Vodafone 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

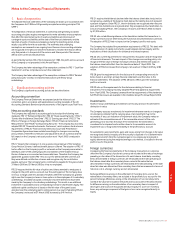

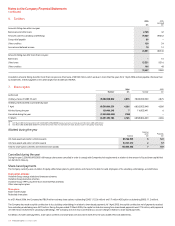

1. Basis of preparation

The separate financial statements of the Company are drawn up in accordance with

the Companies Act 1985 and UK generally accepted accounting principles (“UK

GAAP”).

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenue and expenses during the reporting period. Actual

results could differ from those estimates. The estimates and underlying

assumptions are reviewed on an ongoing basis. Revisions to accounting estimates

are recognised in the period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future periods if the revision

affects both current and future periods.

As permitted by Section 230 of the Companies Act 1985, the profit and loss account

of the Company is not presented in this Annual Report.

The Company has taken advantage of the exemption contained in FRS 1 “Cash flow

statements” and has not produced a cash flow statement.

The Company has taken advantage of the exemption contained in FRS 8 “Related

party disclosures” and has not reported transactions with fellow Group

undertakings.

2. Significant accounting policies

The Company’s significant accounting policies are described below.

Accounting convention

The Company Financial Statements are prepared under the historical cost

convention and in accordance with applicable accounting standards of the UK

Accounting Standards Board and pronouncements of the Urgent Issues Task Force.

New accounting standards

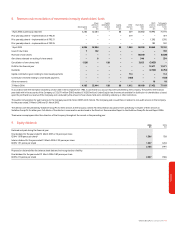

The Company has adjusted its accounting policies to adopt the following new

standards: FRS 17 “Retirement Benefits”, FRS 20 “Share-based Payments”, FRS 21

“Events after the Balance Sheet Date”, FRS 22 “Earnings per share”, FRS 23 “The

Effects of Changes in Foreign Exchange Rates”, FRS 26 “Financial Instruments:

Measurement” and FRS 28 “Corresponding Amounts”. The Company has also early

adopted FRS 29 “Financial Instruments: Disclosures”, which replaces the disclosure

requirements of FRS 25 “Financial Instruments: Disclosure and Presentation”.

Comparative figures have been restated accordingly for changes in accounting

policy. Details of the effect of the prior year adjustment are set out below and the

full impact on the Company’s net asset position as at 1 April 2005 is analysed in

note 8.

FRS 17 impacts the Company in its role as sponsoring employer of the Vodafone

Group Pension Scheme, a defined benefit pension scheme. The adoption of FRS 17

had no effect on the Company’s profit or net assets as the Company was unable to

identify its share of the underlying assets and liabilities of the Vodafone Group

Pension Scheme on a consistent and reasonable basis. Therefore the Company has

applied the guidance within FRS 17 to account for defined benefit schemes as if

they were defined contribution schemes and recognise only the contribution

payable each year. The Company had no contributions payable for the years ended

31 March 2006 and 31 March 2005 as it has no employees.

FRS 20 requires that the fair value of options and shares awarded to employees is

charged to the profit and loss account over the vesting period. The Company does

not incur a charge under this standard. However, where the Company has granted

rights over the Company’s shares or share options to the employees of its subsidiary

undertakings, an additional capital contribution has been deemed to have been

made by the Company to its subsidiary undertakings. This results in an additional

investment in subsidiaries and a corresponding increase in shareholders equity. The

additional capital contribution is based on the fair value of the grant issued

allocated over the underlying grant’s vesting period. As a result of adopting FRS 20,

the Company’s net assets at 31 March 2005 increased by £419 million.

FRS 21 requires that dividends declared after the balance sheet date should not be

recognised as a liability at the balance sheet date as the liability does not represent

a present obligation. Under FRS 21, interim dividends are recognised when they are

paid, and final dividends are recognised when they are approved by shareholders. As

a result of adopting FRS 21, the Company’s net assets at 31 March 2005 increased

by £1,395 million.

FRS 23 sets out additional guidance on the translation method for transactions in

foreign currencies and on determining the functional and presentational currencies.

The adoption of FRS 23 had no impact on the Company’s profit or net assets.

The Company has adopted the presentation requirements of FRS 25. This deals with

the classification of capital instruments issued between debt and equity and the

implications of that classification for dividends and interest expense.

FRS 26 sets out the requirements for measurement, recognition and de-recognition

of financial instruments. The main impact of this change in accounting policy is to

recognise the fair value of foreign exchange contracts and interest rate swaps on

the balance sheet with effect from the transitional date of 1 April 2004. The

adoption of FRS 26 increased the Company’s net assets at 31 March 2005 by £182

million.

FRS 28 gives the requirements for the disclosure of corresponding amounts for

items shown in an entity’s primary financial statements and the notes to the

financial statements. The adoption of FRS 28 had no effect upon the Company’s

profit or net assets.

FRS 29 sets out the requirements for the disclosures relating to financial

instruments. The Company has early adopted FRS 29 and applied its requirements

from 1 April 2005. The Company is exempt from the requirements of the standard as

full FRS 29 disclosures are available in the Vodafone Group Plc Annual Report 2006.

Investments

Shares in Group undertakings are stated at cost less any provision for permanent

diminution in value.

The Company assesses investments for impairment whenever events or changes in

circumstances indicate that the carrying value of an investment may not be

recoverable. If any such indication of impairment exists, the Company makes an

estimate of the recoverable amount. If the recoverable amount of the cash-

generating unit is less than the value of the investment, the investment is

considered to be impaired and is written down to its recoverable amount. An

impairment loss is recognised immediately in the profit and loss account.

For available-for-sale investments, gains and losses arising from changes in fair value

are recognised directly in equity, until the security is disposed of or is determined to

be impaired, at which time the cumulative gain or loss previously recognised in

equity, determined using the weighted average costs method, is included in the net

profit or loss for the period.

Foreign currencies

In preparing the financial statements of the Company, transactions in currencies

other than the Company’s functional currency are recorded at the rates of exchange

prevailing on the dates of the transactions. At each balance sheet date, monetary

items denominated in foreign currencies are retranslated at the rates prevailing on

the balance sheet date. Non-monetary items carried at fair value that are

denominated in foreign currencies are retranslated at the rate prevailing on the date

when fair value was determined. Non-monetary items that are measured in terms of

historical cost in a foreign currency are not retranslated.

Exchange differences arising on the settlement of monetary items, and on the

retranslation of monetary items, are included in the profit and loss account for the

period. Exchange differences arising on the retranslation of non-monetary items

carried at fair value are included in the profit and loss account for the period except

for differences arising on the retranslation of non-monetary items in respect of

which gains and losses are recognised directly in equity. For such non-monetary

items, any exchange component of that gain or loss is also recognised directly in

equity.

Vodafone Group Plc Annual Report 2006 133

Financials

Notes to the Company Financial Statements