

R&D EXPENDITURE ON CORE BUSINESSES

31.7 35.2

54.1

31.0

60

50

40

30

20

10

28.9

Geographically, North America remained as

the major market for telecommunication

products, accounting for 93.3% of total

telecommunication products revenue in the

financial year 2003, as compared to 95.0%

in the financial year 2002.

Revenue of the ELP business decreased by

16.4% to US$161.9 million.The ELP business

faced severe challenges in the US market

due to rapid expansion of major

competitors in the pre-school and infant

categories. Competition from personal

computers,TV and hand-held games also

posted a challenge to the ELA category.

Reduction in the shelf space offered by

leading customers put additional pressure

on the business. VTech, however, maintained

its leadership in principal European markets,

which accounted for 54.4% of the total

revenue of the ELP business in the financial

year 2003 as compared to 49.1% in the

financial year 2002. Building on the

innovative ability of our R&D teams in Hong

Kong and mainland China, management

decided to close the R&D centre in

Connecticut, USA and shift the R&D function

to Hong Kong and mainland China under

the leadership of the new management

team that was put in place in late 2002.This

will both lower the operational costs and

improve the Group's ability to develop

products that are better accepted by

consumers.

The CMS business continued to provide a

reliable source of cash flow to the Group,

as the strategy of providing a complete

range of EMS services to medium-sized

companies continued to prove successful.

Despite an overall decline in the EMS market

worldwide, the business recorded modest

revenue growth of 2.0% to US$94.7 million,

while profits remained stable.

GROSS PROFIT Despite the decrease in

revenue, the gross profit of the Group was

comparable to the last financial year.The

gross profit margin for the year improved

from 29.9% to 33.4%.The increase was

mainly attributable to the Group’s strategy

of focusing on higher margin products in

the telecommunication products business.

Enhancement in supply chain management

and manufacturing processes, leveraging

the Group’s volume advantage in

purchasing to reduce materials costs,as well

as improvement in product design to lower

costs also contributed to the improvement

in gross profit margin.

OPERATING PROFIT The operating profit

improved from US$23.0 million to US$59.5

million. Current year’s operating profit

included a non-recurring gain on settlement

of a lawsuit amounted to US$34.0 million.

Excluding such gain, operating profit

increased from US$23.0 million to US$25.5

million. Offsetting the effect of less than

satisfactory performance of ELP business in

the United States, the strong sales of

branded telecommunication products in

both AT&T and VTech brands and the solid

performance of the CMS business

contributed to the increase in the Group’s

operating profit.

In driving product acceptance and sales of

ELP products in the second half of financial

year 2003, the Group launched aggressive

marketing and sales campaigns.This

resulted in a disproportionate increase in

spending on advertising and promotion

dollars, which resulted in a substantial

increase in the Group’s selling expenses

compared to the last financial year.This was

only partly offset by savings from higher

efficiency in logistics and improved supply

chain management, which considerably

lowered the Group’s distribution expenses.

Staff costs for the year ended 31st March

2003 was approximately US$90 million.Total

number of employees as at year-end

decreased from 14,251 to 13,560.

Notwithstanding the decrease in revenue, the

Group maintained the normal level of

investment in R&D, which represented

approximately 3% to 4% of the Group revenue.